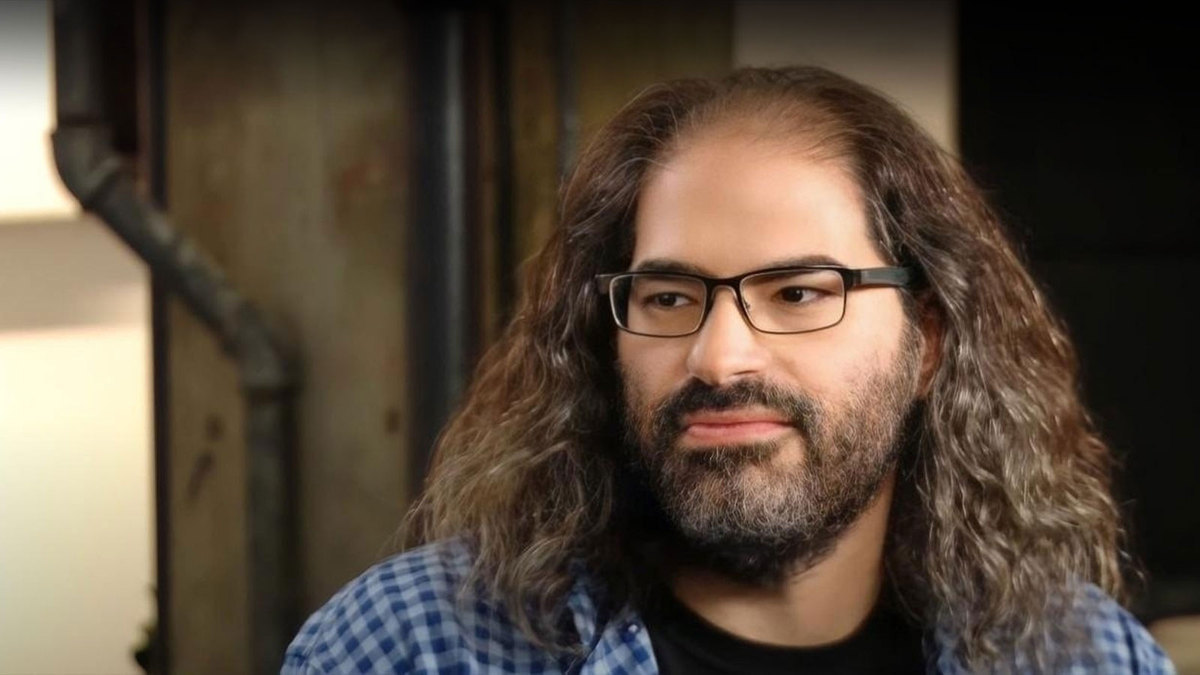

David Schwartz, Ripple’s Chief Technology Officer (CTO), has clarified his stance about airdrops in the crypto industry. Schwartz shared his insights while contributing to a conversation on X, which asked me to understand the IRS taxing system on digital assets.

Tax Implications of Crypto Airdrops

In his post, Schwartz noted that the tax consequences could prove problematic for recipients of these rewards. He sees this challenge more in terms of auto or self-claiming rewards, which are automatically distributed to users without requiring any action on their part.

According to Schwartz, long-term capital profits are only taxed when value increases, while income is taxed when the user receives the asset. Hence, with airdrops, the receipt of the assets often determines if it is taxable. The authorities do not bother with how the recipient uses or claims it.

Due to their tax implications, the Ripple CTO cautions against using self-claiming distribution methods. In his opinion, receiving auto rewards can lead to immediate taxable events. The recipient is potentially tax-liable even if they have not sold the tokens or received cash for the asset.

Schwartz’s Proposed Alternatives to Airdrops

Schwartz explained that the complication lies with the holders of the asset. Since airdrop tokens are taxed based on their value when given out, users might have to pay more taxes if the asset appreciates. This arrangement could worsen things for recipients who want to hold long-term.

He offers an alternative to the current reward system, suggesting a distribution model where users benefit from appreciating their token’s value. Schwartz favors this approach to users receiving additional tokens as a reward.

This model helps defer taxable events until when the tokens are sold or converted to cash by the user. This appears more favorable for taxation purposes, according to Schwartz. As such, users do not have to deal with the tax issues that come with airdrops.

Past Warnings and Predictions

Schwartz has regularly given insights into crypto activities and events.

Notably, before the ecosystem’s launch of RLUSD, he cautioned investors that volatility issues could occur due to supply shortages. True to his prediction, RLUSD was temporarily disrupted due to its initial inflated value.