Ripple also warned investors against falling victim to FOMO as it gears up to launch RLUSD. The stablecoin recently secured approval from the New York Department of Financial Services and is expected to boost XRP demand by settling transactions on the XRPL and EVM sidechain. Meanwhile, stablecoin industry partnerships are intensifying. Paxos is collaborating with Standard Chartered to boost USDG and USDL in Singapore and the UAE. Circle and Binance also recently announced a strategic partnership to expand USDC adoption.

Ripple Warns Against FOMO as RLUSD Prepares for Launch

Ripple’s Chief Technology Officer, David Schwartz, warned investors about potential “supply shortages” and volatility after the launch of Ripple’s U.S. dollar-pegged stablecoin, RippleUSD (RLUSD). In a post on Dec. 15, Schwartz shed some light on the possibility of major fluctuations in RLUSD’s value in its early days, despite its design to maintain a 1:1 parity with the U.S. dollar. He shared that some early pre-market bids for RLUSD were already inflating its perceived value, with one Ripple wallet listing 1 RLUSD for 511 XRP, equivalent to over $1,200 at current prices.

Schwartz dismissed the inflated valuation, and suggested that it was likely an attempt by someone looking for the symbolic honor of buying the first RLUSD. He also reassured potential users that the stablecoin’s price will return to its intended $1 parity once supply stabilizes. Schwartz warned against “FOMO” buying into the stablecoin, and clarified that it is not a vehicle for speculative profit and urged users to exercise restraint.

RippleUSD recently received its final approval from the New York Department of Financial Services, which was announced by Ripple CEO Brad Garlinghouse on Dec. 11. The stablecoin is designed to work alongside XRP in the company’s cross-border payments solutions. According to Ripple, RLUSD is expected to serve large institutional players and complement XRP, with both assets paired to enhance liquidity and stabilize RLUSD’s price.

Ripple’s president, Monica Long, previously described RLUSD as “complementary and additive” to XRP. XRP’s widespread availability on exchanges will support RLUSD’s liquidity, while pairing mechanisms will prevent potential depegging.

A stablecoin is a type of cryptocurrency that is specifically designed to maintain a stable value by being pegged to a reserve asset, like a fiat currency such as the U.S. dollar, a commodity like gold, or a basket of assets. This pegging mechanism helps reduce the price volatility that is typically seen in other cryptocurrencies.

Stablecoins achieve their stability through reserves held in fiat currencies or other assets, algorithms, or a combination of both. They are widely used for transactions, remittances, and as a store of value, which essentially makes them a bridge between traditional financial systems and the world of digital assets.

RLUSD Stablecoin Poised to Boost XRP

The upcoming RLUSD stablecoin is also expected to drive increased demand for XRP in 2025, according to Georgios Vlachos, co-founder of the Axelar interoperability platform. Axelar serves as the canonical bridge connecting the XRP Ledger (XRPL) to the XRPL EVM chain and 69 other blockchains.

Vlachos pointed out that stablecoins like RLUSD are widely used in emerging economies for transactions and as a store of value. With RLUSD transactions and remittances settling on the XRPL and XRP-EVM sidechain, gas fees paid in XRP will burn tokens, benefiting XRP holders and adding to the demand for the cryptocurrency.

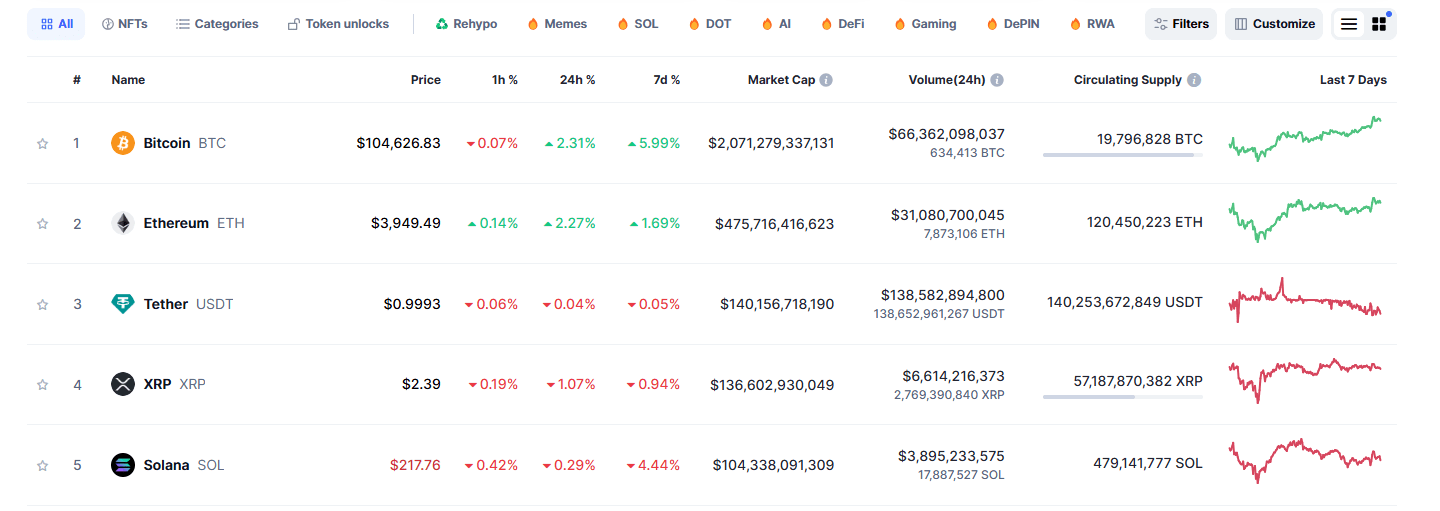

XRP price action over the past month (Source: CoinMarketCap)

XRP recently saw a historic rally after reaching a seven-year high of $2.90 on Dec. 3 of 2024, before retreating to its current level of $2.39. The pullback happened after a surge in the relative strength index (RSI) to 95, indicating overbought conditions.

However, XRP continues to attract investor interest due to several catalysts. These include political tailwinds from Donald Trump’s election victory, which boosted pro-crypto sentiment and hopes for a favorable regulatory environment in the U.S. XRP also gained some momentum after flipping Solana in market capitalization on Dec. 1, which allowed it to become the fourth-largest cryptocurrency with a market cap of $136 billion. This is just shy of Tether’s $140 billion.

Top cryptocurrencies by market cap (Source: CoinMarketCap)

Further fueling optimism, major asset management firms like WisdomTree, Bitwise, Canary Capital, and 21Shares, have filed for XRP exchange-traded funds (ETFs) with the SEC.

Paxos and Standard Chartered Partner

In other stablecoin-related news, Paxos partnered with Standard Chartered to strengthen the management of its U.S. dollar-backed stablecoins, Global Dollar (USDG) and Lift Dollar (USDL), in Singapore and the UAE. Through this collaboration, Standard Chartered will provide cash management, trading, and custody services to enhance the infrastructure supporting these stablecoins.

The partnership will also integrate Standard Chartered’s banking capabilities across transaction banking, financial markets, and securities services with Paxos’ global tokenization platform. One of the main goals of this partnership is to offer institutional-grade solutions for the growing stablecoin industry.

Adam Ackermann, the head of treasury and portfolio management at Paxos, pointed out just how important Standard Chartered’s expertise in risk management and compliance are in supporting Paxos as a regulated stablecoin issuer. John Collura, global head of banks and broker dealer sales at Standard Chartered, shared that the bank is fully committed to advancing secure and regulated digital asset solutions that promote global adoption and economic inclusion.

Global Dollar (USDG) is issued by Paxos Digital Singapore, and complies with the Monetary Authority of Singapore’s (MAS) forthcoming stablecoin regulations. Lift Dollar (USDL) was introduced by Paxos International and is regulated by the Financial Services Regulatory Authority of Abu Dhabi Global Market. It also offers holders a daily programmatic safe yield.

Circle and Binance Team Up

Circle and Binance also recently announced a strategic partnership to enhance the global financial services ecosystem and support the growth of digital assets. The alliance was unveiled during Abu Dhabi Finance Week.

As part of the partnership, Binance will integrate Circle’s USD Coin (USDC) into its platform, increasing its availability for users. Binance plans to offer additional USDC trading pairs, promotions, and other platform products to encourage its adoption. Circle will provide Binance with technology, liquidity, and support to strengthen Binance’s connections within global finance and commerce.

During Abu Dhabi Finance Week, Circle also announced its incorporation in the Abu Dhabi Global Market and a new partnership with LuLu Financial Holdings. This collaboration will facilitate cross-border payments and remittances using USDC, taking advantage of LuLu Financial’s extensive operations in Gulf Cooperation Council countries, the Indian subcontinent, and the Asia-Pacific region.

Looking ahead, Circle also plans to relocate its headquarters to New York in early 2025 and pursue an initial public offering (IPO) once it receives approval from the U.S. Securities and Exchange Commission (SEC).