- According to Robert Kiyosaki, it has reached its potential of $100,000 in 2020 and will go even higher.

- The firm’s outflow of $188.7 million in BlackRock Bitcoin ETF increases questions of institutional impact and possible manipulation in the crypto-space.

- He interprets declining global economic trends and implores others to save and acquire Bitcoin, gold, and silver.

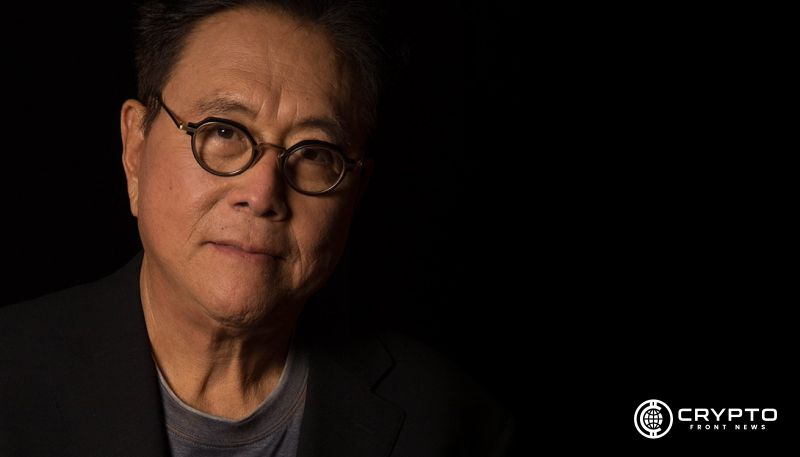

The author of *Rich Dad Poor Dad* Robert Kiyosaki Bitcoin supporter predicts that Bitcoin will cost $350k in 2025. His forecast is released as he has been calling people not to have too much of everything such as a Bitcoin ETF but to keep it simple with self-funded wallets. According to Kiyosaki, this makes Bitcoin a form of protection against economic fluctuation hence a good form of hedge.

Some of Kiyosaki’s statements came at the time of large withdrawals from BlackRock’s iShares Bitcoin Trust. On 24th December, the fund outflowed $188.7 million, the second largest ever for a Bitcoin ETF. Researchers believe this outflow may not be a coincidence and might be aimed at controlling Bitcoin’s price for the benefit of major institutional traders, as it was mentioned before.

The Use of Bitcoin as an Instrument of Hedging

Kiyosaki has consistently championed Bitcoin as a hedge against economic uncertainty. He highlighted financial difficulties in Europe, China, and the United States, pointing to these as reasons for individuals to secure their assets. He recommends Bitcoin, gold, and silver as reliable stores of value in times of global financial instability.

The financial educator has been vocal about his skepticism of large financial institutions. He criticizes their Environmental, Social, and Governance (ESG) practices, claiming they promote centralized market control. Kiyosaki argues such approaches undermine individual ownership and limit financial independence.

Optimism Amid Challenges

Despite concerns about institutional influence, Kiyosaki remains optimistic about Bitcoin’s long-term potential. He views Bitcoin as a critical asset for securing financial stability in a volatile global economy. His forecast continues to fuel discussions about Bitcoin’s role in safeguarding personal wealth and resisting centralized control.

DISCLAIMER:

The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.