CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

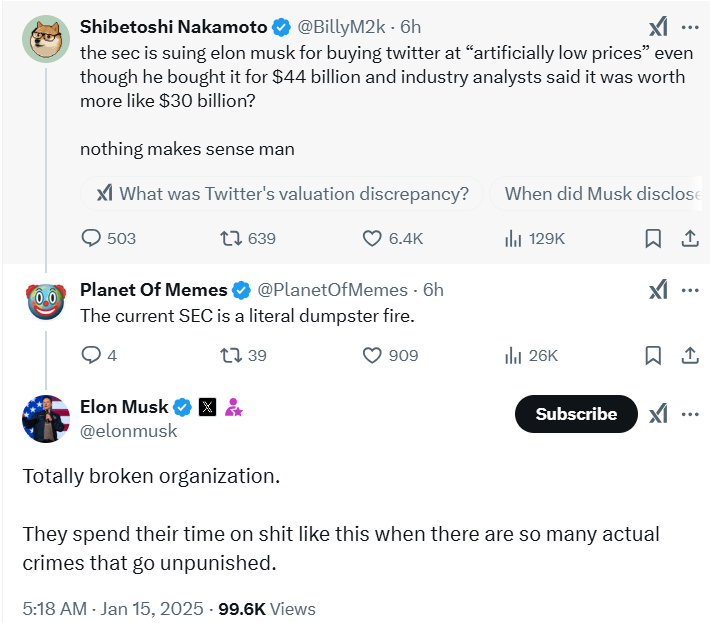

The U.S. SEC has charged Elon Musk with fraud, alleging that he made inadequate disclosures about his acquisition of over 5% of Twitter shares. According to the lawsuit, Musk failed to disclose his holdings in the company when the purchase of Twitter was completed within the required time frame.

Musk started buying Twitter shares in the first quarter of the year 2022. By March, he had reached the 5% mark, which is the legal limit under the federal securities laws, to submit a disclosure form to the SEC. Federal regulations require the filing of this notice within ten days after crossing that threshold.

However, Musk did not meet this requirement but rather did so on 4th of April 2022, which was 11 days late. The regulators further accuse that this delay will enable Musk to purchase more shares at artificially low prices since the market knew the increasing influence of Musk in the firm.

SEC Accuses Musk of Unfair Advantage

In the view of the SEC, the failure of Musk to disclose his ownership resulted in injury to investors. According to the lawsuit, the investors who sold Twitter shares between March 25 and April 1, 2022, did so without knowledge that Musk was buying up the company’s stock. Therefore, these investors liquidated their stakes at cheap prices, which otherwise they would not have done had they known Musk’s plans.

The SEC also alleged that Musk’s actions allowed him to buy shares at a lower price than he would have been able to otherwise. The agency claims the market undervalued the shares by at least $150m and Musk would have had to have offered at least that amount to acquire the extra shares.

Musk finished the $44 billion deal to buy Twitter in October of 2022. After that, it relaunched the platform under the name X. According to the SEC, Musk’s failure to disclose his interest at the earliest opportunity influenced the timing and price of the acquisition and, therefore, the market reaction to his actions.

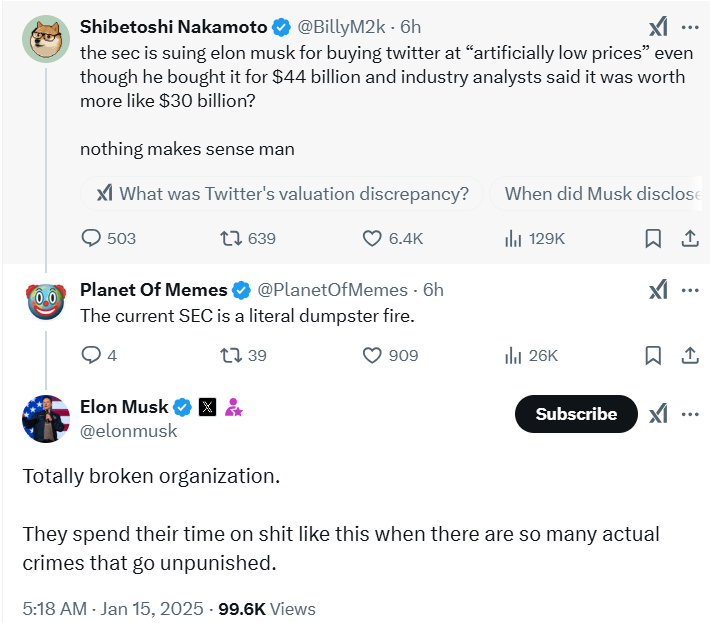

Musk Responds to SEC Accusations

The regulators has filed the lawsuit and is asking for several relief. It has sent a court order that would demand Musk to give back any profits he made over the delayed announcement. The agency also wants the court to impose a civil penalty and to enjoin Musk from future securities law violations indefinitely.

However, Musk has not admitted to any wrong doing in the entire process. Spiro, his lawyer, said that the SEC’s lawsuit was without merit and was an indication of the agency’s inability to prosecute a proper case. Spiro described the suit as a “sham,” arguing that the SEC’s case centers on an administrative violation of filing a form, and that even if true, the penalty would be minimal at worst.

Spiro also pointed out that the SEC’s suit was but one example of the regulator’s harassment of Musk over the past few years. He said that the regulators had not leveled serious charges against Musk and were now coming up with a “trimmings complaint.”

The SEC’s lawsuit is the latest of Musk’s problems with the regulators. The business magnate has come under fire for a number of his ventures, including those of Twitter and SpaceX. It continues the SEC’s efforts to enforce compliance with the laws governing the market and the sale of company securities.

The result of this case could be significant for further business interactions of Musk. If the SEC wins in court, Musk may receive fines and may be required to forfeit any profit coming from the delayed disclosure. It may also change Musk’s behavior in terms of future acquisitions and financial reporting as he is currently under much scrutiny.

Conclusion

The legal action is the latest salvo in the broader investigation into the management style of the world’s richest man. Since Musk is the CEO of Tesla and the owner of Twitter (now X), his moves have not evaded the regulator’s attention. The lawsuit is a good example of the consequences that await investors who fail to make disclosures and adhere to federal laws.

As for Musk and his lawyers, they are likely to challenge the allegations further as the case goes on. The result may have implications for other similar cases in the future. This legal war only increased the intensity of Musk’s publicity and his other business endeavors.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

What is Elon Musk accused of in the SEC lawsuit?

Musk is charged with fraud for failing to timely disclose his purchase of more than 5% of Twitter shares.

Why was Musk’s delayed disclosure considered harmful?

The regulators claim Musk’s delay allowed him to buy additional shares at a lower price, negatively affecting investors.

What does the SEC want from Musk in this lawsuit?

The SEC seeks to have Musk return any profits made from the delayed disclosure and face civil penalties.

How does this SEC lawsuit affect Musk’s future business dealings?

The lawsuit could result in financial penalties and influence how Musk handles future acquisitions and disclosures.