CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

- Senate delays Paul Atkins’ confirmation for SEC Chair post.

- Vote date pending new responses from nominees.

- Market carefully watches regulatory stance impacts.

Yesterday, the Senate Banking Committee postponed the vote on Paul Atkins as SEC Chair after a confirmation hearing.

This delay highlights ongoing scrutiny over Atkins’ stance on crypto regulation, impacting market and policy expectations.

Senate Pushes Back Vote on Atkins’ SEC Nomination

The Senate Banking Committee postponed Paul Atkins’ vote for SEC Chair, a role important to crypto regulation. The delay follows Atkins’ confirmation hearing, raising attention. Eleanor Terrett reported that nominees, including Atkins, must answer questions for recording before the delayed vote.

Given Atkins’ past as an SEC Commissioner and crypto supporter, changes in regulatory approach are expected. Gary Gensler’s successor, Atkins, holds equity in crypto companies like Anchorage and Securitize, indicating a shift towards industry-friendly regulations.

Market reactions have been insightful, with Senator Elizabeth Warren voicing concerns about potential conflicts of interest. Atkins responded to scrutiny, pledging a new regulatory direction. “You also have significant potential conflicts of interest through your work on behalf of corporate interests—and a long record of advocating for weaker protections for investors and weaker rules to prevent wrongdoing by giant corporations,” Warren wrote in a letter to Atkins. His plan marks a considerable departure from his predecessor’s enforcement-heavy strategy, causing discussions.

Crypto Market Awaits Impact of SEC Leadership Change

Did you know? Paul Atkins holding equity in significant crypto companies could shift the SEC’s approach toward digital assets, differing from his predecessor.

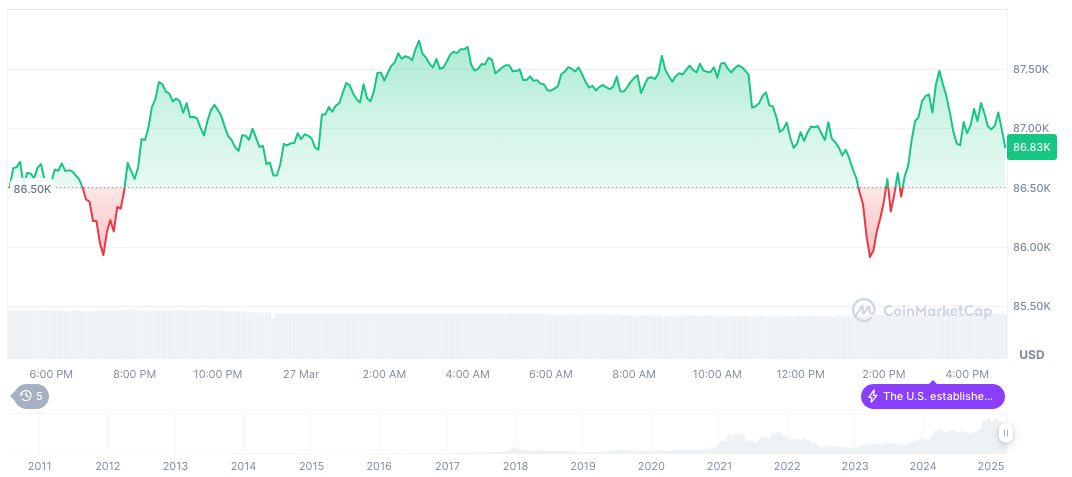

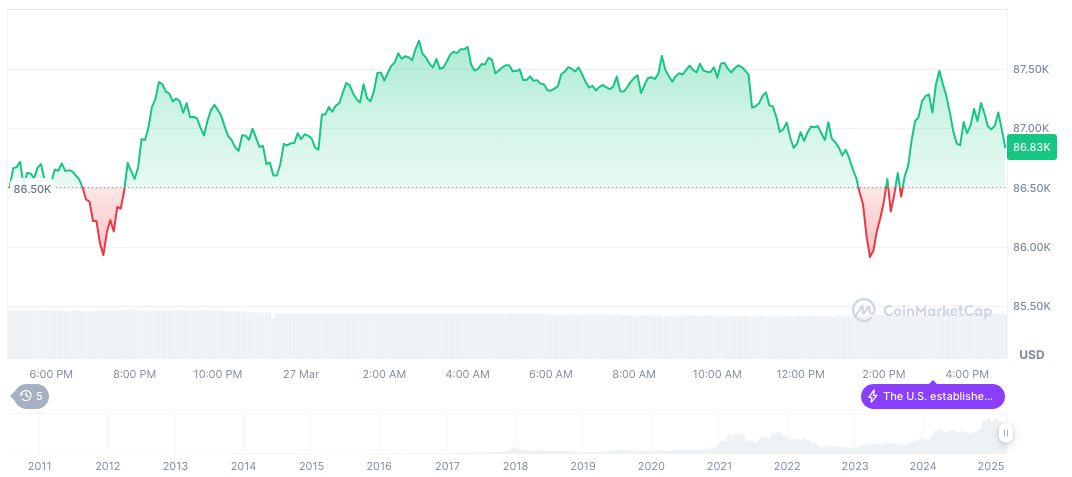

Bitcoin (BTC) is currently valued at $86,877.53, reflecting a market cap of 1.72 trillion. As of March 27, it’s down 0.82% over 30 days. Data from CoinMarketCap notes a trading volume of $26.74 billion, falling 6.69% in 24 hours.

According to the Coincu research team, Atkins’ confirmation could stimulate positive changes in crypto regulation, affecting financial frameworks. The potential adaptation to industry needs aligns with Atkins’ historical trends, indicating beneficial outcomes. Historical trends support a possible alignment favoring digital asset innovation.