Shiba Inu (SHIB) price is down 5.6% over the past seven days but has recovered 3% in the last 24 hours as it attempts to regain momentum. The Relative Strength Index (RSI) remains neutral at 50.9, reflecting balanced buying and selling pressures, while whale activity has stabilized after a recent decline.

SHIB is trading near critical levels, with the potential to test key resistances if the uptrend strengthens or support zones if selling pressure increases.

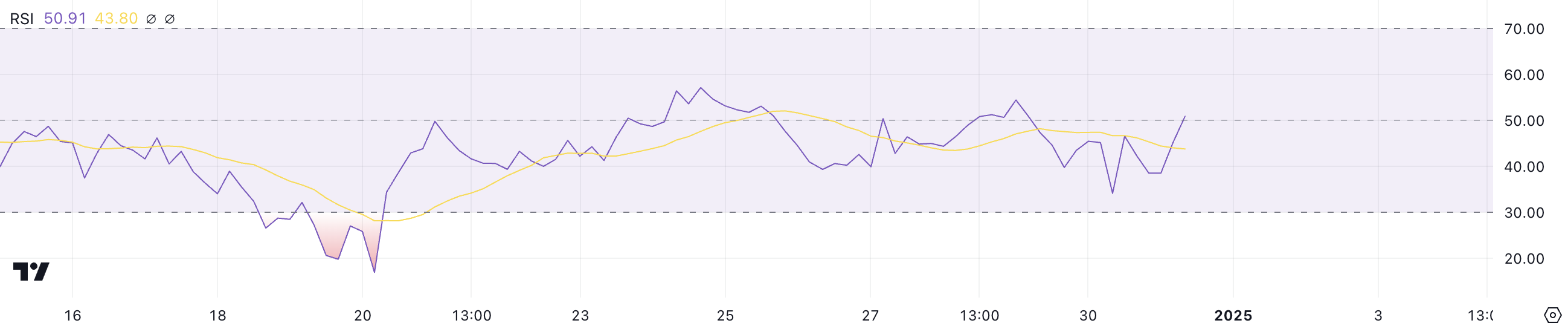

Shiba Inu RSI Has Been Neutral Since December 20

Shiba Inu RSI is currently at 50.9, maintaining its position in the neutral zone since December 20. This level indicates a balance between buying and selling pressure, with no clear dominance from either side. The RSI’s stability suggests that SHIB price is consolidating, as traders remain indecisive about the next direction.

This neutral reading reflects a lack of significant momentum, leaving the price vulnerable to potential triggers from external factors or market sentiment shifts.

The RSI is a momentum indicator that measures the speed and strength of price movements on a scale from 0 to 100. Readings above 70 indicate overbought conditions, often signaling a potential price pullback, while readings below 30 suggest oversold conditions and the possibility of a recovery.

With SHIB’s RSI at 50.9, it sits near the midpoint, signaling neither overbought nor oversold conditions. In the short term, this neutral RSI suggests SHIB price may continue to trade within a range unless there is a decisive increase in buying or selling activity to push the momentum in a clear direction.

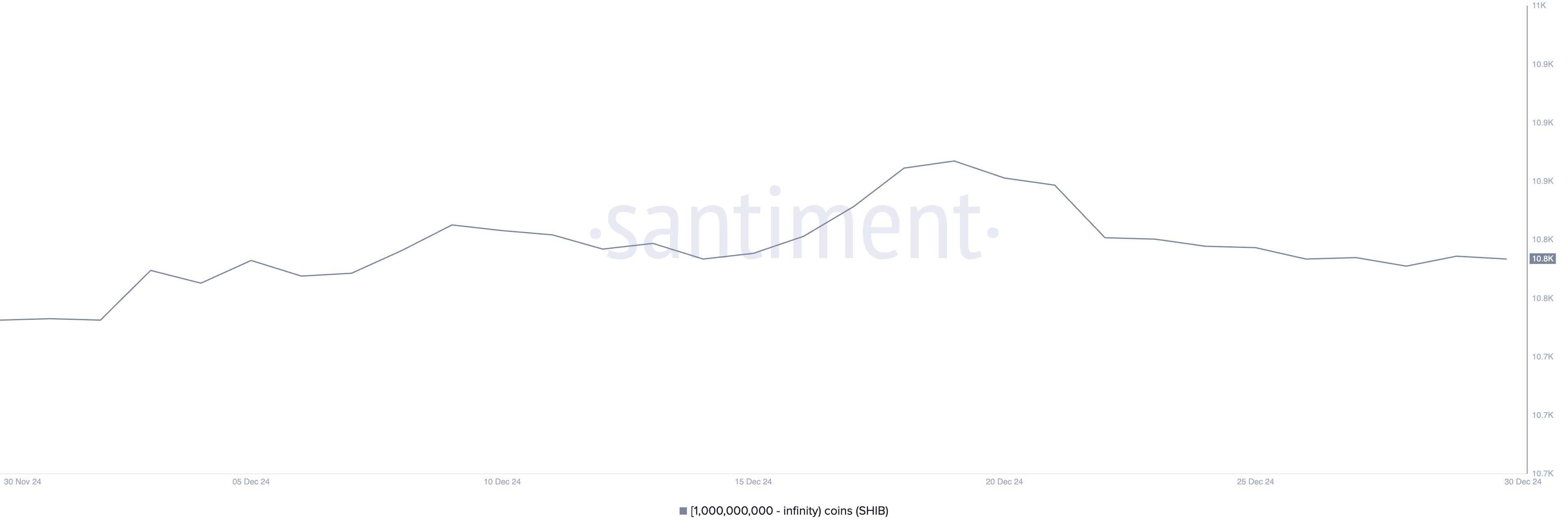

SHIB Whale Activity Stabilizes

Shiba Inu whales, defined as addresses holding at least 1 billion SHIB, reached a monthly high of 10,930 on December 19 but have steadily declined since.

The number of SHIB whale addresses stands at 10,861 and has remained below 10,900 since December 20. This stabilization follows a period of decline, suggesting that large holders are neither aggressively accumulating nor significantly reducing their positions at the moment.

Tracking whale activity is crucial because these large holders often drive market trends due to their capacity to execute significant trades. Their accumulation can generate upward momentum, while distribution can lead to selling pressure.

The current stability in SHIB whale numbers indicates a neutral sentiment among major investors.

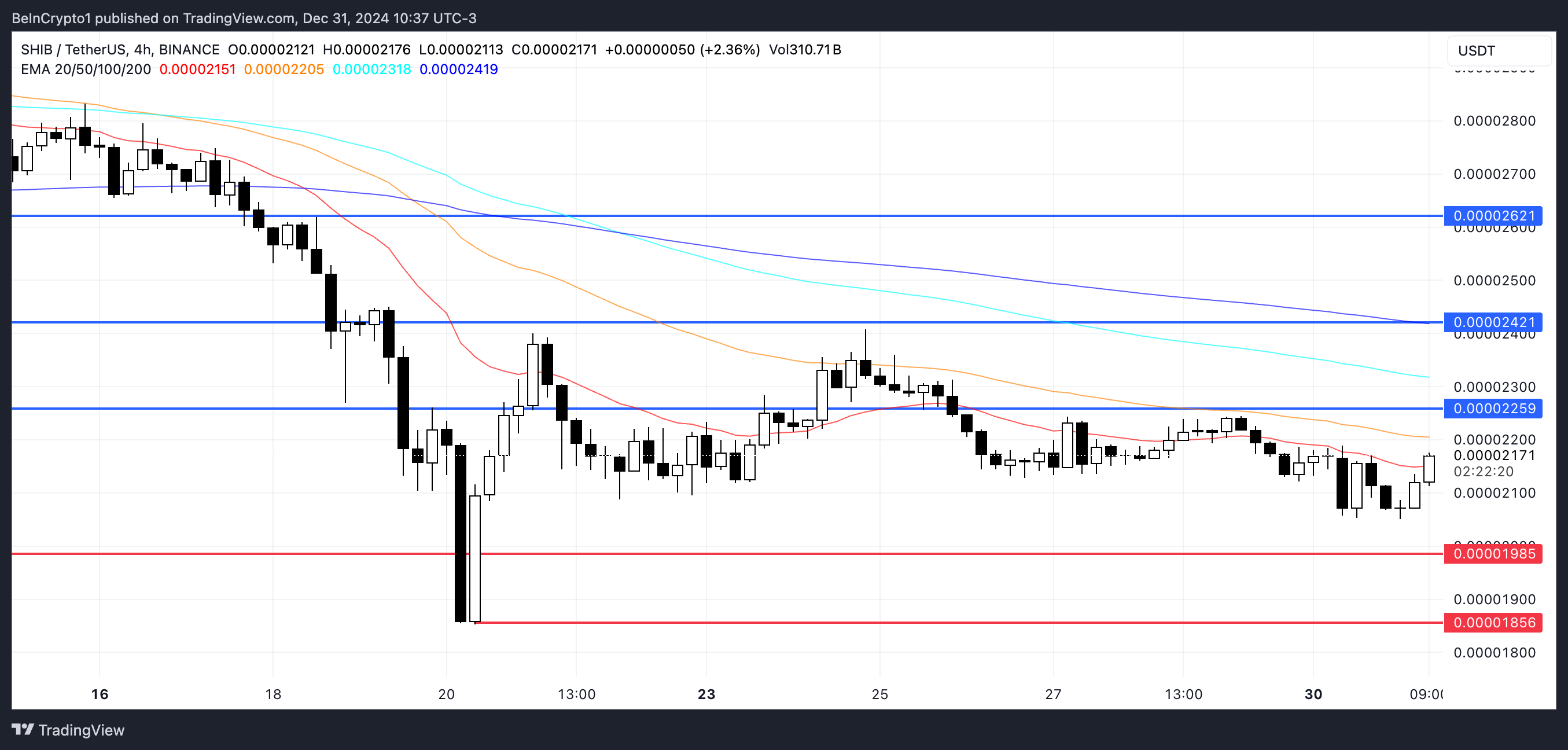

SHIB Price Prediction: Will the Recover Continue?

If the current uptrend strengthens, Shiba Inu price is positioned to test resistance at $0.0000225. Breaking above this level could pave the way for further gains, with the next resistance targets at $0.000024 and $0.000026.

A strong uptrend would signal growing bullish momentum, potentially attracting more buying interest and pushing SHIB to higher levels.

However, if the uptrend loses steam and a strong downtrend takes over, SHIB price could test the first support at $0.0000198. If this level fails to hold, the price may decline further to $0.0000185, signaling increased selling pressure.

These key resistance and support levels will likely define SHIB short-term trajectory, with traders closely monitoring whether bullish or bearish forces prevail.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.