CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

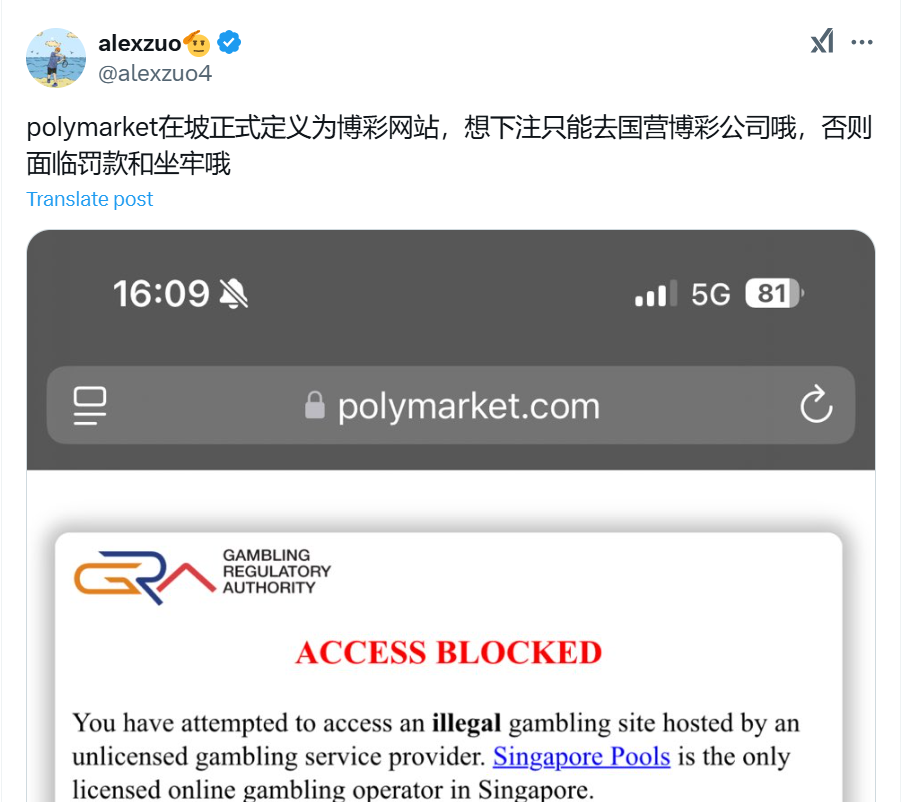

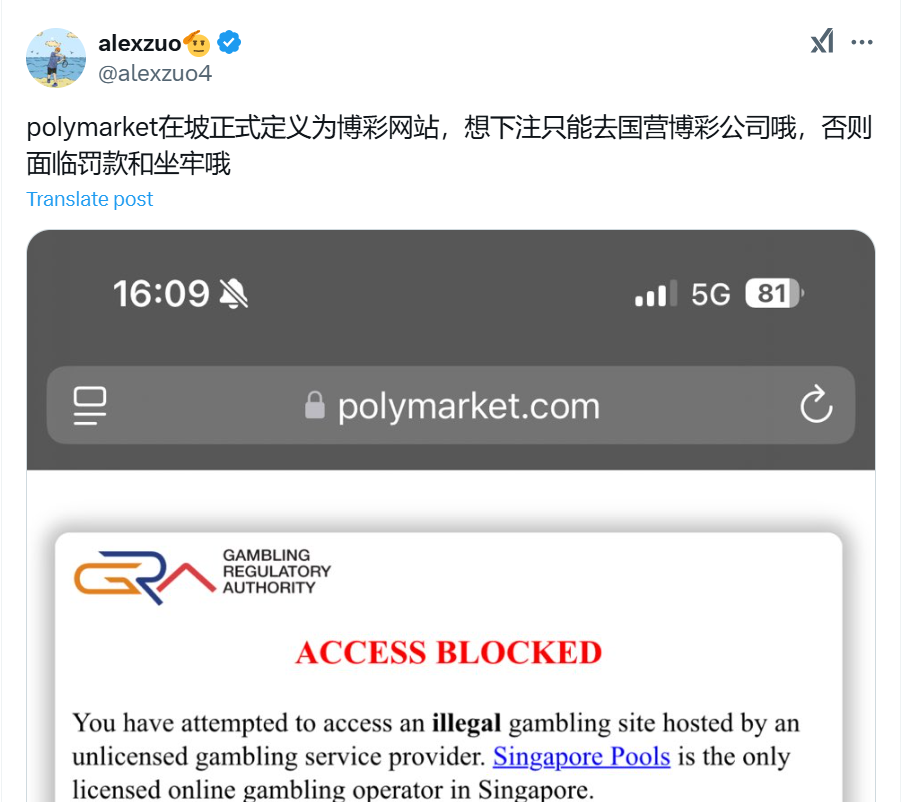

Singapore recently took a firm stand against Polymarket, banning the decentralized prediction market platform under its strict Remote Gambling Act of 2014. For those unfamiliar, this act is basically Singapore’s way of saying, “Not on our watch,” to unregulated online gambling. But here’s the kicker—Polymarket isn’t your typical betting site. It’s built on blockchain tech, allowing users to speculate on real-world events using cryptocurrency. Sounds innovative, right? Well, Singapore’s government doesn’t think so.

Singapore’s Gambling Laws: No Room for Flexibility

Let’s get one thing straight: Singapore doesn’t mess around when it comes to gambling. The country’s laws are tighter than a drum. They only allow specific types of betting—like lotteries and sports wagering—through state-approved organizations. Everything else? Banned. So when Polymarket popped up on their radar as an unregulated online platform, the government wasted no time slapping it with a ban.

Here’s the irony: Polymarket’s decentralized nature—built on Polygon, an Ethereum layer-2 solution—makes it tough for regulators to put their foot down. Unlike traditional platforms, there’s no central authority to target. This lack of a single point of accountability is a nightmare for countries with stringent online gambling laws, and Singapore just isn’t in the mood to navigate that headache.

Polymarket’s Troubles Don’t Stop There

Singapore isn’t the only country giving Polymarket the cold shoulder. The United States has already come down hard on the platform. The Commodity Futures Trading Commission (CFTC) recently called out Polymarket for failing to comply with regulations. In fact, the CFTC made them cough up a hefty fine as part of a settlement deal. The Commission’s chair, Rostin Behnam, didn’t mince words when he said they’re ready to play “primary cop” in the digital asset markets.

Other countries, especially those in the European Union and Asia, are taking similar stances. China, for instance, has a blanket ban on most blockchain-based platforms. In short, if you’re trying to access Polymarket from one of these regions, you’re probably running into all kinds of digital roadblocks.

Why Governments Are Freaking Out About Polymarket

Here’s the thing: Polymarket isn’t your typical online betting site. Instead of offering the usual casino games or sports bets, it lets users place wagers on real-world outcomes. Think about elections, stock market movements, or even the weather. It’s like betting on life itself. Cool, right? But from a regulatory perspective, it’s a Pandora’s box.

First off, there’s the issue of decentralization. Without a central authority, governments don’t know where to start when trying to enforce regulations. Add cryptocurrency into the mix, and you’ve got a platform that’s even harder to track. For countries like Singapore, which prioritize control and oversight, Polymarket is essentially a regulatory nightmare.

And let’s not forget the potential for misuse. Decentralized platforms can be a magnet for shady activity—money laundering, fraud, you name it. While Polymarket positions itself as a legitimate platform, it’s tough for regulators to separate the wheat from the chaff.

What This Means for Decentralized Finance (DeFi)

Polymarket’s ban in Singapore raises bigger questions about the future of decentralized finance (DeFi). Platforms like Polymarket represent a shift away from traditional financial systems. They offer transparency, lower fees, and greater accessibility. But as this case shows, they also come with a slew of challenges.

Governments worldwide are still figuring out how to deal with DeFi platforms. Some are trying to regulate them. Others, like Singapore, are opting for outright bans. Either way, the road ahead for platforms like Polymarket is going to be bumpy.

What’s Next for Polymarket?

Despite the growing list of bans and regulatory hurdles, Polymarket isn’t waving the white flag. The platform continues to operate in countries where regulations are more relaxed. And let’s be real—it’s not going away anytime soon. Decentralized platforms are like weeds. You can try to uproot them, but they’ll find a way to grow back.

In the meantime, Polymarket is likely to face increased scrutiny. More countries may follow Singapore’s lead, especially as concerns about unregulated gambling and financial crimes grow. The platform might also need to rethink its approach to compliance. Whether that means partnering with regulators or introducing self-imposed guidelines, only time will tell.

Conclusion

Polymarket’s ban in Singapore is a wake-up call for decentralized platforms everywhere. It highlights the challenges of operating in a world where laws are struggling to keep up with technology. For users, it’s a reminder to stay informed and cautious when navigating the DeFi space. After all, innovation is exciting, but it’s not always smooth sailing.

FAQs

1. Why did Singapore ban Polymarket?

Singapore banned Polymarket because it operates as an unregulated online gambling platform, violating the country’s strict gambling laws.

2. What is Polymarket’s unique feature?

Polymarket allows users to bet on real-world events using cryptocurrency, setting it apart from traditional betting platforms.

3. Is Polymarket banned in other countries?

Yes, countries like the United States and China have also taken action against Polymarket due to regulatory concerns.

4. Can Polymarket operate legally anywhere?

Polymarket can operate in countries with more lenient regulations, but its decentralized nature makes global compliance tricky.