A recent Syncracy thesis on Solana revealed that the blockchain had surpassed Ethereum across several metrics in the past few months. The thesis-driven hedge fund calculated Solana’s performance as a percentage of Ethereum’s. The report indicated that Solana showed signs of dominance in the crypto market and suggested that the blockchain was taking Ethereum’s market share.

Syncracy data outlined that Solana’s Real Economic value, combining the chain’s transaction fees and MEV tips, was 111% against Ethereum’s. Total application volumes, stablecoin volumes, total value locked (TVL), Solana DEX volumes, and active addresses stood at 109%, 98%, 13%, 124%, and 234%, respectively, against Ethereum. The report highlighted that active addresses included those of Layer 2 chains on Solana and Ethereum.

Token Terminal data revealed the same results, with Ethereum (397.3K users) lagging behind on January 9 in active users compared to Solana (5.8 million users). Solana’s fees on January 9 stood at $4.544 million, while Ethereum’s was $3.675 million.

The hedge fund suggested in its report that Solana is mispriced, considering its scalability, increase in developer action, and infrastructure. Syncracy revealed that Solana was mispriced at 13% of Etehreum’s value when the report was published last year.

Another report by asset management firm VanEck’s subsidiary, Market Vector, agreed that Solana was severely undervalued. Market Vector explained that Solana’s market cap stood at only 22% of Ethereum’s. The report added that Solana’s outperformance over Ethereum and its layer 2 chains suggested that Solana’s price had the potential to surge in the future.

Syncracy owes some of Solana’s growth to the memecoin frenzy

The Syncracy report highlighted that Solana’s total application revenue and real economic value growth depended on the chain’s financial activity. The report mentioned that a significant part of the growth resulted from the memecoin frenzy from Solana’s memecoin launcher, Pump.fun. Syncracy also suggested that the frenzy resulted from retaliation against high-valued investment options that limited the threshold of joining.

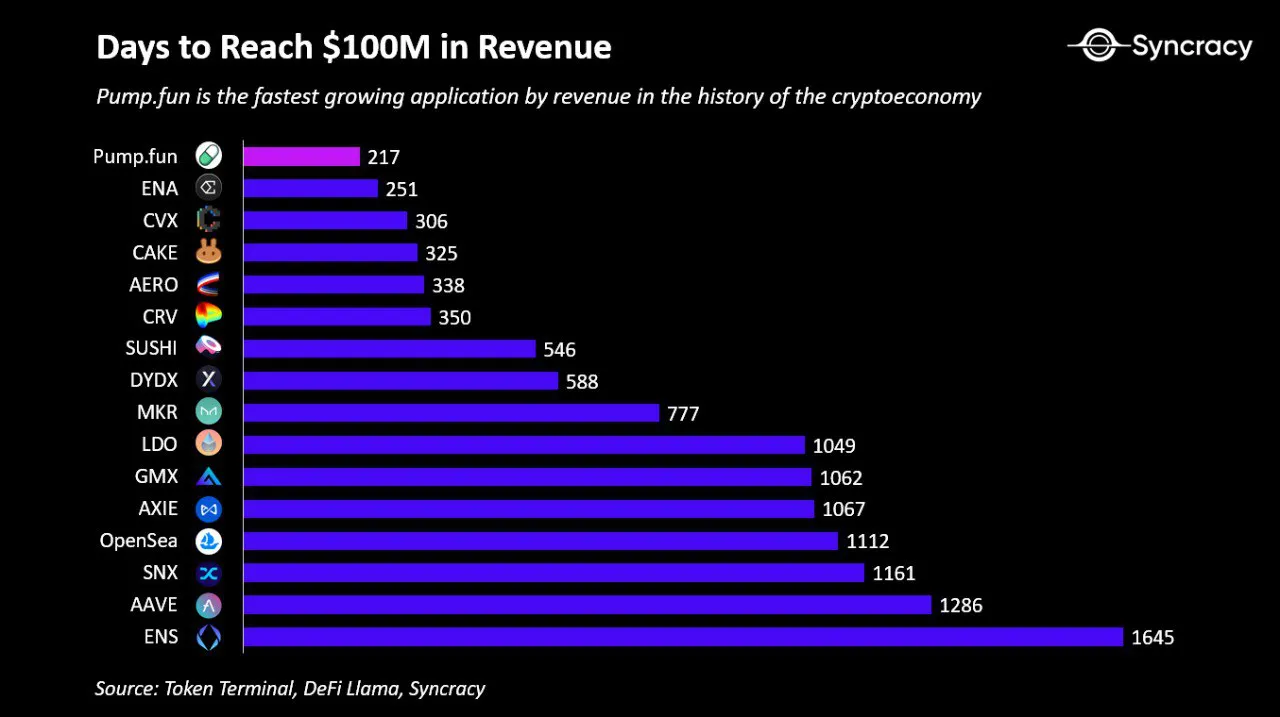

The report further indicated the growing revenue from Solana-based applications, highlighting their higher growth speed than Ethereum-based apps. For example, Dune Analytics data has shown that Solana’s Pump.fun has accumulated over $390 million in revenue since its inception last year. More Syncracy data has indicated that Pump.fun was the fastest growing application in revenue in crypto economy history.

Market Vector also attributed one reason Solana is outperforming Ethereum to Pump.fun’s activity. The VanEck subsidiary still added institutional Solana adoption as another trigger for Solana’s growth. Citibank and Franklin Templeton are some of the financial institutions planning to integrate Solana to improve their financial services.

Solana is also expecting more stablecoin activity as more of the backed coins deploy on the blockchain. The French-based banking conglomerate Société Générale announced its plans to deploy the EUR CoinVertible stablecoin on Solana. Sky’s stablecoin, USDS, is also planning to launch on the blockchain.

Solana’s Firedancer upgrade might fuel more growth

📊 Solana vs. Ethereum$SOL is now rivaling $ETH on almost all key metrics.

At one point in December, Solana generated $431M in fees, more than all other L1s combined.

With the Firedancer scalability upgrade expected in 2025, Solana’s activity might grow further. pic.twitter.com/U6P65KvD0g

— Satoshi Club (@esatoshiclub) January 10, 2025

Solana plans to upgrade its ecosystem in the Firedancer upgrade, which has been in development since 2022. Syncracy speculated that the upgrade could trigger more growth in the blockchain in 2025.

The upgrade is meant to improve the network’s scalability and stability. The blockchain has not yet announced the launch date for the upgrade but has released a call-to-action for all of the blockchain’s validators to test the early Firedancer version, Frankendancer.

Solana has also lined up another upgrade for its hashing system through the new proposal, SIMD-215 (Homographic Hashing of Account State). The hashing system would enable the blockchain to change its account verification and tracing, improving scalability. The crypto firm Republik Labs described the new hashing system as only cleaning the messy parts of a house to save time.

The blockchain further launched its layer 2 chain, Solaxy, to ease the congestion growing on Solana. Solaxy announced its presale on December 13 last year, securing over $1 million daily. The layer 2 chain will make transaction processing more efficient while bundling up transactions.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.