Solana (SOL) attained a new 3-month high of $180 on 29 October. However, it has experienced a retracement as it is currently priced at $178.76 SOL/USDT on Gate.io. The new value comes after the asset lost by 0.65% within the last 24 hours. Notably, this price decline came after an 18.41% decrease in its trading within a single day. At the time of writing, SOL is in a bearish momentum. The following graph shows its price trajectory during the past 24 hours.

SOL 24-Hour Price Chart – Coinmarketcap

Currently, the price is anchored on the $178.10 support level. This means that it may rise again towards its recently established resistance level at $180.58. Thus, there is a possibility that it can surge again within the next 24 hours. It is also important to note that the cryptocurrency is within a range-bound market.

SOL also regained the $180 price level after its price rose by 16.3% during the previous month. Several indicators show the possibility of a sustained price rise during November. For example, the Solana network’s total value locked (TVL) has reached a new 2-year high. The next graph shows the change in its TVL.

Solana network total value locked, SOL – DefiLlama

On 26 October the Solana TVL reached 42.5 million SOL which is its highest value since September 2022. Jupiter, Radium and Sanctum contributed 13%, 18% and 17% respectively to the Solana TVL rise. Based on these statistics Solana has become the second largest blockchain in terms of TVL after It has overtaken BNB. On the other hand, the gap between Solana and Ethereum in this respect has been decreasing in recent years. For example, Binance’s launch of SOL liquid staking service has increased its standing on the market.

While Solana’s TVL increased over the past 30 days BNB’s decreased by 5%. On the other hand, Ethereum’s TVL rose by 2% within the same period. However, it is important to note that there are many decentralized applications that do not need to make large deposits. These include the dApps in the marketplaces, games, collectibles, social networks and Web3 infrastructure.

Another interest area relates to the performance of decentralized exchanges on these networks. Solana remains the best blockchain in this respect as it has recorded a 19% increase in decentralized exchange (DEX) volumes during the past 7 days. Ethereum DEX activity increased by 6% while BNB had 5%. The main performers on the Solana blockchain include Radium, Lifinity and Phoenix. In addition, the network performed outstandingly in terms of meme coin trading activity.

Pertaining o the SOL perpetuals the network has been excelling as well. The SOL perpetual activity points to a health market outlook. For example, SOL’s funding rate is 0.01 which indicates that the buyers are paying for leverage. However, when there is high demand for retail buyers the SOL often surpasses 2.1%.

Another metric that is indicating a bullish Solana trend is the increase in its monthly active wallet. The number of active SOL senders and receivers surged to 107.04 million on 26 October. This shows an increase in transaction activity on the network. Usually, this is accompanied by a rise in the price of the asset. The daily total active users was at 2.68 on the same date. However, that was a decrease from 8.81 million recorded on 22 October.

SOL Market Analysis : Its Potential Future Price Moves

It is important to note that SOL has been making steady gains since the beginning of October. After testing the $180 level, the SOL price will likely rise to $210, if it manages to stay above its recent high. As a fact, SOL reached $210 on 18 March but it has been experiencing dips and bounce since then. The SOL relative strength index is at 68 showing that it is moving towards an overbought market state. However, if the selling pressure increases the SOL price may fall to $160.99 or worse still below $159.85.

Bitcoin Eyes a New All-Time High

The bitcoin price surged past $72,000 on 30 October showing slight gains from the previous two days. If its value continues to rise during the next few days that will strengthen its market position. Also, if the trend continues bitcoin may reach a new all-time high in the coming days. As a result, its market capitalization will surpass $1.45 trillion. This will als lead to a rise in its market dominance. If the number one cryptocurrency hits another ATH that will validate that bitcoin performs the best in Q3, especially in October.

At the time of writing, bitcoin is trading at $99, 161 BTC/USDT. This is after its value increased by 1.72% within the last 24 hours. On the other hand, its market cap stands at $1.43 trillion. As a result of this price surge bitcoin dominance is now at 60%. As things stand, the next bitcoin target is $100,450, which will also become its new all-time high. More importantly, its next price range is between $85,000 and $160,000 which gives hope of further gains. If the political crisis in the Middle East continues to ease and the United States presidential election results in a pro-crypto president bitcoin may end the year at around $100,000.

Gate.io P2P: A Platform for Trading Bitcoin (BTC)

In addition to centralized exchanges, Bitcoin (BTC) can be traded on Gate.io P2P, a decentralized peer-to-peer (P2P) trading platform. Gate.io P2P allows users to trade BTC directly with one another, bypassing traditional exchange systems. It provides a more flexible and secure way to buy or sell BTC using a range of payment methods, ensuring that both buyers and sellers are protected by an escrow service.

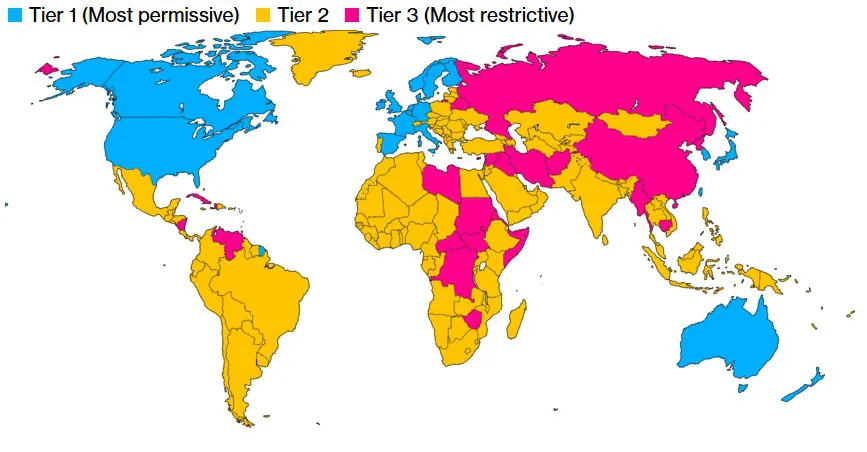

The Gate.io P2P platform supports multiple currencies, offering an alternative for users who may face restrictions in accessing centralized exchanges. With the rising popularity of Bitcoin, trading BTC on Gate.io P2P provides an opportunity to participate in the market at competitive prices and with lower fees, which is particularly advantageous for users in regions with fewer exchange options.

Post Views: 103