CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Solana demonstrates robust expansion in 2025 as USDC issuance exceeds $10.75 billion while capturing more of the DeFi market share. But despite these gains, long-term investors maintain a cautious outlook as market anxiety rises, according to NUPL on-chain metrics.

Solana Long-Term Holders Show Signs of Fear

Solana’s long-term token holders display signs of doubt based on Glassnode’s on-chain data. Long-term holders now face “fear” conditions according to the Net Unrealized Profit/Loss (NUPL) metric.

The NUPL values for Solana dropped from optimistic levels in January before remaining at low points throughout March. This shift shows that most of the long-held SOL investments now face unrealized losses or have reached that point.

Moreover, the price decline since the January highs has resulted in Solana holders showing decreased confidence in the market direction.

The fears of long-term holders do not necessarily trigger them to sell their assets right away. However, lower confidence levels tend to reduce buying or holding activity, thus slowing down market momentum.

The current NUPL indicator signals that long-term investors in the Solana market should exercise caution.

Circle Mints More USDC on Solana

Meanwhile, sentiment change has not impacted the high levels of activity within Solana’s stablecoin ecosystem.

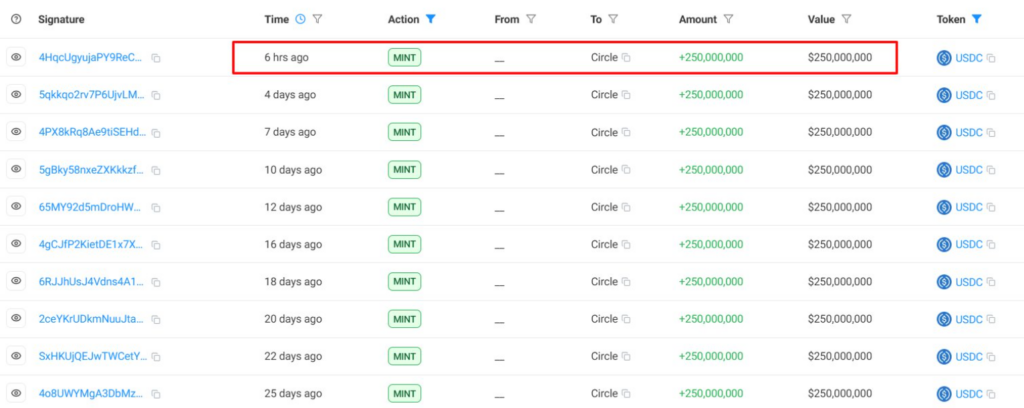

According to OnchainLens, the Solana blockchain received another $250 million USDC issuance from Circle. It brings the total USDC minted on Solana during 2025 to approximately $10.75 billion.

Solana’s network usage depends heavily on stablecoin expansion. USDC serves as the foundation for decentralized finance (DeFi) operations and remittance services while maintaining its value within blockchain networks.

Moreover, USDC issuance continues, indicating developers, alongside institutions, maintain their capital deployment and blockchain development activities on Solana.

Meanwhile, high levels of stablecoin liquidity enable users to participate in trading operations, lending activities, and other decentralized applications on-chain. The increased network activity from this behavior can raise fees while using the network, which eases short-term concerns among users.

The ongoing issuance of USDC by Circle demonstrates their sustained faith in Solana’s operational capabilities and speed.

New Gains Share in DeFi Market

The DeFi sector of Solana continues to expand as the network grows its presence. Based on CryptoRank and DeFiLlama data, Ethereum experienced a decrease in its Total Value Locked (TVL) market share during the previous year.

As of March 2025, the DeFi TVL market share held by Ethereum decreased to 60.1% from its previous all-time high of over 80%.

Solana, in contrast, has achieved an 8.6% share of total value locked (TVL) while starting from a smaller base one year ago.

Bitcoin has also seen growth alongside stable performance from other platforms in the market. The data shows that users in the DeFi market are expanding their activity into networks that extend past Ethereum.

The migration towards Solana occurs because it offers both affordable transactions and swift processing capabilities.

During times of high network usage, Ethereum fees become expensive. Hence, Solana’s features provide users with an attractive alternative.

Moreover, Solana developers continue to expand their protocols on the network. That results in attracting users and liquidity from alternative chains.

SOL Price Breakout Suggests Price Recovery

Analyst CryptoCurb chart indicates Solana has successfully escaped its downward movement, which started in late January. The price breakout occurred after market stability and matched the price recovery from recent bottom areas.

The price decline started when Solana reached its peak in January, at the same time that major transactions using Solana-based meme tokens were observed.

Since then, SOL experienced downward pressure during this period. However, the price has shown signs of stabilizing before moving upward.

Additionally, the next price targets for the market lie between $150 and $180 if current momentum persists.

The market also shows signs of trader participation according to technical indicators despite the conservative stance of long-term investors. Moreover, the market-wide altcoin recovery seems to be one of the factors behind this price breakout.