The IRS crypto tax delay announcements have shaken the cryptocurrency world. The agency now pushes back digital asset reporting rules to 2026. At the same time, they’ve called the U.S. tax system “voluntary.” The IRS tax regulations for crypto shift come as many worry about system readiness.

Also Read: Bitcoin Plummets Below $96K: Is Your Investment Safe?

IRS Delays Crypto Tax Reporting to 2026: What You Need to Know About New Regulations

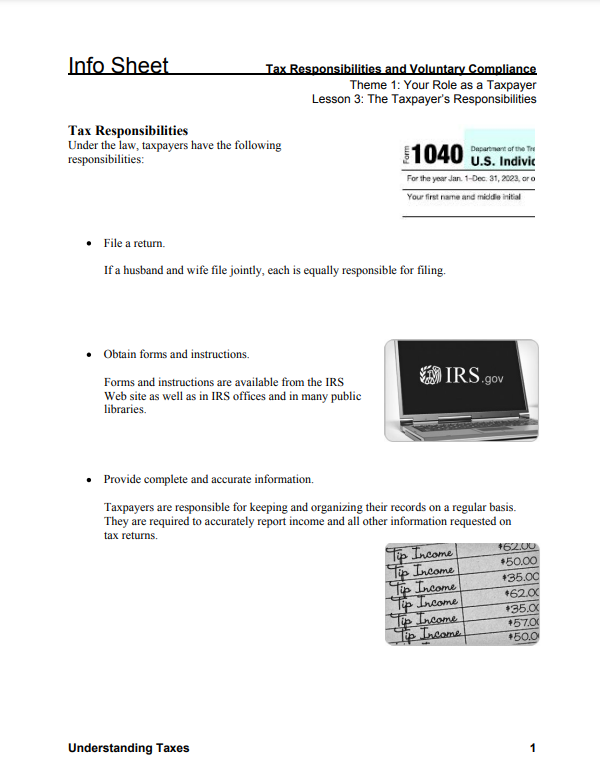

The Voluntary Nature of the U.S. Tax System

🇺🇸IRS: TAXES ARE VOLUNTARY

“And if the public doesn’t see that the IRS is enforcing the law, we will see a decline in those willing to comply.”pic.twitter.com/McO13JlImz

— Mario Nawfal (@MarioNawfal) January 7, 2025

The IRS has started open talks about taxes being voluntary. They stated clearly: “Our US tax system is a voluntary tax system.” The agency stresses that people must want to comply. Without clear enforcement, the IRS fears they “risk losing people continuing to voluntarily comply.”

Extended Timeline for Crypto Reporting

The new crypto reporting rules won’t start until January 1, 2026. This gives digital asset brokers more time to build better systems. They need this extra time to track the cost basis for crypto assets on main platforms. The IRS cryptocurrency reporting changes aim to make things clearer.

Also Read: DogWifHat (WIF) And Pepe Price Prediction For Mid-January 2025

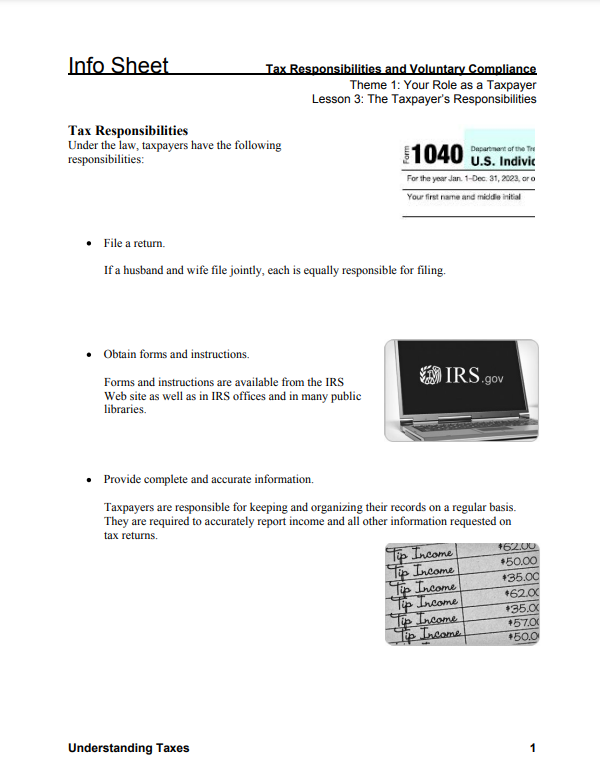

Key Changes in Reporting Requirements

The crypto tax rules update brings new duties for brokers. They must now follow these guidelines:

- Use the FIFO method when traders don’t pick another option

- Leave out wallet addresses to protect privacy

- Match DeFi rules with regular finance rules

Impact on Investors and Platforms

Both investors and crypto platforms get more time to adjust. Most brokers can’t yet track specific coins when people sell. This matters because exact tracking helps report taxes correctly.

Also Read: Cryptocurrency Market Loses $622 Million: Why Is It Down Today?

Privacy and Security Improvements

The new rules help protect user data better. Form 1099-DA no longer shows wallet addresses or transaction IDs. This change makes crypto tax reporting safer for everyone.

This IRS crypto tax delay helps both sides prepare better. The IRS wants to watch crypto trades while making sure platforms can actually track everything. The 2026 date lets everyone build stronger reporting systems.