CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

| Key Points:

– Tether is in talks with a Big Four accounting firm to conduct its first independent audit to increase transparency around its USDT reserves. |

Tether, the issuer of the world’s largest stablecoin USDT, is in discussions with a Big Four accounting firm to conduct an independent audit of its reserves.

According to Reuters, CEO Paolo Ardoino confirmed the company is “engaging” with one of the global professional services giants—PwC, EY, Deloitte, or KPMG—but did not specify which firm or provide a timeline for when the audit might take place.

Tether Pursues Big Four Accounting Firms to Boost Transparency

The push for greater transparency comes amid renewed optimism in the U.S. crypto regulatory environment, particularly under President Donald Trump. Ardoino indicated that recent shifts in policy have made a full audit “feasible,” contrasting it with what he described as the previous administration’s hostile stance, often referred to in the industry as “Operation Chokepoint 2.0.”

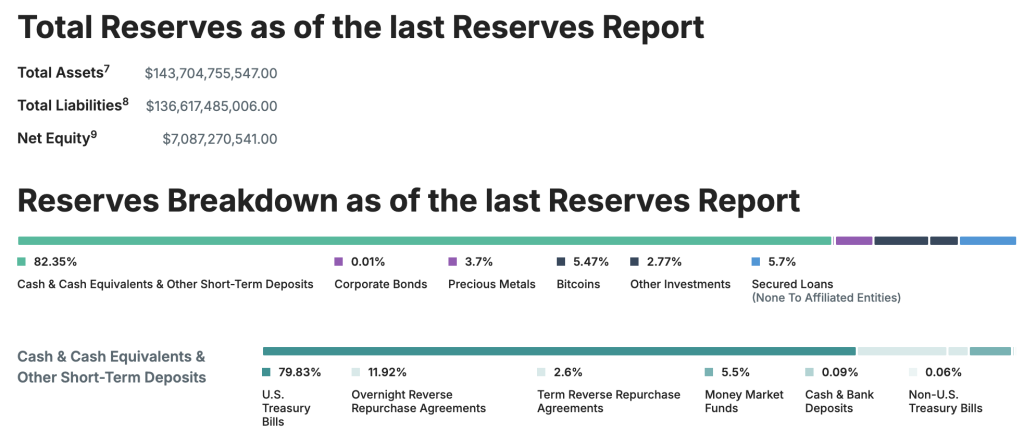

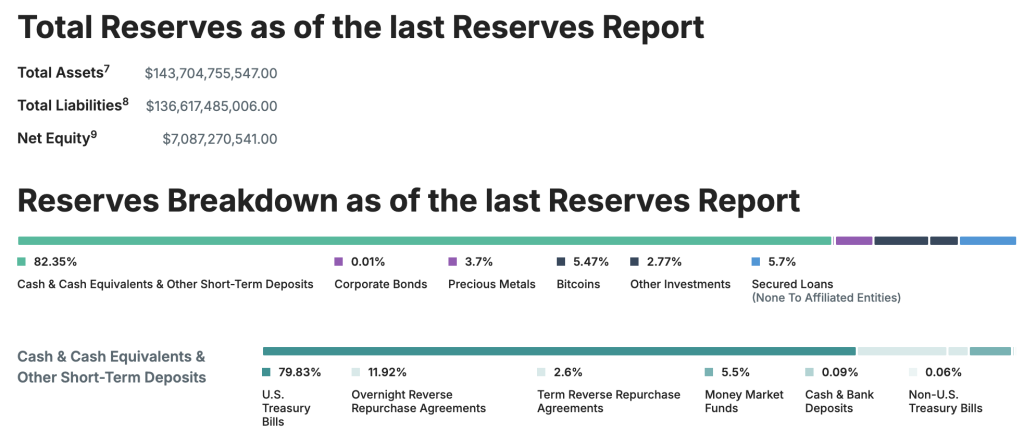

Tether, which is now headquartered in El Salvador, has long promised a full audit of the reserves backing its dollar-pegged token. While the company currently releases quarterly attestation reports, critics and regulators have called for more rigorous, independent verification. An audit from a Big Four accounting firm would mark a significant step toward addressing those transparency concerns.

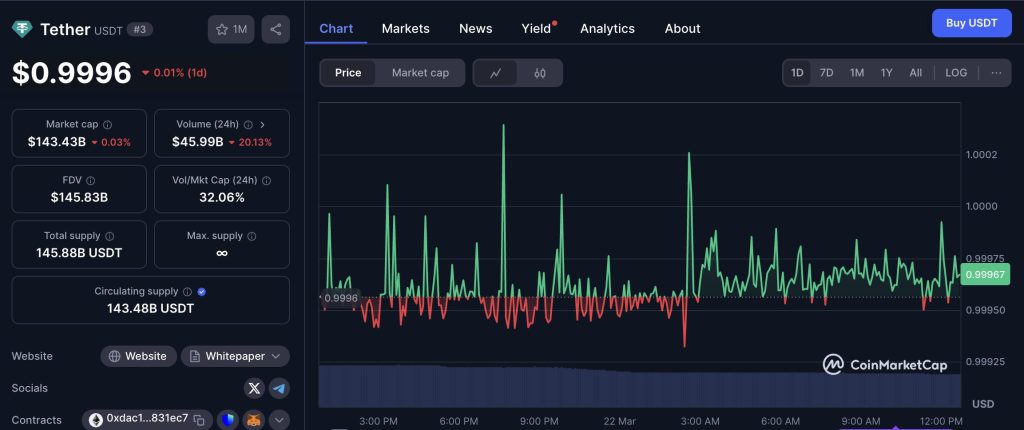

The company’s main product, USDT, operates across several blockchain networks, including Ethereum, Solana, and Tron, and is set to expand to the Bitcoin network soon. USDT is the most traded cryptocurrency in the world and ranks third in market capitalization, trailing only Bitcoin and Ethereum.

Since its launch in 2014, Tether has faced ongoing scrutiny regarding the composition and management of its reserves. The company maintains that every USDT token is backed 1:1 by U.S. dollar-denominated assets, including Treasuries, and claims to have issued more than $143 billion worth of stablecoins.

New CFO and Custody Partnerships Strengthen Oversight

Efforts to secure an independent audit also coincide with broader discussions in Washington. As the U.S. moves closer to establishing federal legislation on stablecoins, President Trump has urged Congress to pass a regulatory bill. Industry participants, including Tether, see this as a potential catalyst for legitimizing and strengthening stablecoin operations within the country.

Despite its market dominance, Tether’s past controversies continue to linger. In 2021, the company agreed to cease operations in New York following a state attorney general investigation that concluded the company had made misleading claims about its reserves.

Since then, the company has taken steps to rebuild trust, including appointing Simon McWilliams as its new chief financial officer. McWilliams is tasked with leading the charge toward achieving a full financial audit.

Adding further credibility to its reserve management, Tether has partnered with Cantor Fitzgerald, a firm led by newly appointed U.S. Commerce Secretary Howard Lutnick, which currently custodies a significant portion of the assets backing USDT.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |