CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

The Blockchain Group’s latest buy took place during a wave of corporate adoption of digital assets. This move also follows a 200+% surge in the company’s stock since it began buying Bitcoin in late 2024. GameStop saw a nearly 12% stock jump as well after announcing plans to invest in Bitcoin by using proceeds from a $1.3 billion convertible notes offering. Meanwhile, Bitcoin mining stocks fell after Microsoft reportedly scaled back its AI data center expansion plans, which caused doubt on miners’ diversification into AI infrastructure to offset post-halving revenue declines.

The Blockchain Group Makes Biggest BTC Purchase

France-based The Blockchain Group recently expanded its Bitcoin holdings by adding 580 BTC to its treasury in its largest purchase to date. The acquisition is valued at approximately $50.64 million at current market prices, and was disclosed after market hours on March 26.

Blockchain Group’s stock price over the past 6 months (Source: Google Finance)

This move was made after an impressive 225% surge in the company’s stock price since it began investing in Bitcoin in November of 2024. The Blockchain Group describes itself as a global umbrella for companies focused on data intelligence, artificial intelligence, and decentralized technologies.

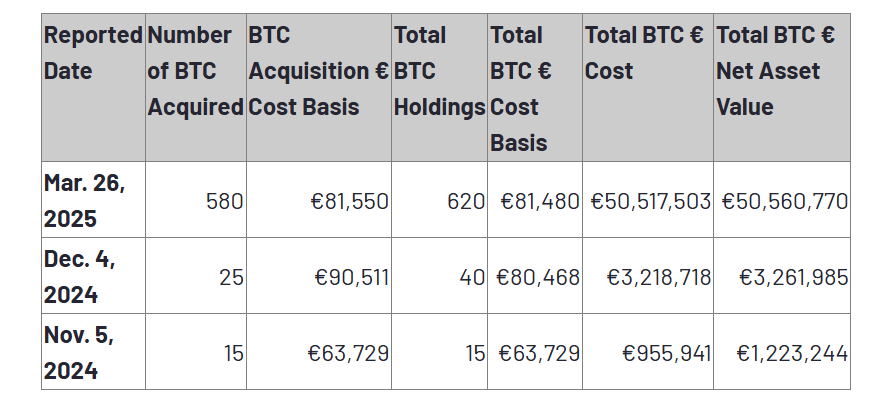

Details about The Blockchain Group’s BTC acquisitions (Source: Euronext)

The firm’s Bitcoin buying strategy seems to align with certain key moments in the broader crypto market. Its first purchase of 15 BTC happened on Nov. 5, which coincided with Donald Trump’s US election win. The second was a 25 BTC acquisition that took place on Dec. 4 as Bitcoin hovered around $96,000, just before it hit six figures. While March 26 wasn’t a specific milestone for Bitcoin, it arrived just before the end of Q1 2025, which is a quarter in which Bitcoin underperformed compared to historical averages, and a few weeks ahead of the April 20 Bitcoin halving anniversary.

The company says its Bitcoin strategy is intended to make use of excess cash and favorable financing options. The most recent purchase also happened as interest in corporate Bitcoin holdings seems to be gaining renewed momentum.

This growing trend of corporate Bitcoin adoption is drawing a lot of commentary from industry players. N7 Capital founder Anton Chashchin believes that it will be worth watching whether other companies follow suit. US angel investor Jason Calacanis agreed with this, and suggested that Bitcoin can serve as a viable asset strategy for public firms lacking robust business models. Meanwhile, Michael Saylor’s firm Strategy recently surpassed the 500,000 BTC mark after buying 506,137 Bitcoin. This was part of the company’s 12-week buying spree from November through January.

Bitcoin Bet Boosts GameStop Shares

GameStop shares also jumped by close to 12% on March 26 after the company’s announcement that it plans to purchase Bitcoin. The move will be financed through debt, with GameStop unveiling a $1.3 billion convertible notes offering after the market closed that day. These convertible senior notes, which can later be turned into equity, will fund general corporate initiatives, including Bitcoin acquisition, which is in line with the company’s updated investment policy.

On March 25, GameStop revealed that it will use part of its corporate cash or future financing to buy digital assets like Bitcoin and US-dollar-pegged stablecoins. The company’s cash reserves saw a massive increase, and stands at about $4.77 billion. This is up from $921.7 million the previous year. GameStop’s stock closed at $28.36 on the NYSE, posting an 11.65% gain for the day.

GameStop stock price over the past 24 hours (Source: Google Finance)

The firm also reported a Q4 2024 net income of $131.3 million, which was more than double the $63.1 million posted during the same period the previous year. Despite a $511 million year-over-year drop in net sales, GameStop aggressively reduced its operating costs, including shutting down 590 stores across the US in 2024. The company was once the face of the 2021 meme stock phenomenon that saw retail investors drive its price sky-high in a dramatic short squeeze, and is now pivoting toward digital asset investment.

GameStop’s move mirrors a broader trend of companies incorporating Bitcoin into their corporate treasuries. Japanese firm Metaplanet plans to acquire 21,000 BTC by 2026, and it experienced a 4800% increase in its stock and a 6300% jump in market capitalization after embracing its Bitcoin strategy. Semler Scientific also reported a rise in its share price after disclosing its intent to buy Bitcoin.

Metaplanet stock price rise over the past year

According to data from CoinGecko, 34 publicly traded companies currently hold Bitcoin on their balance sheets.

Bitcoin Mining Stocks Slide

On the other hand, Bitcoin mining stocks took a hit after reports that Microsoft is scaling back its plans to invest in new artificial intelligence data centers in the United States and Europe. The news was first reported by Bloomberg and reflected in Google Finance data.

In fact, it triggered share price drops of between 4% and 12% for major crypto mining firms including Bitfarms, CleanSpark, Core Scientific, Hut 8, Marathon Digital, and Riot. The decline shed some light on the growing reliance of Bitcoin miners on AI-related revenue streams, particularly after the April 2024 Bitcoin halving event that reduced mining rewards and tightened margins across the industry.

Core Scientific stock price over the past 24 hours (Source: Google)

Benchmark analyst Mark Palmer thinks that while Microsoft’s decision was expected by some investors, the broader market reaction may be more closely tied to Bitcoin’s stagnant price and growing investor fatigue in the sector. Mining difficulty is also at historically high levels, compounding the challenges for miners already grappling with weaker crypto prices.

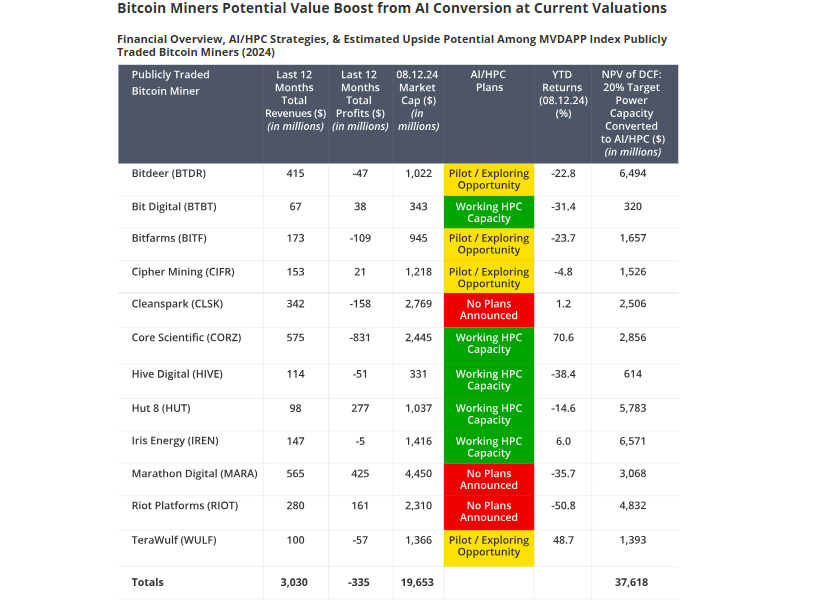

To adapt, many mining companies started repurposing their infrastructure to support high-performance computing for AI workloads. A March report from Coin Metrics shared some details about this shift, and pointed out that miners are increasingly diversifying into AI data center hosting to boost revenue.

In June of 2024, Core Scientific committed 200 megawatts of capacity to power AI models developed by CoreWeave. In August, asset manager VanEck projected that mining stocks could see up to $37 billion in added market capitalization if they invest in AI infrastructure.

(Source: VanEck)

However, these plans may now face additional headwinds. Microsoft’s decision to cancel or delay data center projects adds a new layer of uncertainty. Analysts at TD Cowen attributed the move to a perceived oversupply of computing capacity for AI applications and a scaling back of some planned collaborations with OpenAI. Over the past six months, Microsoft reportedly abandoned multiple data center leases and may continue to decelerate investments into late 2025, once it completes $80 billion in previously planned developments.

For now, this shift is the start of a more cautious phase for AI infrastructure spending and raises concerns for Bitcoin miners hoping to capitalize on the sector.