2024 was a year of both unprecedented success and significant challenges for the crypto industry. The year recorded major crypto theft and exploits that revealed the weaknesses of decentralized systems, resulting in the loss of billions of dollars.

Yet, amidst these incidents, the industry remains resilient, pushing forward with innovation and tighter security firewalls.

SlowMist, a leading cybersecurity firm, recently published a report on the biggest crypto thefts in 2024. The report also offered key insights to help developers improve security.

2024 Crypto Security Overview

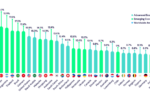

According to the SlowMist report, 2024 saw a sharp rise in crypto thefts. 410 security incidents resulted in losses of over $2 billion.

This compares to 2023, which saw 464 incidents and approximately $2.486 billion in losses.

This represents a year-over-year decrease of 19.02%. Ethereum topped the list with $465 million in blockchain losses, while Binance Smart Chain (BSC) followed with $87.35 million in losses.

– Advertisement –

The Decentralized Finance (DeFi) sector has remained the primary target, suffering most breaches. Security incidents increased by 33.12% compared to the previous year.

As the industry evolves, attackers use more sophisticated tactics to exploit vulnerabilities.

Crypto theft has shifted from simple hacks to organized cybercrime groups employing advanced tools. These include social engineering, phishing schemes, and software vulnerabilities.

Implementing Anti-Money Laundering (AML) regulations has improved the detection of illicit transactions. However, it has also pressured exchanges and protocols to strengthen security frameworks.

This dual impact highlights the balancing act between regulatory compliance and operational efficiency.

Despite these efforts, attackers continuously exploit weaknesses in smart contracts, bridges, and wallet systems.

This highlights the constant cat-and-mouse game between attackers and developers.

As a result, the industry must continuously reassess security strategies and remain adaptable to evolving threats.

The Top Crypto Theft of the Year

In 2024, multiple crypto platforms were targeted by hackers, resulting in significant losses.

DMM Bitcoin, a Japanese crypto exchange, lost $330 million after hackers exploited a vulnerability in its smart contract.

In another incident, PlayDapp, an Ethereum-based gaming platform, lost over $36.5 million. This loss came following a hack that exploited a leaked private key.

WazirX, an Indian crypto exchange, lost over $230 million through a flaw in its multisig wallet.

Meanwhile, BtcTurk, Munchables, and Radiant Capital also faced major breaches. Notably, the Radiant Capital’s attack was linked to a North Korean hacking group.

The financial losses amounted to $5.3 million, $62.5 million, and $97 million, respectively.

BingX lost $45 million in a hot wallet hack, and Hedgey Finance suffered a $44.7 million loss due to weak security.

Penpie and FixedFloat were also attacked, resulting in millions of losses. These incidents underscore the need for stronger security in the crypto industry.

Keynote to Developers for 2025

As the crypto landscape evolves, security should be a top priority for developers.

In 2025, focusing on smart contract security, improving code reviews, and user education will be essential.

Decentralized finance protocols, blockchain bridges, and multi-chain systems are vulnerable, making them critical areas for protection.

Conducting regular security audits will help spot vulnerabilities before launch. Enhanced authentication methods like multi-factor verification and hardware wallets can prevent attacks.

Additionally, blockchain forensics and AML tools will aid in detecting and addressing threats early in this rapidly changing environment.