It has been a historic year for the crypto industry. With so many industry-defining moments throughout 2024, we have pinpointed five of the most influential events that drove the cryptocurrency market to its all-time high.

From the SEC’s approval of Bitcoin ETFs to the crazy meme coin rally, here are the top five events that shaped the crypto market in 2024.

The SEC Approves Spot Bitcoin ETFs

In Q4 2023, Grayscale achieved a surprising legal victory against the SEC regarding converting its Bitcoin Trust to an exchange-traded fund (ETF). This created an exciting anticipation for asset management firms to take Bitcoin into institutional markets, which materialized in January 2024.

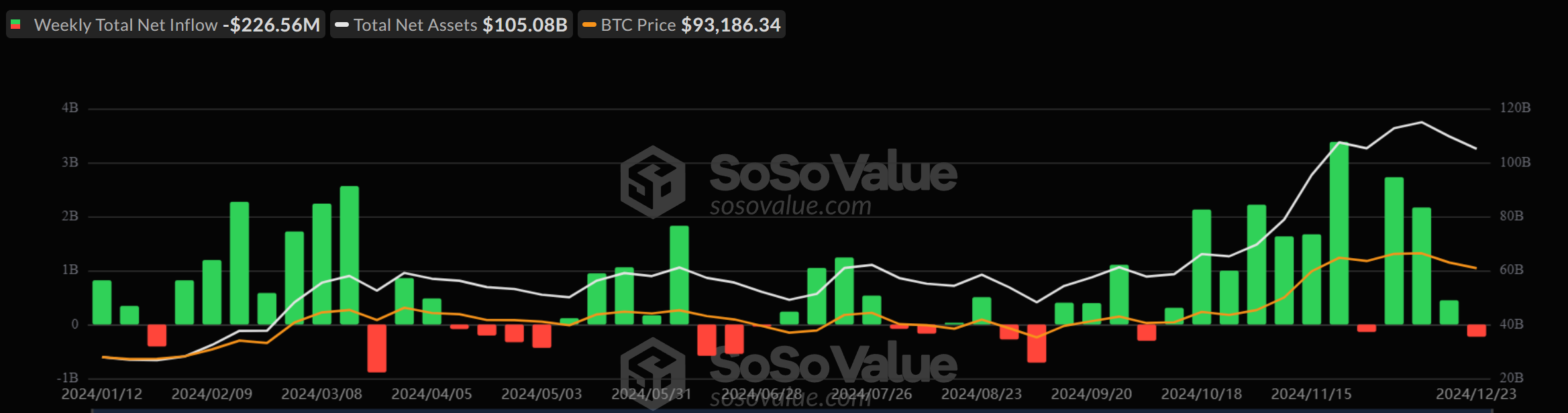

This year started with the SEC approving 12 Spot Bitcoin ETFs, marking Bitcoin’s first entry into the US retail investment scene. The impact was immediate, as retail investors poured millions into these funds. In fact, Bitcoin ETFs saw the fastest growth than any other ETFs in history.

Consecutively, Bitcoin broke its 2021 all-time high in less than two months of the approval, breaking the $70,000 barrier in March. This success also influenced other global markets like the UK to introduce Bitcoin-based exchange-traded products (ETPs).

As of Christmas 2024, the 12 US spot Bitcoin ETFs had a total net asset of over $105 billion, representing nearly 5.7% of the BTC supply. Most notably, these ETFs now hold more assets under management (AUM) than Gold ETFs.

The staggering success of Bitcoin ETFs in the US opened doors for crypto’s institutional adoption. Soon after, Ethereum ETFs were also approved, and several other altcoins have similar applications with the SEC.

“This year’s market momentum has shown us the significant role of regulated financial products in driving adoption. The significant inflows into existing ETFs highlight a strong demand for regulated crypto investment tools. Financial institutions are incentivized to broaden offerings if market performance supports additional assets. Looking ahead to 2025, we expect more diverse crypto ETFs entering the market,” Forest Bai, Co-founder of Foresight Ventures told BeInCrypto.

While Bitcoin ETFs opened the doors, industry experts think 2025 will set a much grander stage, and diverse crypto ETFs will dominate the retail market. Kadan Stadelmann, CTO at Komodo Platform, thinks Solana ETFs have the upper hand as Donald Trump previously launched his NFT collection on the network.

However, some industry experts are more cautious, showing concerns that the increasing inflow of these funds could lead to liquidity challenges.

“Crypto has its own cycles, and retail activity, DeFi growth, and global adoption play a big role too in price movements. That said, there’s a risk if too much liquidity gets tied up in traditional markets through ETFs. For crypto to thrive long-term, we need to focus on building decentralized solutions that don’t rely solely on external validation,” John Patrick Mullin, CEO & Co-Founder of MANTRA told BeInCrypto.

The Surge of Solana Meme Coins

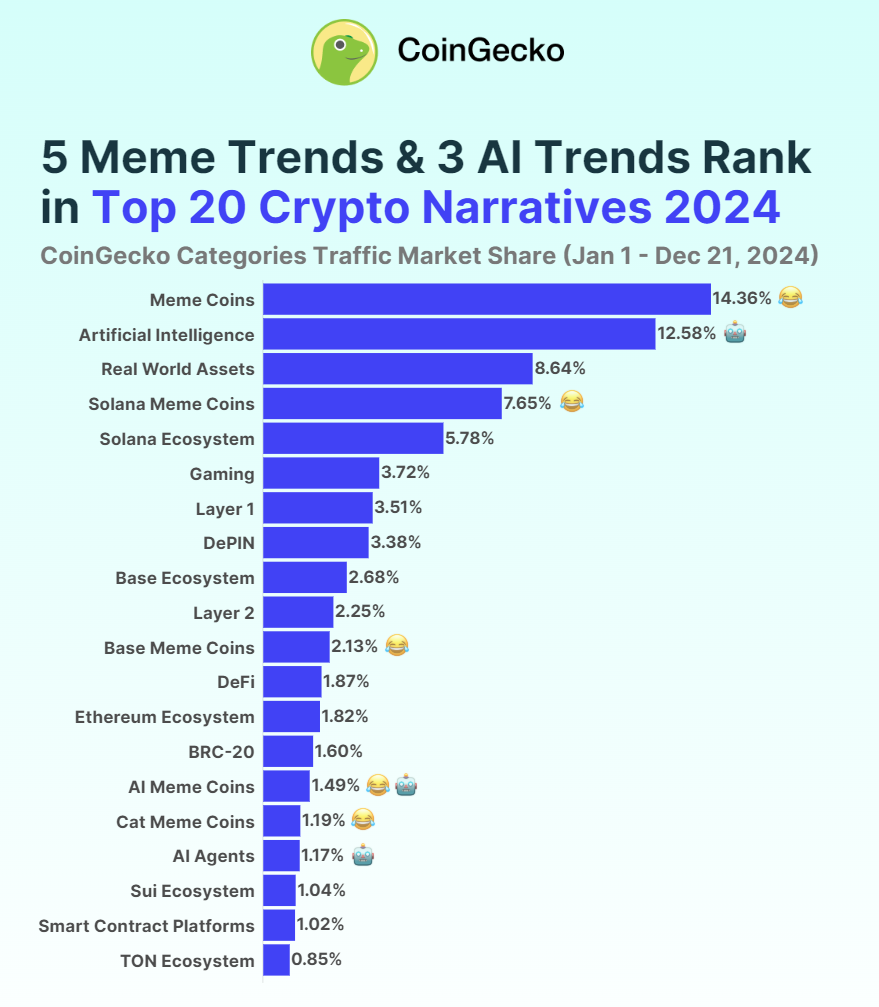

The crypto community will always remember 2024 as the year of the Solana meme coin craze. While meme coins have existed on Solana for some time, platforms like Pump.fun propelled their popularity.

This momentum placed Solana’s meme coins in the 4th spot for investor interest, accounting for 7.65% of crypto narrative discussions, according to CoinGecko.

Also, the collective market cap of Solana-based meme coins now exceeds $16 billion. In fact, three of the top five meme coins in the market, including Dogwifhat (WIF) and BONK, operate on the Solana network. WIF surged by 1,100% this year, while BONK recorded a staggering 38,000% growth over two years.

“While meme coins have been popular, I believe their dominance will fade as we shift towards meaningful utility and real adoption. Emerging technologies like AI agents and confidential computing will drive attention to more impactful blockchain use cases,” said Jonathan Schemoul, CEO of Aleph.im and lead contributor to LibertAI

Meanwhile, this surge in meme coin activity also elevated Solana to the position of the second-largest blockchain, trailing only Ethereum. The network’s total value locked (TVL) surpassed $8.6 billion, as SOL reached an all-time high of $263 in November.

So, what made Solana so popular for meme coin creators in 2024? The answers are scalability and accessibility. Tools like Pump.fun streamlined the process of launching tokens, requiring minimal effort to create and deploy a meme coin.

“2024 cemented Solana’s dominance in the meme coin market, but 2025 may bring diversification as AI meme coins gain traction. With companies like ai16z and Crew AI launching open-source frameworks for autonomous AI agents, creating AI-driven tokens is more accessible than ever. This could encourage projects to explore other blockchains, such as Sui, which, with its fast transactions and low costs, is naturally well-suited for AI meme coins,” Hisham Khan, CEO & Co-founder of Atoma, told BeInCrypto.

Additionally, Solana’s low transaction fees have fostered widespread participation, blending humor with financial opportunity. These factors contributed to the explosive growth of meme coins on Solana throughout 2024.

However, the extreme volatility of such meme coins has been a concerning factor for the market. Recent stats revealed that the majority of the Solana meme coin traders are actually losing money. Only a handful are making the big bugs due to speculative trading.

“There is a rotation from memes to meaning, from quick pumps and rug-pulls to projects building for the future with real utility, and real community adoption,” said Matt O’Connor, Co-founder of Legion, in an interview with BeInCrypto.

Donald Trump’s Election Victory

While crypto is all about decentralization, the political influence in the industry is undeniable due to the regulatory factor. Donald Trump’s election victory in 2024 has significantly impacted the cryptocurrency industry, ushering in a period of optimism and growth.

His administration’s pro-crypto stance has already led to several key developments even before his official presidency begins.

Following Trump’s win, the crypto market surged by nearly $1 trillion as investors sensed an ease in regulatory scrutiny. Consecutively, Bitcoin jumped to new peaks, ultimately reaching the $100,000 milestone.

However, the most profound impact was on Ripple’s XRP, which was held back by the SEC’s lawsuit for nearly four years. With Trump’s victory and his promise to restructure the SEC, XRP jumped to a six-year high.

“If the US continues to ease restrictions, it will create a ripple effect globally. Countries like China and Russia may not jump on the crypto bandwagon right away, but they’ll definitely take notice, especially as tokenized assets and blockchain tech become essential to global finance,” said John Patrick Mullin, CEO & Co-Founder MANTRA.

The administration’s favorable outlook has encouraged institutional investors to enter the market, further legitimizing digital assets. Trump’s appointment of pro-crypto candidates such as Paul Atkins, David Sacks, and Elon Must signals a shift towards more crypto-friendly policies.

Additionally, Trump promised to work toward a national Bitcoin reserve during his campaign, and his party senators are also onboard with the idea. These discussions show a commitment to integrating cryptocurrencies into the national financial framework.

“The plan for a strategic Bitcoin reserve is perhaps the most audacious on the macroeconomic level. The incoming President has also confirmed plans to sunset the push for a CBDC while promising to support policies that will boost self-custody for crypto holders. Pro-crypto figures have a close relationship with the president, which might be instrumental in helping the incoming administration keep its crypto promises,” Maksym Sakharov, Co-Founder of WeFi, told BeInCrypto.

The pro-crypto policies have already spurred a global increase in crypto adoption. Notably, there has been a 683% rise in users aged 18–25, indicating growing interest among younger demographics.

European markets have also seen substantial inflows into crypto-related exchange-traded products, reflecting widespread optimism about the industry’s future.

“The US shift could trigger greater legitimacy and institutional adoption worldwide, potentially setting a standard for other regions to follow. One standout region is Hong Kong, which has emerged as a critical gateway for China’s crypto market and innovation. Hong Kong’s progressive stance on crypto is evident—it launched Ethereum ETFs earlier than the US, demonstrating its openness to digital assets,” said Forest Bai, Co-founder of Foresight Ventures.

As the industry continues to evolve, such ongoing support from the highest levels of government is likely to play a crucial role in shaping its future trajectory.

Bitcoin Reached $100,000

Perhaps the biggest yet most predicted event of 2024 was Bitcoin’s $100,000 milestone. This was a psychological milestone for Bitcoin and the overall crypto community. Reaching the six figures reflects its maturation as a financial asset, boosting both institutional and retail investment confidence.

For companies like MicroStrategy, which always championed a Bitcoin-first strategy, this was an assertion of their projections. This is reflected in MSTR’s stock performance and its recent inclusion in the Nasdaq-100.

Additionally, since the $100,000 milestone, more governments have started considering the idea of a Bitcoin reserve, recognizing its store of value. This includes countries that once had a pessimistic perspective toward crypto, such as Russia and Japan.

Corporations like Amazon are also reportedly exploring Bitcoin investments, signaling the potential integration of cryptocurrencies into their business models. Such interest from major corporations could drive further adoption and innovation within the crypto ecosystem.

“While this historic milestone demonstrated how policy shifts catalyze institutional adoption, recent pullbacks remind us that even Trump’s pro-crypto stance was quickly priced in after the initial rally. Key financial hubs around the world are already recalibrating their approaches. However, market volatility will likely persist amid macro-economic uncertainty, particularly given the Fed’s unclear rate cut timeline for 2025,” OKX Global CCO, Lennix Lai told BeInCrypto.

In summary, Bitcoin reaching $100,000 enhanced its legitimacy and encouraged broader adoption across both public and private sectors. However, the threat of volatility still remains high due to macroeconomic uncertainty.

Gary Genslar’s Resignation

Gary Gensler’s tenure at the SEC was challenging for the crypto industry in the US. However, with Trump’s re-election, the SEC is starting to undergo significant restructuring.

In November, Gary Gensler announced his resignation as the SEC chair. Gensler has been a contentious figure in the crypto industry due to his stringent regulatory approach.

“Gensler’s policy was one extreme, but the remaining question is if we will shift to another extreme. I think there is already progress in pushing forward a neutral stance and regulation/adoption from the SEC,” Sander Gortjes, CEO of HELLO Labs, told BeInCrypto.

During his tenure, Gensler asserted that most crypto tokens qualify as unregistered securities, necessitating compliance with existing securities laws. This perspective led to enforcement actions against major crypto exchanges, including Binance and Coinbase, for operating without proper registration.

Critics argue that Gensler’s “regulation by enforcement” strategy created an environment of uncertainty and hindered innovation within the crypto space. Meanwhile, Trump has already named Paul Atkins as his replacement, who has been a long-term advocate for digital assets.

“The path to further regulatory clarity in crypto needs a lot more pieces to fall into place: regulators worldwide need to get on the same page, markets need to mature, and institutions need to be ready. More pro-crypto regulations could bring more institutional players to the table, but it’s worth remembering that crypto’s innate volatility. Those 10-15% Bitcoin swings and even bigger moves in smaller tokens – will persist regardless of the regulatory environment,” said OKX Global CCO, Lennix Lai

The crypto community views this transition as an opportunity for a more favorable regulatory environment, anticipating that the new administration will adopt policies that support the industry’s development.

“Gary Gensler is not the origin of the crypto crackdown by the US SEC. However, he amplified the enforcement actions beyond his predecessors. With Paul Atkins, innovators in the market might find it easier and more rewarding to relate with the regulator,” WeFi Co-Founder Maksym Sakharov told BeInCrypto.

Overall, Gensler’s tenure at the SEC was marked by a rigorous stance on cryptocurrency regulation, leading to significant friction with industry participants who perceived his policies as obstacles to innovation and growth.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.