CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

- Trump’s 25% auto tariffs may contribute to inflation, impacting XRP’s value and investor sentiment, with a potential 40% drop ahead.

- XRP’s bearish descending triangle pattern signals a possible 40% decline, but a rebound could push prices toward $2.55 or higher.

As global markets brace for economic delays due to U.S. President Donald Trump’s proposed 25% tariffs on auto imports, as reported by ETHNews, cryptocurrency investors feel pressure.

The tariffs, set to take effect on April 3, 2025, could have far-reaching effects on U.S. manufacturing, consumer prices, and financial markets. XRP, one of the largest cryptocurrencies by market capitalization, is already showing signs of possible weakness, with analysts predicting a 40% drop in value.

The combination of macroeconomic uncertainties and a bearish technical pattern in XRP’s price chart raises concerns for traders and investors alike.

Macroeconomic Pressures from Trump’s Tariffs

The announcement of the tariffs has caused widespread concern in the market, particularly in sectors reliant on auto imports. U.S. manufacturers and consumers are expected to face higher prices, further straining the economy.

The February 2025 U.S. Consumer Price Index (CPI) report showed a 0.2% increase month-over-month, hinting at inflationary pressures. Federal Reserve President Alberto Musalem predicted that these tariffs could add as much as 1.2 percentage points to inflation, with both direct and indirect effects on prices.

The general economic environment also influences investor sentiment, with market participants now cautious about riskier assets, including cryptocurrencies. In response to these pressures, the likelihood of the Federal Reserve cutting interest rates in June has dropped, which could lead to further selling in volatile markets like XRP.

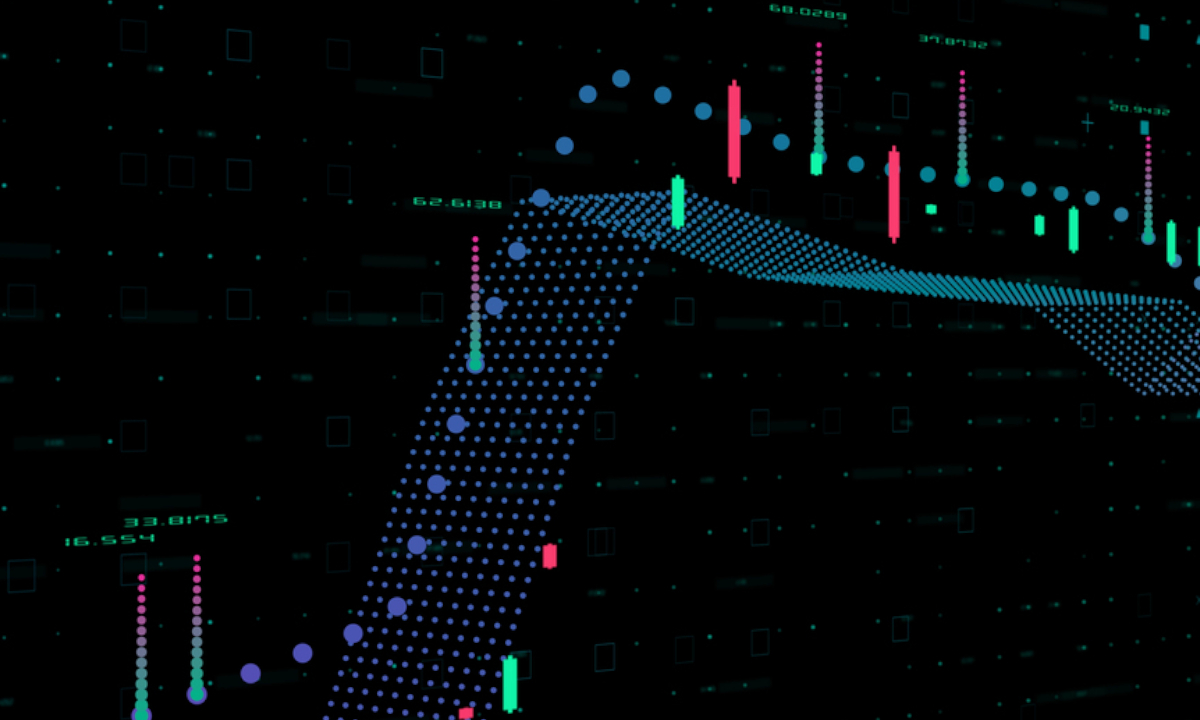

XRP’s Bearish Technical Pattern

XRP’s price chart reveals a potentially troubling pattern. Since the cryptocurrency’s late 2024 rally, the weekly chart has formed a descending triangle, a bearish formation that typically follows a strong uptrend. This pattern suggests that XRP may experience a decline if it breaks below the key support level.

The descending triangle, marked by a flat support line and a sloping resistance line, indicates that the cryptocurrency could fall as much as 40% if the support level breaks. A move towards $1.32, a downside target for XRP, could occur by April 2025. If this prediction holds, it would significantly drop from XRP’s current price levels.

Market expectations for the Federal Reserve’s next moves also weigh heavily on risk assets like XRP. As of March 28, the probability of a rate cut to a target range of 400-425 basis points in June has decreased from 67.3% to 55.7% in just a week.

The Fed’s cautious stance may signal that broader economic conditions could be less favorable for high-risk assets. The likelihood of further rate cuts appears minimal, leaving XRP vulnerable to potential downward pressure as investors turn more risk-averse.

Potential for Rebound or Breakdown

Despite the bearish outlook, XRP could still find support at its current price level, potentially leading to a rebound. If the cryptocurrency bounces off the triangle’s support level, it could test resistance at around $2.55, shifting towards more positive momentum.

However, a breakout above this level would negate the bearish technical patterns, pushing XRP toward its previous high of $3.35. Traders should remain cautious and watch the ongoing developments in the macroeconomic environment and XRP’s price action for signs of either a breakdown or a recovery.