The United Arab Emirates (UAE) now holds $40 billion in Bitcoin, according to a report shared by Binance founder Changpeng “CZ” Zhao. The Gulf nation has spent years building the foundation for this moment.

Government initiatives, progressive regulations, and an open-door policy for blockchain businesses have all contributed to this Bitcoin boom.

Dubai’s crypto empire

Dubai has been pulling out all the stops to attract crypto companies since launching the Virtual Assets Regulatory Authority (VARA) in 2022. The Dubai Multi Commodities Center (DMCC) Crypto Center is a big deal too, helping draw blockchain startups all over the world.

Regulation is where the United Arab Emirates has truly outsmarted its competitors. Instead of treating crypto as a threat and stifling innovation with heavy-handed laws, the country created a framework that balances control with creativity.

The Securities and Commodities Authority (SCA) oversees virtual asset activities nationwide. In Dubai’s financial free zones, the Dubai Financial Services Authority (DFSA) handles the rules.

In June, the United Arab Emirates introduced the Payment Token Services Regulation. This law requires that crypto payments can only be made using stablecoins backed by the Emirati dirham and approved by the Central Bank of the UAE (CBUAE).

Abu Dhabi Global Market (ADGM), another financial hub, has its own set of crypto rules. Reportedly, stablecoin issuers must back their tokens with reserves and maintain complete transparency at all times.

Bitcoin’s explosive rise

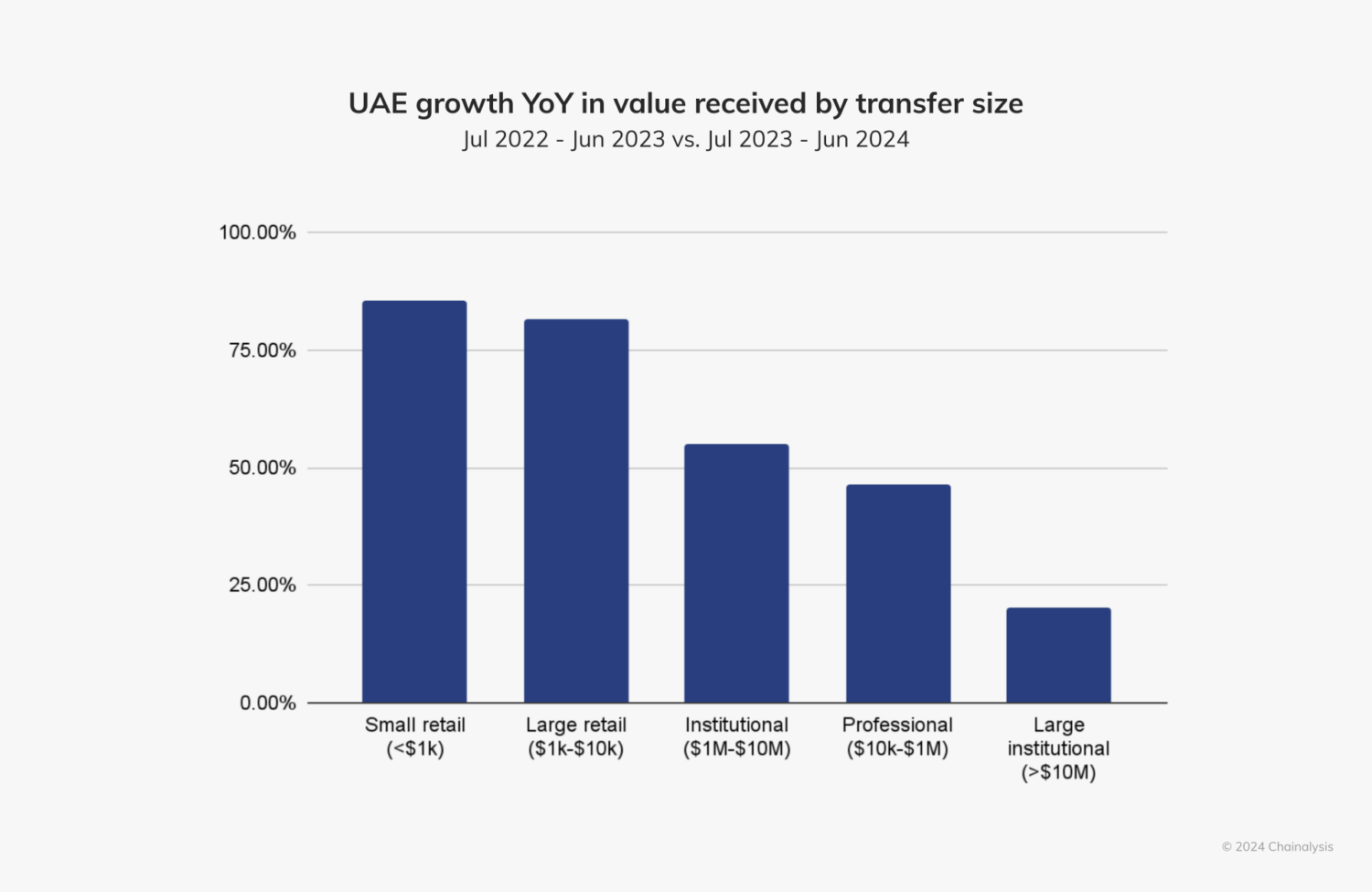

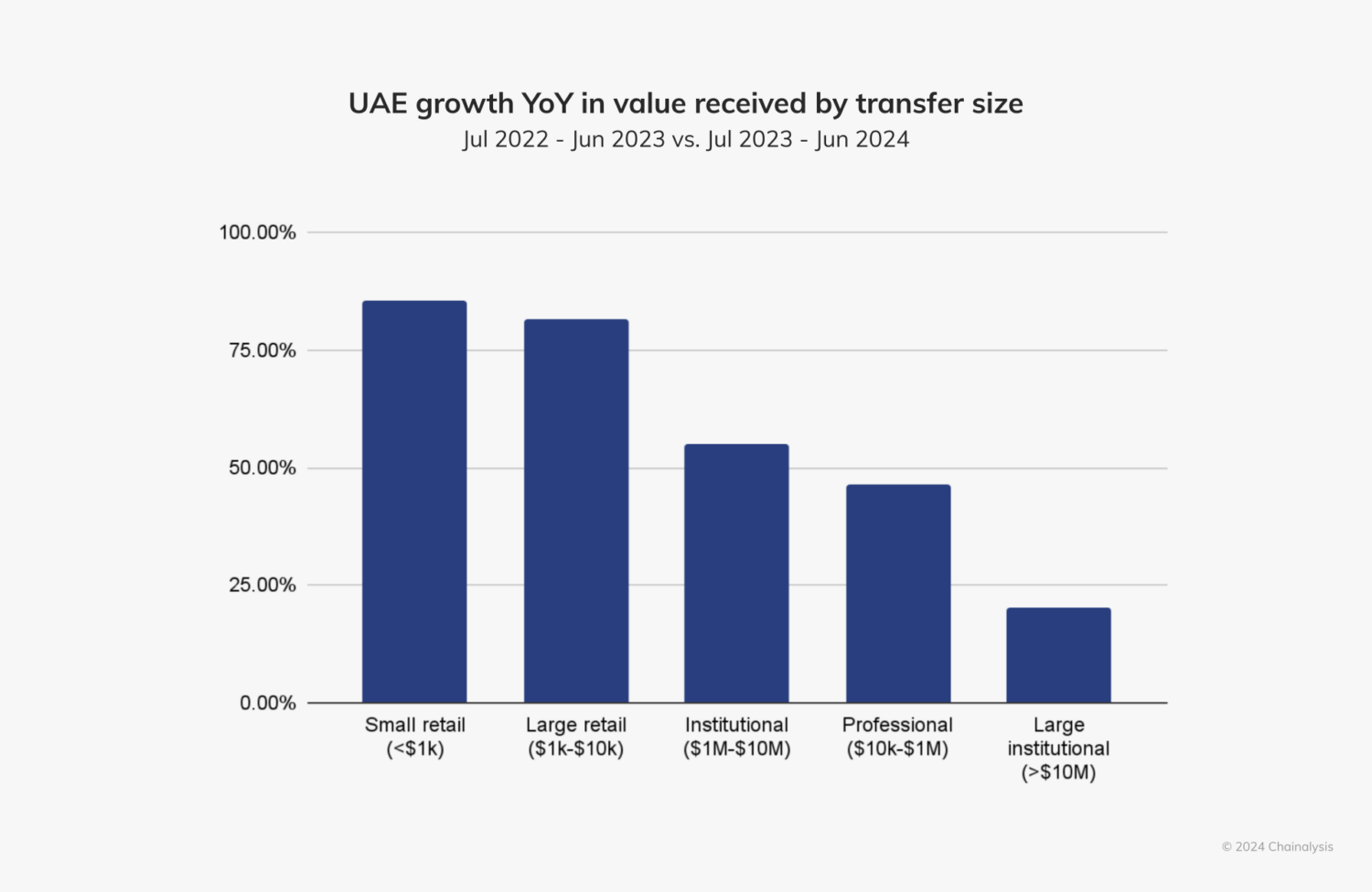

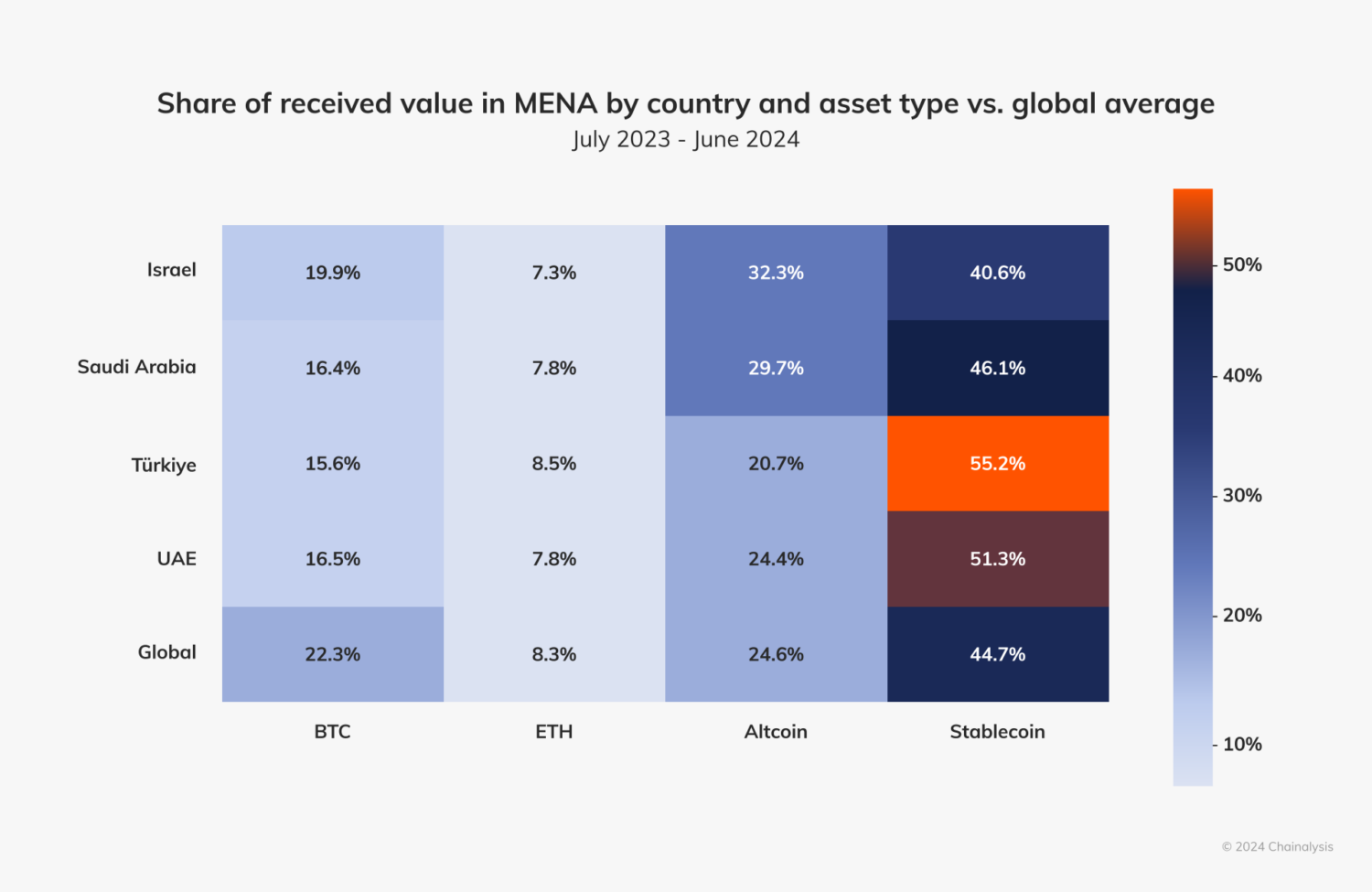

From July 2023 to June 2024, the UAE received $34 billion in cryptocurrencies—a 42% increase from the previous year. Bitcoin leads the pack, capturing 19% of the market share. Stablecoins aren’t far behind, accounting for 51% of all crypto activity.

The number of crypto users in the UAE is expected to hit 3.78 million by 2025. That’s a penetration rate of nearly 39%. If those numbers don’t scream “crypto hub,” what does?

Tether, the world’s most traded stablecoin, has even announced plans to launch a dirham-backed token. The UAE is the testing ground for global blockchain experiments.

Institutional money and DeFi

A recent report said that 72% of UAE residents had invested in Bitcoin by early 2024. This is serious money pouring in from venture capital funds, banks, and financial institutions.

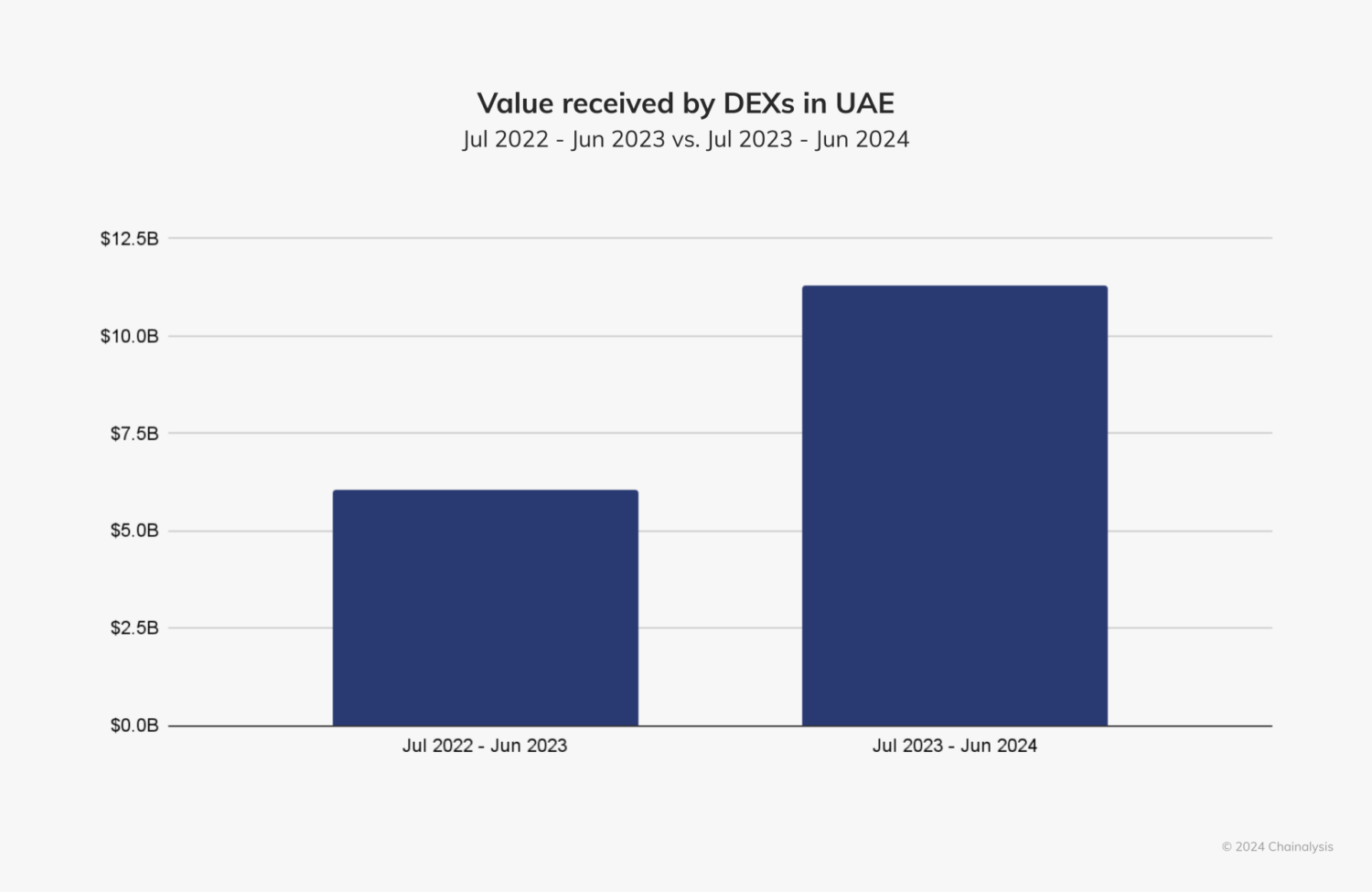

Decentralized finance (DeFi) is another area where the UAE is leading. From July 2023 to June 2024, the total value received by DeFi services grew by 74%. Decentralized exchanges (DEXs) alone saw an 87% spike in activity, jumping from $6 billion to $11.3 billion.

The MENA region is now one of the fastest-growing crypto markets in the world. The UAE ranks among the top 40 crypto economies globally and is the third-largest in the region.

The UAE’s success is also driven by its young, tech-savvy population. Around 63% of the region’s citizens are under 30, making them the perfect audience for technologies like blockchain.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap