CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

- Whale Alert reported $250M USDC minting on Solana.

- Market share dominance impacts stablecoin trends.

- Minting frequency indicates ongoing blockchain demand.

At 20:20 Beijing time, USDC Treasury reportedly minted 250 million USDC on Solana, as noted by Whale Alert monitoring on April 1.

The occurrence represents another significant minting action by Circle, highlighting the growing use of USDC within the Solana ecosystem.

$250M USDC Minting: Implications for Solana and Circle

Whale Alert monitoring indicated the minting of 250 million USDC on Solana by USDC Treasury. This minting follows a series of actions by Circle in 2025. Circle maintained their position as a leading issuer in stablecoin markets. Their continued activity underscores their influence within these ecosystems.

This minting adds to the growing total of $7.75 billion minted on Solana in 2025. Circle’s presence in Solana’s stablecoin market is evident, holding a 77% market share. The influx of USDC illustrates the token’s increasing adoption across decentralized platforms, potentially influencing liquidity dynamics.

There are no recent statements from Circle’s CEO Jeremy Allaire on this minting. However, industry experts highlight the strategic importance of such actions. These events are likely shaping institutional interest. The blockchain community remains attentive to further official confirmations regarding this minting activity.

USDC Market Dynamics: Stability and Future Prospects

Did you know? In early 2025, Circle minted billions on Solana, indicating a strategic expansion into this blockchain. This frequent activity reflects a growing demand for USDC across diverse platforms.

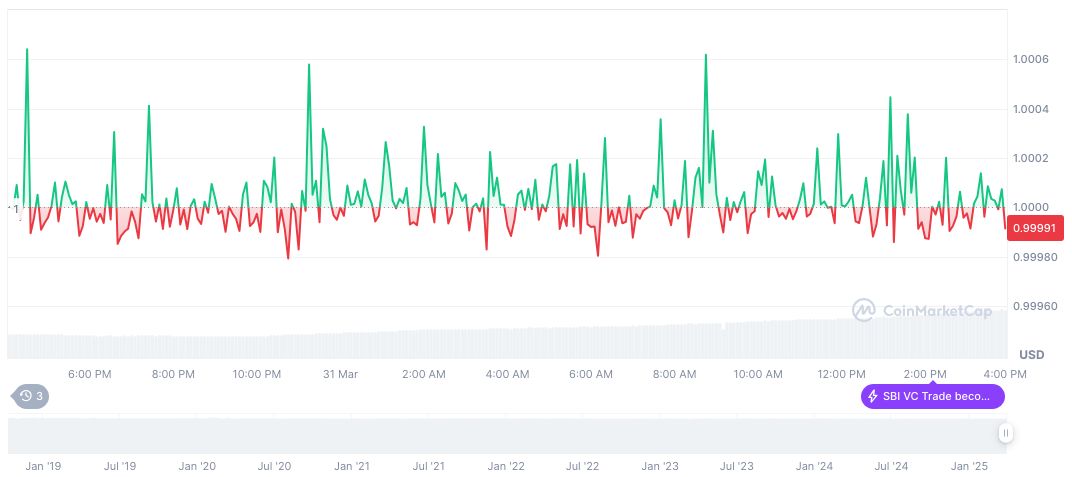

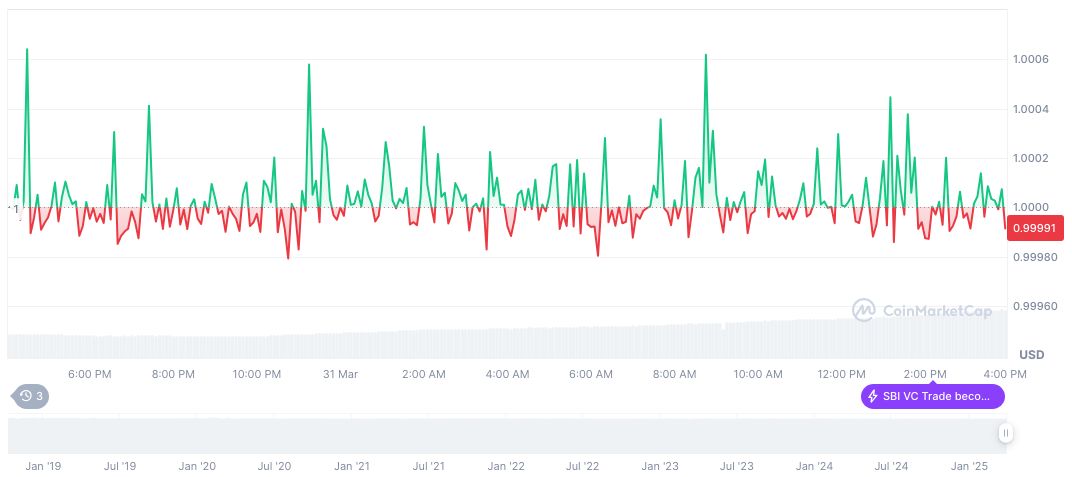

USDC holds a market cap of $60.04 billion, representing a 2.21% market dominance, CoinMarketCap reports. Despite slight drops, USDC maintains its pegged value at $1.00. With a circulation of over 60 billion, the stablecoin remains crucial for trading stability, especially in fluctuating markets.

According to the Coincu research team, Circle’s ongoing minting on Solana indicates a potential boost in blockchain interoperability. This could influence wider adoption and innovation in decentralized finance, despite lacking official comment on the recent minting. Such activities underscore the prominence of stablecoins in digital economies.