CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Walrus Protocol is a decentralized storage protocol built on the Sui Network, focused on providing programmable data storage solutions for blockchain applications and autonomous agents.

With the project’s native token WAL having launched an airdrop, is there a way to earn more WAL token through other methods once the first opportunity has passed? Okay! Let’s go through this guide.

| Key Takeaways:

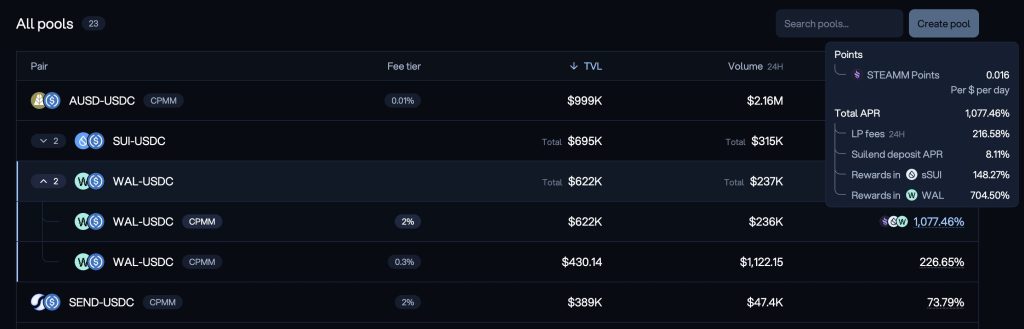

– STEAMM offers the highest yield for WAL through the WAL-USDC pair with an APR over 1,077%, minimal impermanent loss, and future airdrop potential via Steam Points. |

Article based on idea of FlowX Finance Co-founder @0xjulian76.

Ranking Platforms With Yield Farm Opportunity for WAL Token

WAL token is now available on many exchanges such as Celtus, Bybit, Upbit,… but they only support direct token trading. Therefore, choosing a DeFi platform to earn more WAL is not a bad choice for you if you hold tokens for the long term.

Below is a ranking of protocols that support yield farming for WAL tokens according to tiers S, A, B, C, D. In which S is the highest potential that you should aim for.

Currently, after the airdrop, it seems that users have cooled down with WAL as the token price has dropped more than 30% in the past 24 hours. Currently, WAL token is trading at $0.44 with a market capitalization of more than $560 million.

Read more: Walrus Protocol Review: Scalable, Secure, and Cost-Efficient Solution For Blockchain Storage

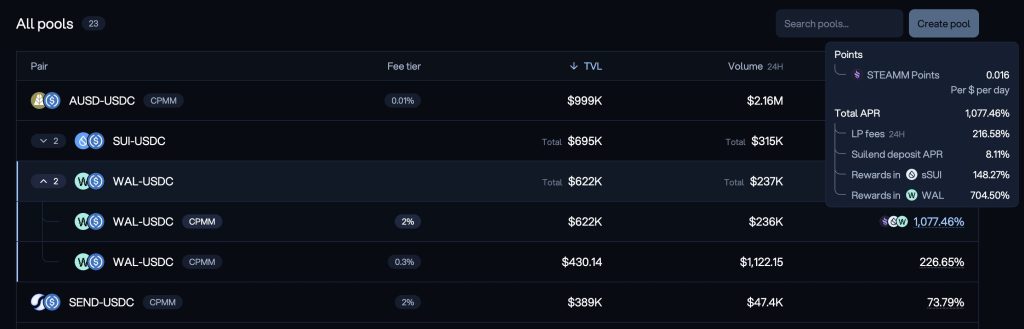

Tier S: STEAMM

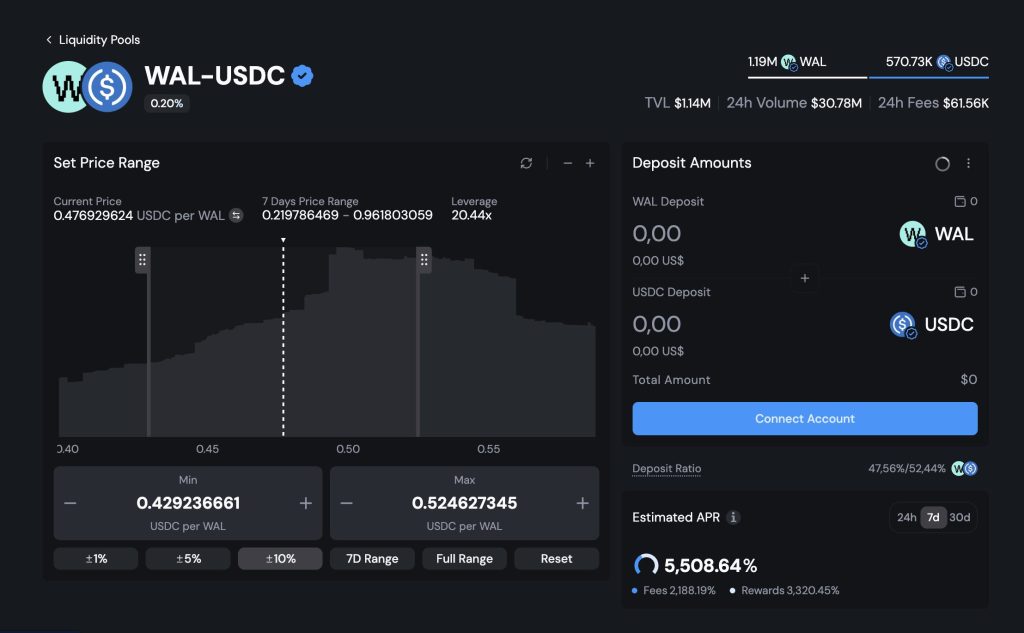

WAL-USDC pair is currently the liquidity pair with the highest APR with over 1,077%.

According to @0xjulian76, liquidity providers with volatile prices can get impermanent loss but since the pool is a continuous market maker, the impermanent loss is much less than Concentrated Liquidity Market Maker (CLMM) like Cetus or BlueFin.

The main profit comes from WAL rewards which is why STEAMM is an S-tier protocol for mining WAL. Steam Points will also be accumulated if you participate in LPs on STEAMM with future airdrop opportunities.

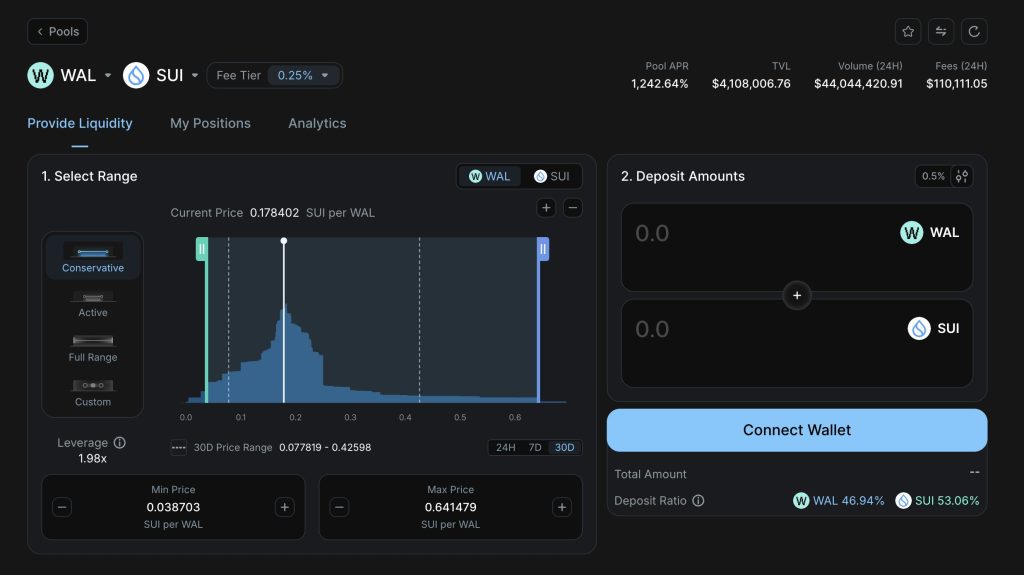

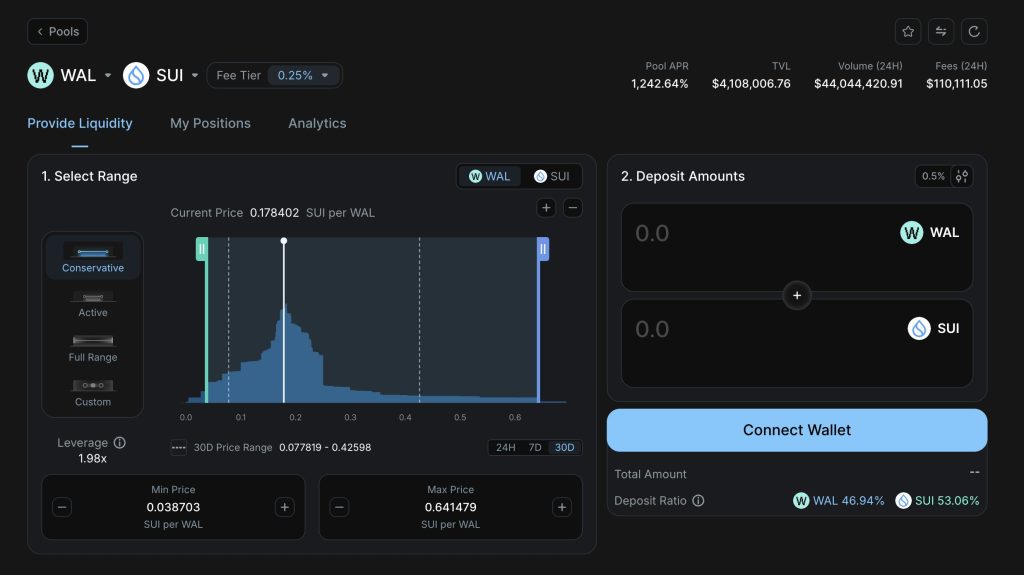

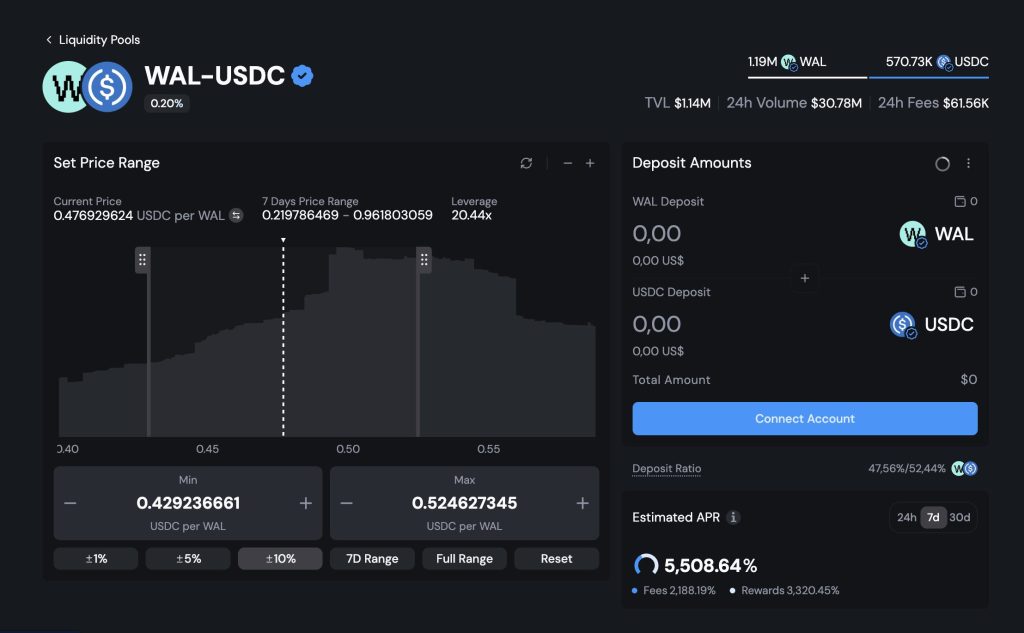

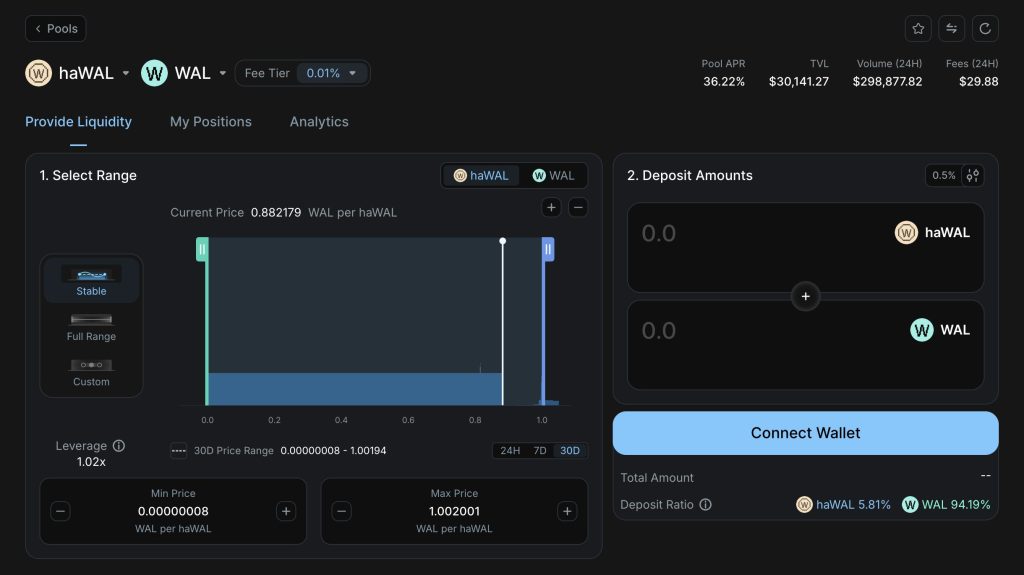

Tier A: Cetus, Bluefin, Turbos Finance, Scallop

Cetus is ranked best because at the protocol there is a WAL-SUI pool while Bluefin only has WAL-USDC, liquidity providers have to take more impermanent loss when participating in the pool on Bluefin.

At the time of writing WAL-SUI pool on Cetus is having an APR of over 1200% and WAL-USDC pool on Bluefin is having an APR of over 2400%.

Turbos Finance is the next option with APR up to 3,000% for both WAL-SUI and WAL-USDC pairs. However, on Turbos, liquidity pools are illiquid and only provide SUI rewards.

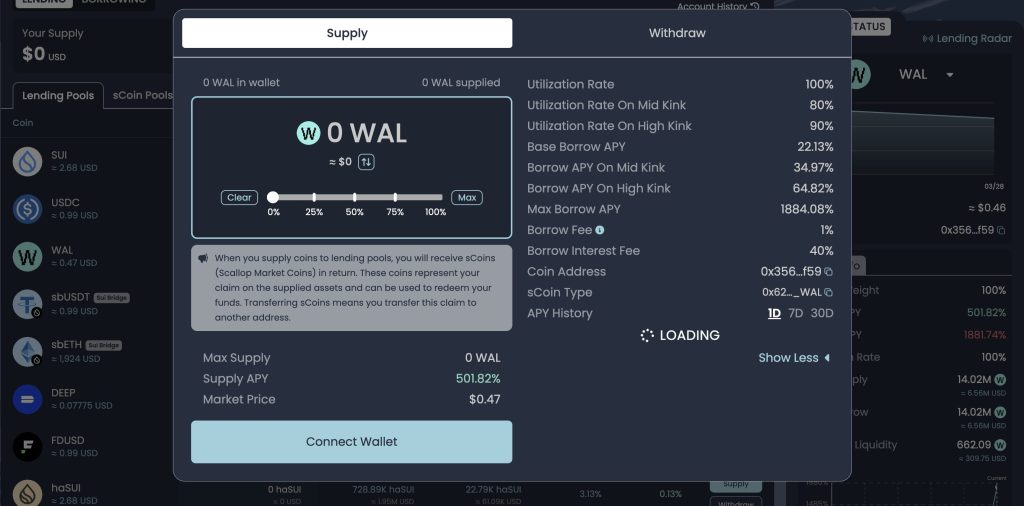

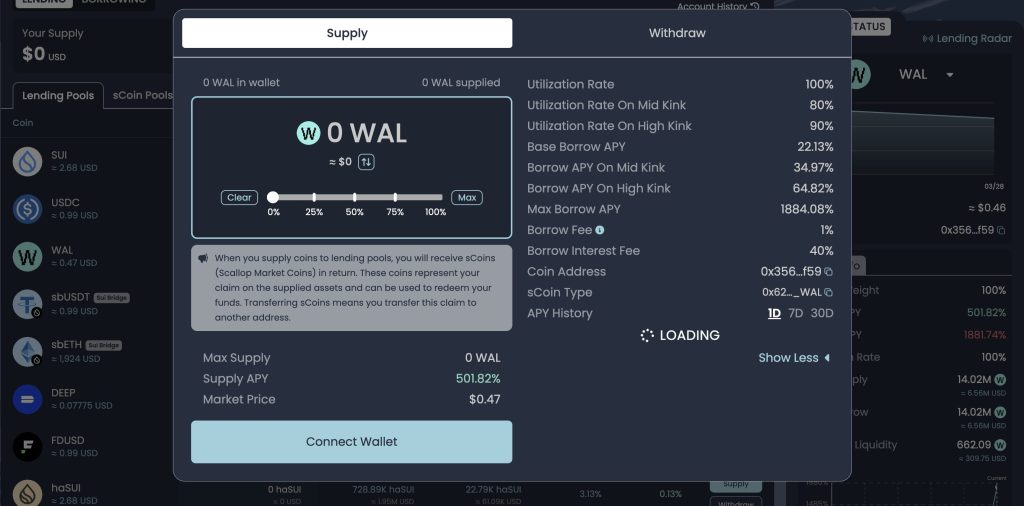

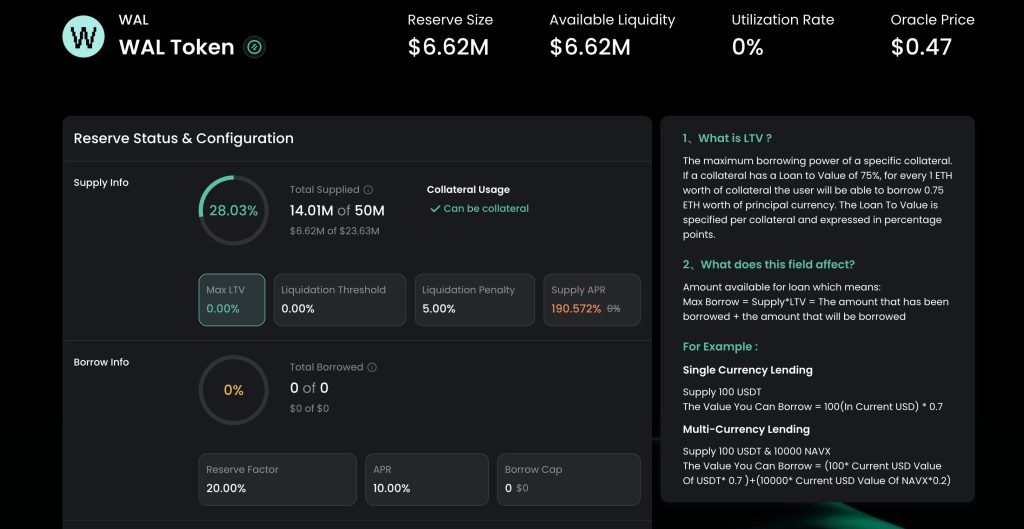

Scallop looks a bit more disadvantageous when compared with APR of only 500% but note one point, it has no impermanent loss, meaning you just need to hold WAL and earn WAL. Of course, being in tier A that @0xjulian76 mentioned for Scallop is reasonable but the liquidity of the pool

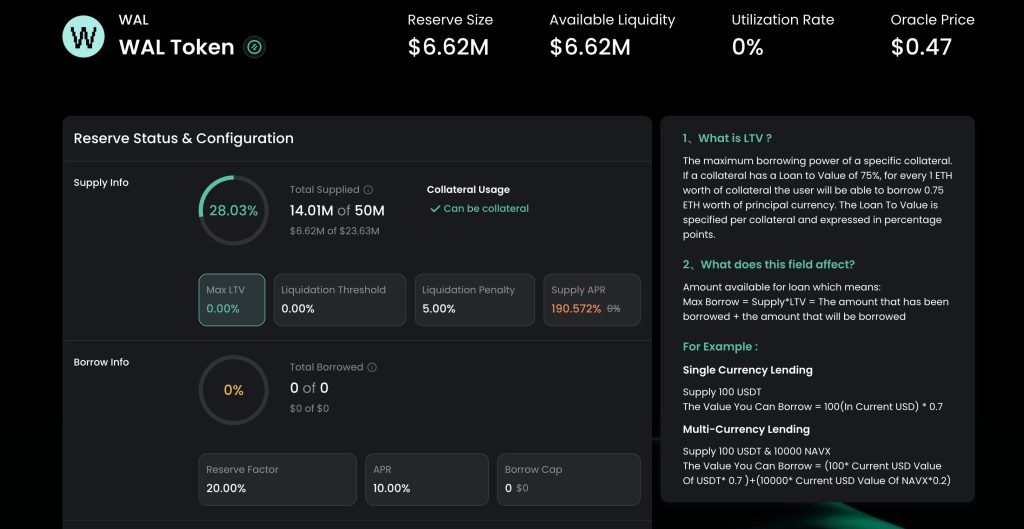

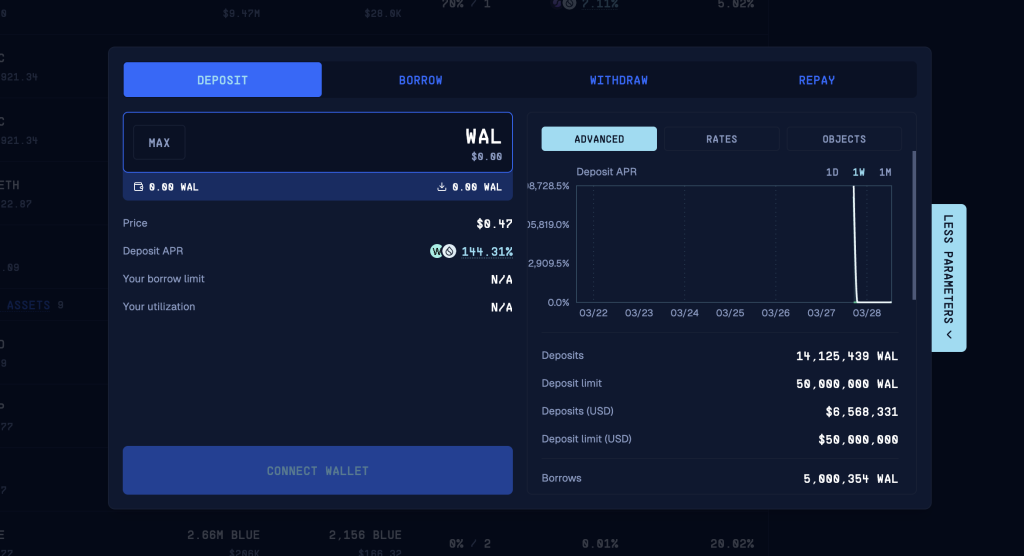

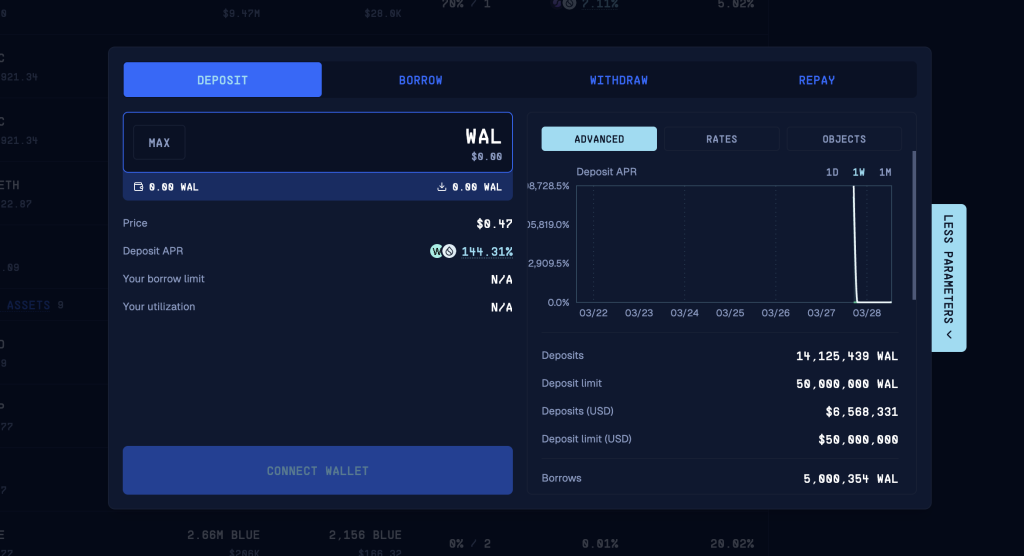

Tier B: NAVI Protocol, Suilend

Although NAVI Protocol and Suilend do not have impermanent loss, the APR of these two protocols is much worse than the above protocols at around 140-100%.

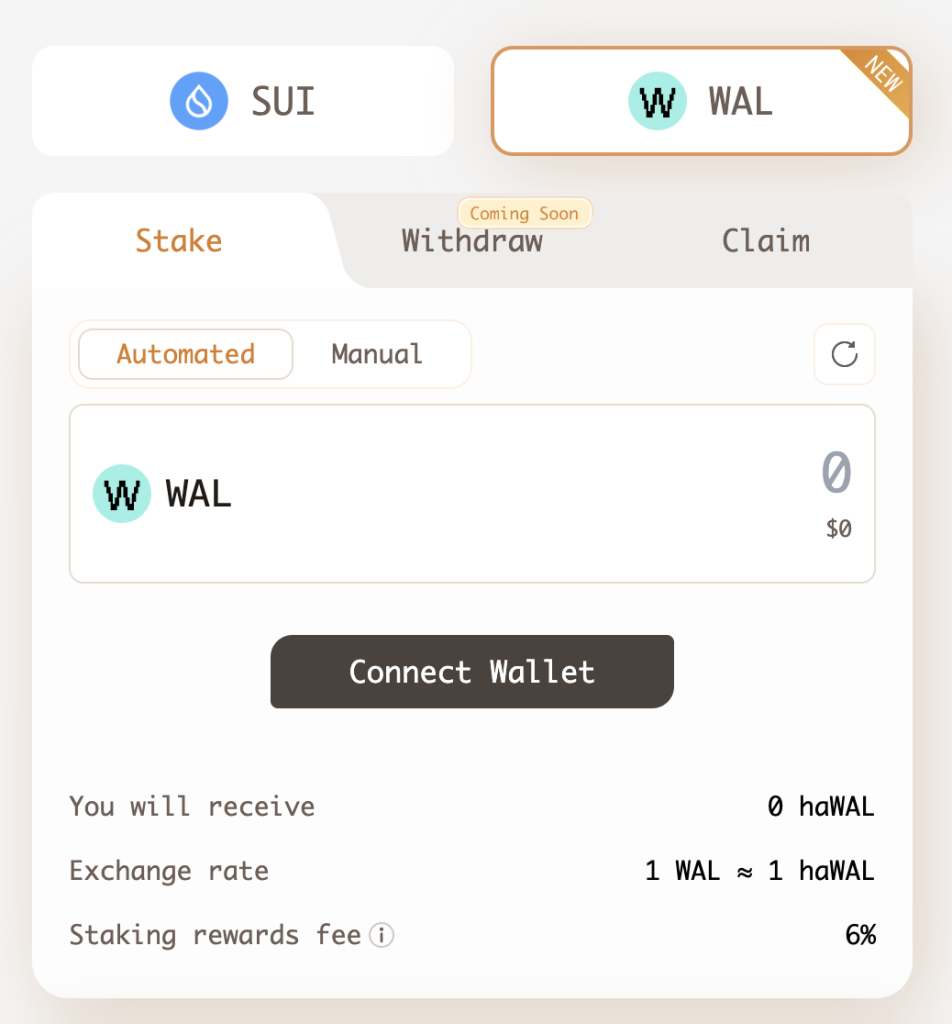

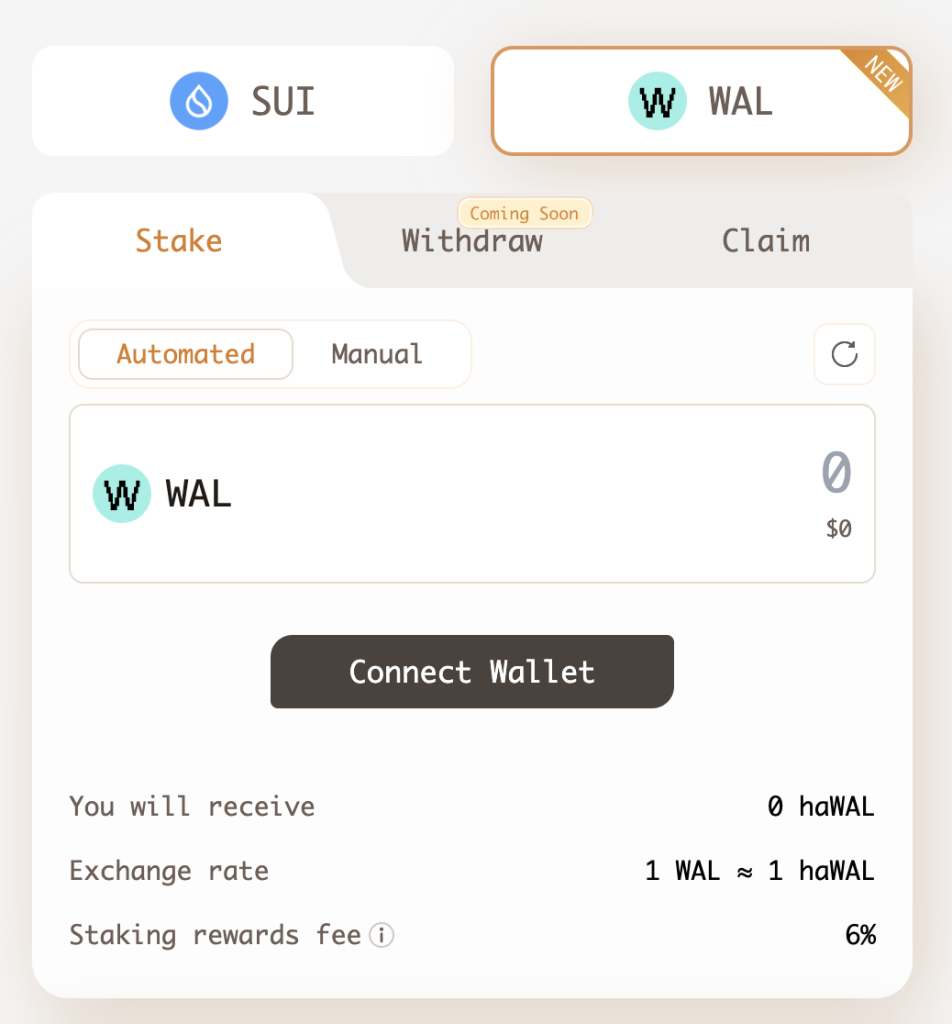

Tier C: Haedal Protocol

When you participate in staking WAL on Haedal, you will receive haWAL back and then participate in the haWAL-WAL pool on Celtus with an APR of about 36%. This is not a very high APR but tier C is worthy for Haedal when you participate in the platform and have the opportunity to receive HAEDAL token airdrop.

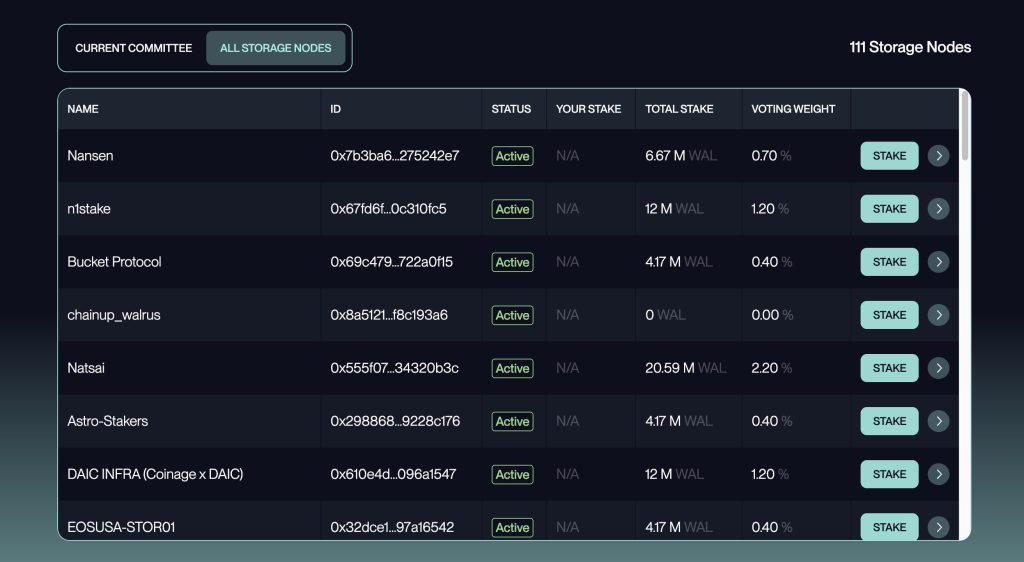

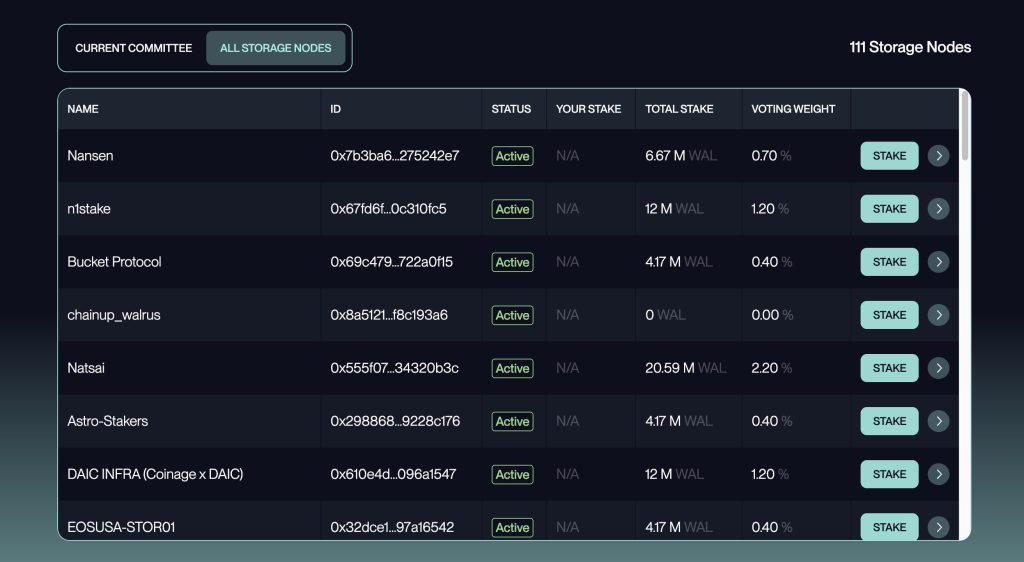

Tier D: Walrus Protocol

It may sound ridiculous, but the lowest ranked platform is actually Walrus Protocol. However, new opportunities are always there, the next airdrop of the protocol will always be the most enthusiastic contributors.

When you stake WAL tokens on Walrus, for each two-week Walrus epoch, you will earn a percentage of your WAL based on your contribution. You will earn that yield for each epoch that passes. To start earning in the next epoch, you must commit to staking for the first half of the current epoch, otherwise you will not be eligible to earn WAL rewards until after the next epoch.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |