CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Pi coin made a big splash when it launched in February. While most of the crypto market was down, Pi price actually went up. It reached an impressive high of $2.9, but things have changed since then. The price has dropped by about 70% and now trades around $0.8.

There’s a key support level at $0.71 where buyers stepped in before. If they defend this level again, we might see prices start to climb.

March has been tough for Pi Coin. The price has fallen about 60% this month. The ecosystem is facing some challenges that are making investors cautious.

We wanted to get a different perspective on where Pi Coin might be headed in April, so we asked ChatGPT. The AI gave us three possible scenarios for Pi’s price next month. Here’s what it had to say.

Pessimistic Scenario — Price Target: $0.50 to $0.65

The AI thinks Pi could drop further if certain problems aren’t solved. Big exchanges like Binance and Coinbase haven’t listed Pi yet because of compliance issues. This keeps a lot of potential buyers on the sidelines.

Governments and regulators have also raised concerns about Pi Network in the past. Some experts are even calling it a scam. This kind of attention isn’t helping the price.

Many early users are unhappy with the KYC requirements and question how decentralized Pi really is. Missed deadlines and comparisons to pyramid schemes have hurt trust in the project.

If the broader crypto market stays in a slump, Pi could get dragged down even more. There are also worries about price manipulation, which might scare away regular investors.

If the price breaks below that $0.71 support level, it could quickly fall to around $0.50.

Read More: How Much Could 10,000 PI Coins Be Worth by 2026?

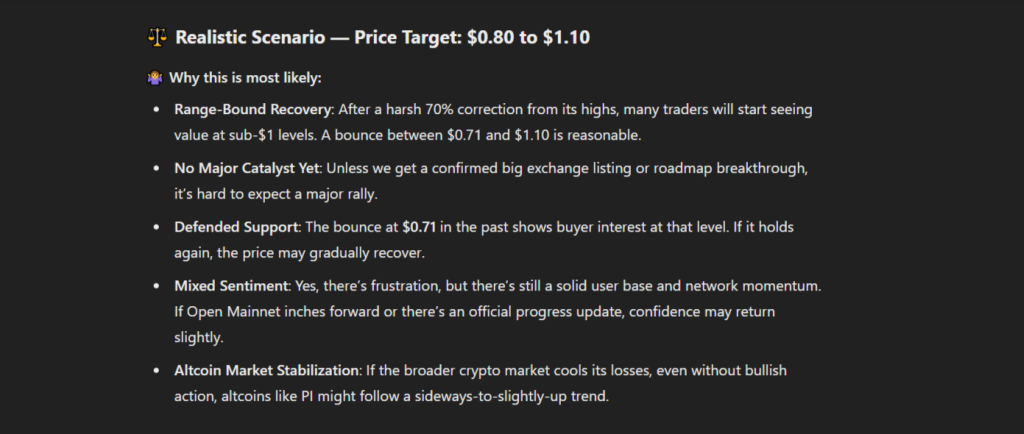

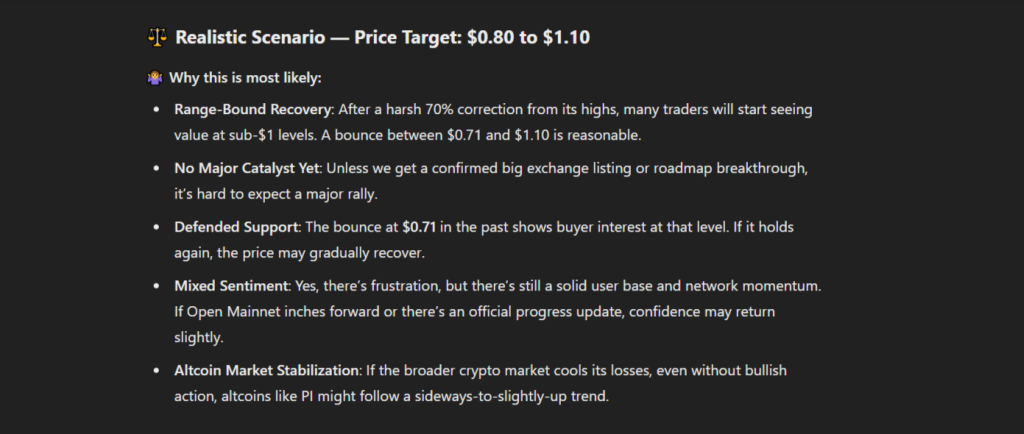

Realistic Scenario — Price Target: $0.80 to $1.10

After such a big drop from its all-time high, the AI thinks Pi might trade in a range for a while. Many traders see value in Pi below $1, which could keep the price between $0.71 and $1.10.

Without a major announcement like a big exchange listing, it’s hard to see a strong rally happening soon. The fact that buyers stepped in at $0.71 before is a good sign, and if that support holds, we might see a gradual recovery.

Though some users are frustrated, Pi still has a large community. If the team shows real progress on the Open Mainnet or shares a solid update, confidence might return. And if the broader crypto market stabilizes, Pi could start to move sideways or slightly up.

Optimistic Scenario — Price Target: $1.50 to $2.20

For Pi to reach higher prices, some good things need to happen. A surprise listing on Binance or Coinbase would be huge news and could cause a price spike.

If Pi Network finds better ways for users to convert Pi to other currencies, new people might join in. Getting clearer regulations would also help bring in more investors.

The biggest boost would come from fully launching the Open Mainnet with working transfers and integrations. New marketing campaigns or incentives like staking could also attract more buyers.

If Pi breaks above $1.10, short-term traders might jump in and push the price toward $1.50 or even back over $2 if everything lines up right.

Read Also: How Much Could 10,000 PI Coins Be Worth by 2026?

April Is Crucial for Pi Coin

April looks like a make-or-break month for Pi Coin. If the price stays above $0.71, we might see it float between $0.80 and $1.10. If it drops below that support, $0.50 could come quickly.

The real challenge for Pi Network isn’t just about price—it’s about trust. Until they address concerns from traders, regulators, and exchanges, even positive scenarios carry risk.

The community is frustrated, and developers are skeptical, but crypto has surprised us before. April could be the month that determines Pi’s future direction.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Active user community and social features like news feeds, chats for specific coins available for trading.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

Source link