Whales are once again reallocating their resources, this time taking up a batch of older altcoins. Whale activity of transactions over $100,000 increased for 10 notable coins and tokens, known from previous bull markets.

Whales are returning to a selection of 10 coins and tokens, potentially boosting older assets. Santiment noted increased whale transactions and trades for 10 notable assets in the past week.

The altcoins added a wider selection compared to the overall trend of picking up DeFi, meme tokens, and AI agent tokens. The most recent selection of tokens follows recent inflows into AI agents, as well as the selling of blue-chip DeFi tokens.

DeXe and AIOZ were the trend’s leaders, with 1,000% and 706% growth in whale activity. The other curious token was Bitfinex’s native asset, Unus Sed Leo (LEO), which saw a 400% spike in whale activity. LEO has gone against the market on multiple occasions, suggesting its trading may be swayed by Bitfinex participants.

Maker (MKR) was one of the exceptions where the 120% whale activity signaled selling. MKR crashed from the $1,600 range, rapidly unwinding down to $1,521.48.

SPX6900 (SPX) is the other prominent token with a 149% increase in whale transactions. SPX showed a mix of whale-sized buying and selling after the asset started to come down from its all-time peak above $1.56. SPX retreated to the $1.35 range, sparking a turnover of profit-taking and reaccumulation.

Centralized tokens may be harder to track, as most whale activity is still focused on memes and AI tokens. Despite this, older narratives are still traded for potential returns. Whale activity increased in general, which is usually correlated with overall interest in altcoins.

Some of the whales trade on the spot market, but futures open interest is also an indicator. Whales increased their positions for Worldcoin (WLD), DOGS, COTI, Arkham (ARKM), My Neighbor Alice (ALICE), and Polkadot (DOT). The presence of leveraged positions also suggested potential short-term volatility.

Web3 tokens attract whales again

Tokens that also attracted whales included some of the older Web3 assets. The group of tokens included Mantle (MNT), Safe (SAFE), a Web3 ownership layer, SuperVerse (SUPER), and Decentraland (MANA). Web3 remained one of the narratives running in the background, as most projects are still aiming to recover their 2021 highs and rediscover users and utility.

The selection arrived at a time when Web3 tokens were mostly in the green, though without the rapid gains of memes or AI tokens.

MNT reacted by trading close to its three-month peak at around $1.27. SAFE recovered to $1.06, though still below its previous peak from 2024, suggesting the token is in re-accumulation mode. Decentraland (MANA) consolidated around $0.52, though decentralized activity shows predominant sell orders.

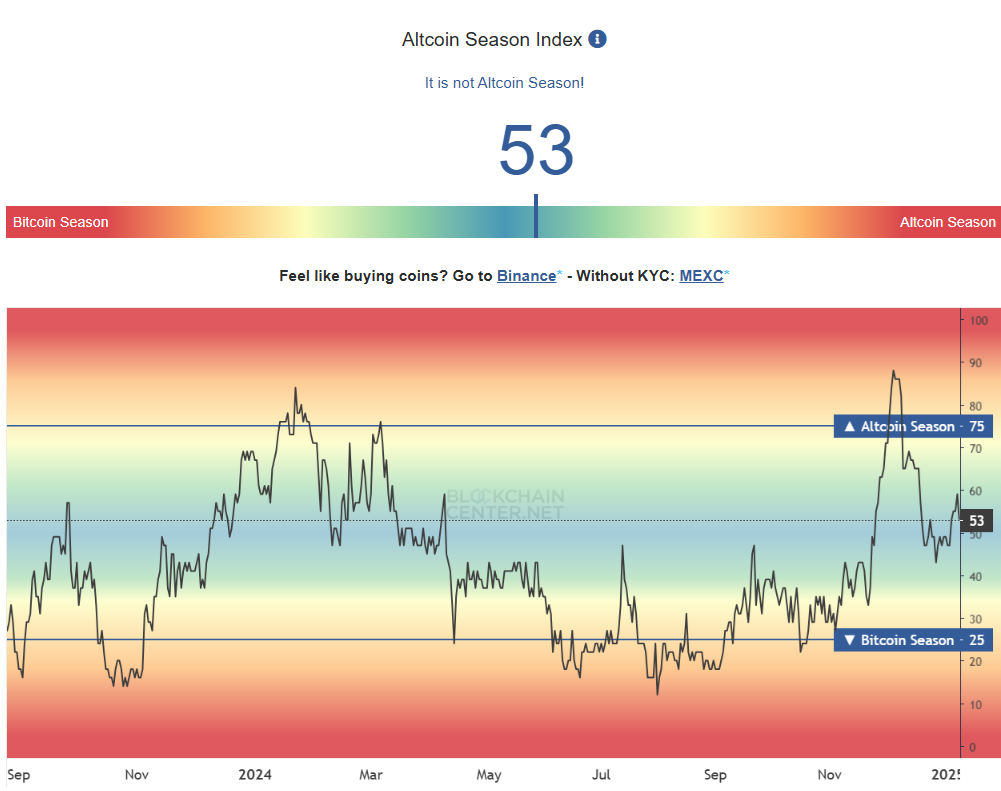

Is altcoin season coming back?

The altcoin season index is once again trying to rediscover its range. The index slid to 53 points after a recent local high of 59 points.

The altcoin rally is still expected sometime in Q1, but there are also fears of another significant drawdown. The recent market recovery was cut short after Ethereum (ETH) crashed from the $3,700 range down to $3,400.

The other basis for an altcoin season prediction is the usual historical cycle of rallies in the first quarter of the new year. This time, the question is whether only the newest asset classes will pump, or if the market will lift even older assets from previously forgotten categories.

Altcoins usually move in the context of a narrative, and most narrative tokens have performed better than the general market in the past few weeks. Even older categories like DEX, DeFi 1.0, DeFi 2.0, and liquid staking tokens performed better than the baseline. Very few narratives erased their gains, usually within a longer time frame.

Altcoins remain highly risky, and some of the older more liquid selections may also prove volatile. Whales are also focusing on the newer token categories, known for more dramatic price swings. This time, both whales and retail traders are more pragmatic, working on a shorter time frame to lock in gains.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.