Tether USDT chain swap operations hit a milestone with a $1 billion move to the Tron blockchain. This shift changes how the cryptocurrency market works. The USDT transfer works with a major exchange and helps blockchain scalability. The total supply of the world’s biggest stablecoin stays the same.

In the next hours Tether will coordinate with a 3rd party prominent exchange to perform a chain swap, converting part of their $USDt cold wallets from different blockchains to $USDt on Tron.

The #tether $USDt total supply will not change during this process.

Amount (subject to…— Tether (@Tether_to) January 6, 2025

Also Read: Ripple’s RLUSD Outshines PayPal and Euro: Could RLUSD Hit $1.80?

Understanding Tether’s $1 Billion Chain Swap on Tron Blockchain and its Impact on Crypto Markets

Strategic Transfer Details

The Tether USDT chain swap moves tokens from various blockchain cold wallets to Tron’s network. “The process will not alter the total USDT supply but will ensure that liquidity is optimized across various networks,” Tether announced via its X account on January 6. This move makes blockchain scalability better. Traders can now use their assets on many platforms.

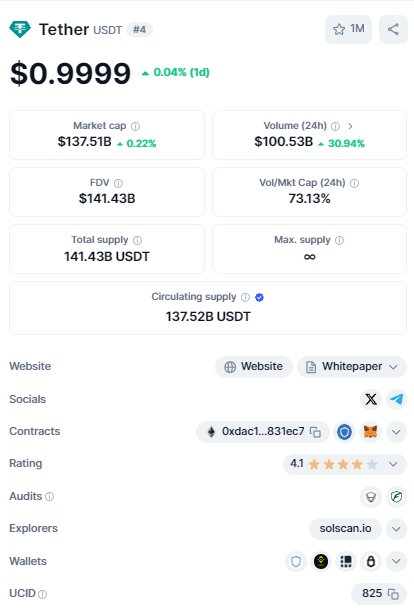

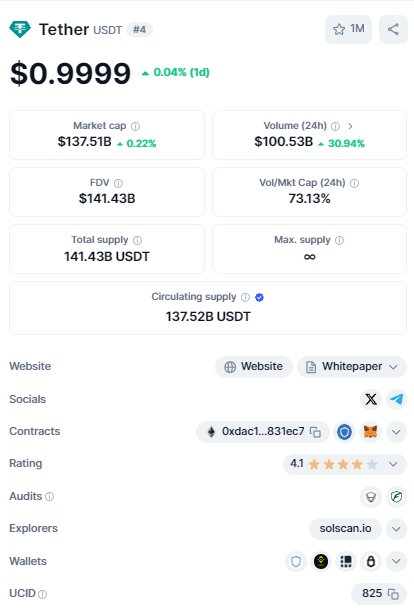

Market Position and Trading Volume

USDT leads the cryptocurrency market with $137 billion in value. The chain swap on the Tron blockchain helped push daily trading to $107 billion. This marks a 69% rise. “USDT remains on top of the list in the stablecoin market cap,” reported industry analysts. They note that USDT beats USDC’s $45.8 billion by a wide margin.

Also Read: U.S. Dollar Price Prediction 2025

Tether’s Expanding Operations

Beyond the USDT chain swap, Tether bought more Bitcoin. They moved 7,629 BTC worth $705.25 million from Bitfinex. This brings their total to 82,983 BTC, worth $7.68 billion. This shows Tether wants diverse assets while keeping blockchain scalability strong.

Regulatory and Market Implications

The Tron blockchain move happens as rules get stricter. The EU’s Markets in Crypto-Assets rules bring new checks to the cryptocurrency market. Peter Schiff questions USDT minting. But Tether keeps showing its reserves through regular checks.

Future Outlook

The USDT transfer shows Tether’s smart approach to cross-chain work. Better blockchain scalability and spread-out funds across networks set new rules for stablecoins in the cryptocurrency market.

Also Read: Bitcoin Reclaims $101,000: Will BTC Hit $140,000 Next?