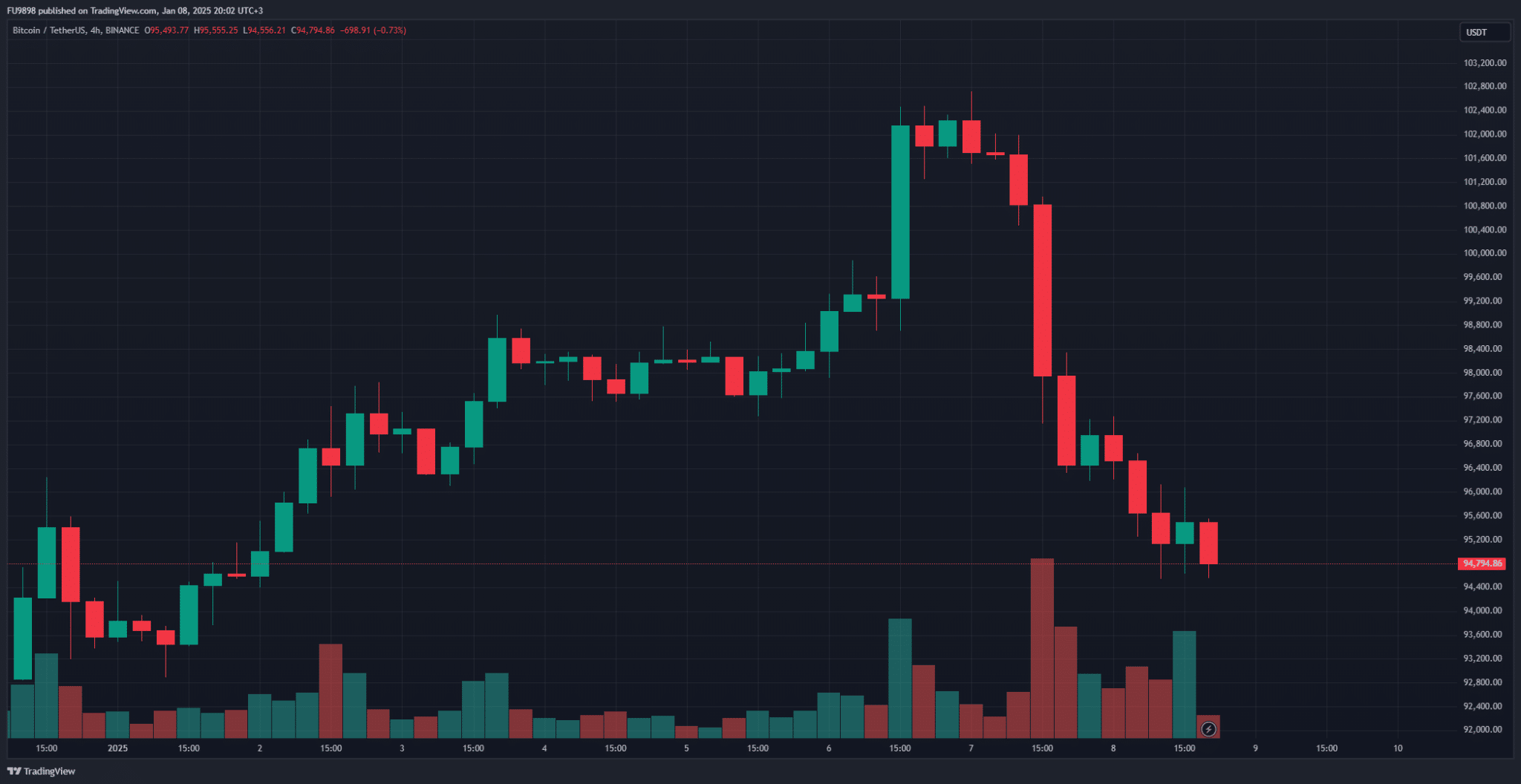

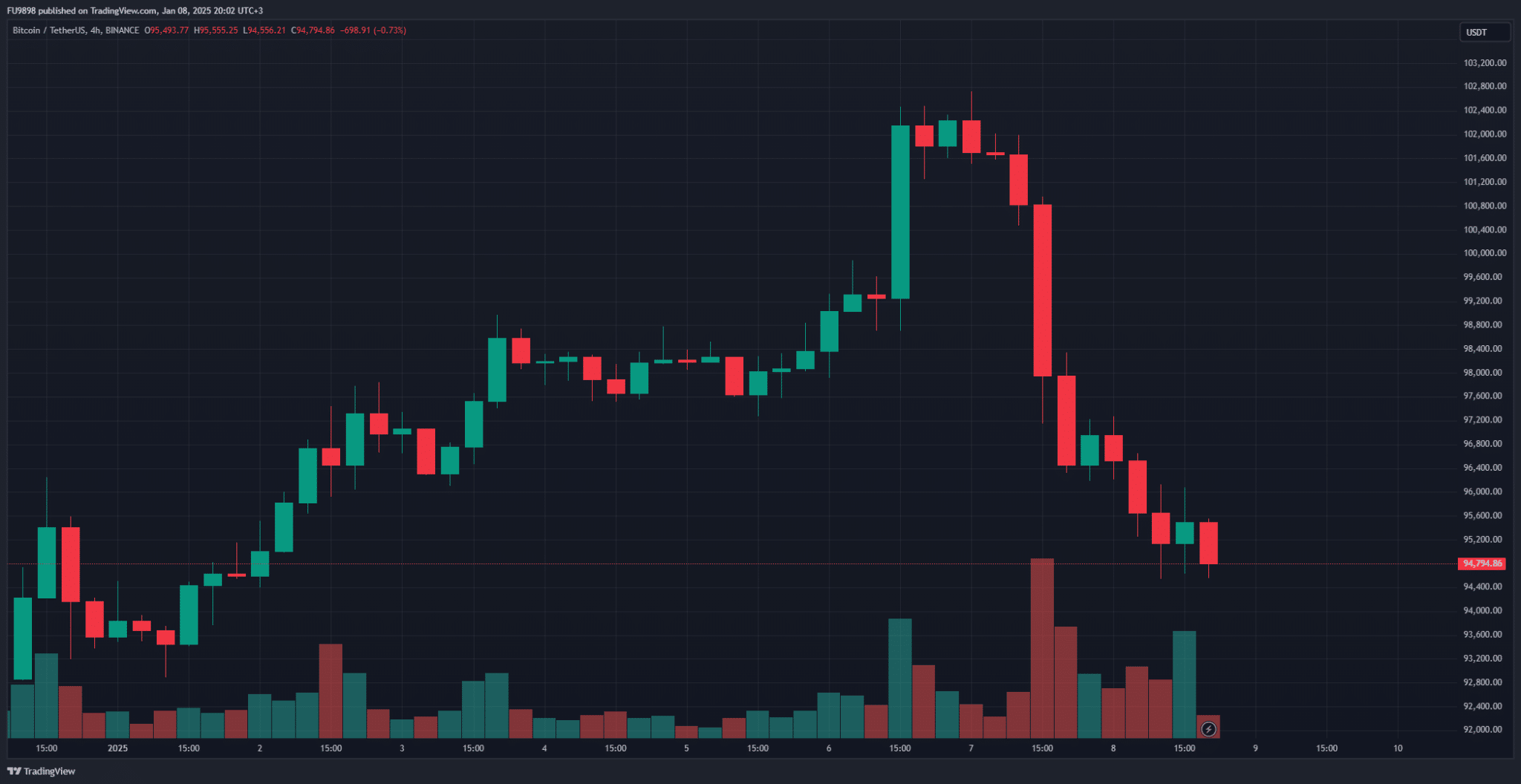

The world’s largest cryptocurrency, Bitcoin, has dropped below $95,000, extending its decline as the overall crypto markets face sharp losses.

At the time of writing, Bitcoin is trading at $94,771, with many altcoins down 20-30%. The market turmoil comes after unexpectedly strong economic data from the US, which has raised concerns about a prolonged period of high interest rates.

The decline was triggered by the release of strong U.S. labor and economic confidence indicators, including:

- JOLTS Job Postings: 8.1 million (over 7.7 million expected).

- Services PMI: 54.1 (better than expected 53.3).

- ISM Service Prices: 64.4 (well above expectations of 57.5).

While positive economic data usually bodes well for traditional markets, it often has the opposite effect on riskier assets like Bitcoin and altcoins. A strong labor market and rising confidence in economic activity suggest the Fed may delay rate cuts, a scenario that has dampened interest in cryptocurrencies.

The crypto market was positioned for weaker economic data that could have supported a more dovish Fed stance. Instead, unexpected strength in the labor market has given the Fed “two reasons to maintain high interest rates,” as analysts put it:

- Resilient Labor Market: Higher income levels increase consumer spending, potentially fueling inflation.

- Service Sector Prices: The sharp increase in service prices is reinforcing inflationary pressures.

With inflation remaining a concern, markets are expecting fewer rate cuts in 2024. As a result, yields on long-term U.S. Treasury bonds have risen, a development that has often pressured Bitcoin given its sensitivity to tighter monetary policy.

Adding to the pressure, retail interest in cryptocurrencies has also waned. Google search trends show a sharp decline in interest in Bitcoin and altcoins since their December highs. Retail investment volume, a key driver of previous bull markets, has also declined significantly in recent weeks, with purchases below $10,000 falling.

Bitcoin’s failure to hold above $100,000 triggered additional selling pressure, with long-term holders dumping significant amounts of Bitcoin at these levels, reminiscent of the $70,000 sell-off in March 2024.

The US Dollar Index (DXY) continues its strong run, adding pressure on Bitcoin. A strong dollar reduces the appeal of riskier assets like cryptocurrencies. However, some analysts predict a potential decline in the dollar’s strength in the coming months, which could provide relief for Bitcoin and altcoins.

While it is not uncommon for institutional investors to sell at year-end for profit, several key events in January can impact market volatility:

- Today: FOMC meeting minutes.

- Friday: US nonfarm payrolls report.

- January 15: US inflation data for 2024.

- January 24: Bank of Japan interest rate decision.

- January 29: FED interest rate decision.

*This is not investment advice.