The cryptocurrency market was not doing well on Tuesday as Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and other digital assets plunged. The crypto market crash occurred in tandem with other risk-off events in the global financial market owing to rising US treasury yields, a more hawkish Fed and heightened macroeconomic uncertainty.

Why The Sudden Crypto Market Crash?

-

Rising U.S. Treasury Yields Trigger Risk-Off Sentiment

Rising bond yields were a primary driver of the crypto market’s decline today. The 10-year U.S. Treasury yield climbed to 4.70%, accompanied by increases in the 30-year and 5-year yields, which reached 4.61% and 4.50%, respectively.

For context, higher bond yields make traditional investments more attractive, drawing capital away from riskier assets like cryptocurrencies. This shift contributed to a broader sell-off across asset classes, including equities. The Nasdaq 100 fell over 1%, and popular tech stocks such as NVIDIA and Tesla saw significant losses.

For instance, Tesla stocks dropped 4.68% to $391.81, erasing $19.24 in share value. The trading volume was 62.12 million shares since investors engaged the market due to macroeconomic risk and increasing yields in bonds.

2. Hawkish Federal Reserve Outlook Adds to Pressure

Additionally, the Federal Reserve’s monetary policy stance weighed heavily on investor sentiment. Minutes from the December meeting signaled fewer interest rate cuts in 2025 than previously anticipated.

Economic reports preceding the Fed minutes showed strong labor market data, with job vacancies reaching a six-month high. This raised concerns about persistent inflation, which could lead to a tighter monetary policy environment. Historically, tighter policies have adversely affected cryptocurrencies, as higher interest rates reduce their appeal.

Moreover, JOLTS job openings rose by 259,000 to 8.1 million in November 2024, marking two consecutive months of growth. Sectors like professional services and finance led the gains. ISM Services PMI also signaled economic resilience, fueling concerns of limited Fed rate cuts in 2025.

3. Macro Uncertainty and Broader Economic Concerns

Uncertainty in the U.S. economy has heightened market volatility. Fiscal policies under President Donald Trump and the looming debt ceiling have created investor unease. Rising fiscal deficits and unclear Treasury strategies add to the concerns, further impacting market confidence.

Analysts, including Arthur Hayes, predict a short-term boost for crypto in Q1 2025 due to increased U.S. dollar liquidity. The Treasury’s spending could temporarily fuel gains for Bitcoin and Ethereum. However, the need to refill the Treasury General Account and April’s tax season could reverse these gains, leading to a crypto market crash.

Crypto-linked stocks like Coinbase and MicroStrategy have also suffered sharp declines. Rising bond yields and the Federal Reserve’s hawkish stance have intensified the sell-off. This downturn reflects the interconnected nature of global markets

BTC, ETH, DOGE, And Altcoins Price Action Amid Crypto Market Crash

The crypto market’s losses were pronounced, with major cryptocurrencies suffering steep declines and trading volumes surging amid the sell-off.

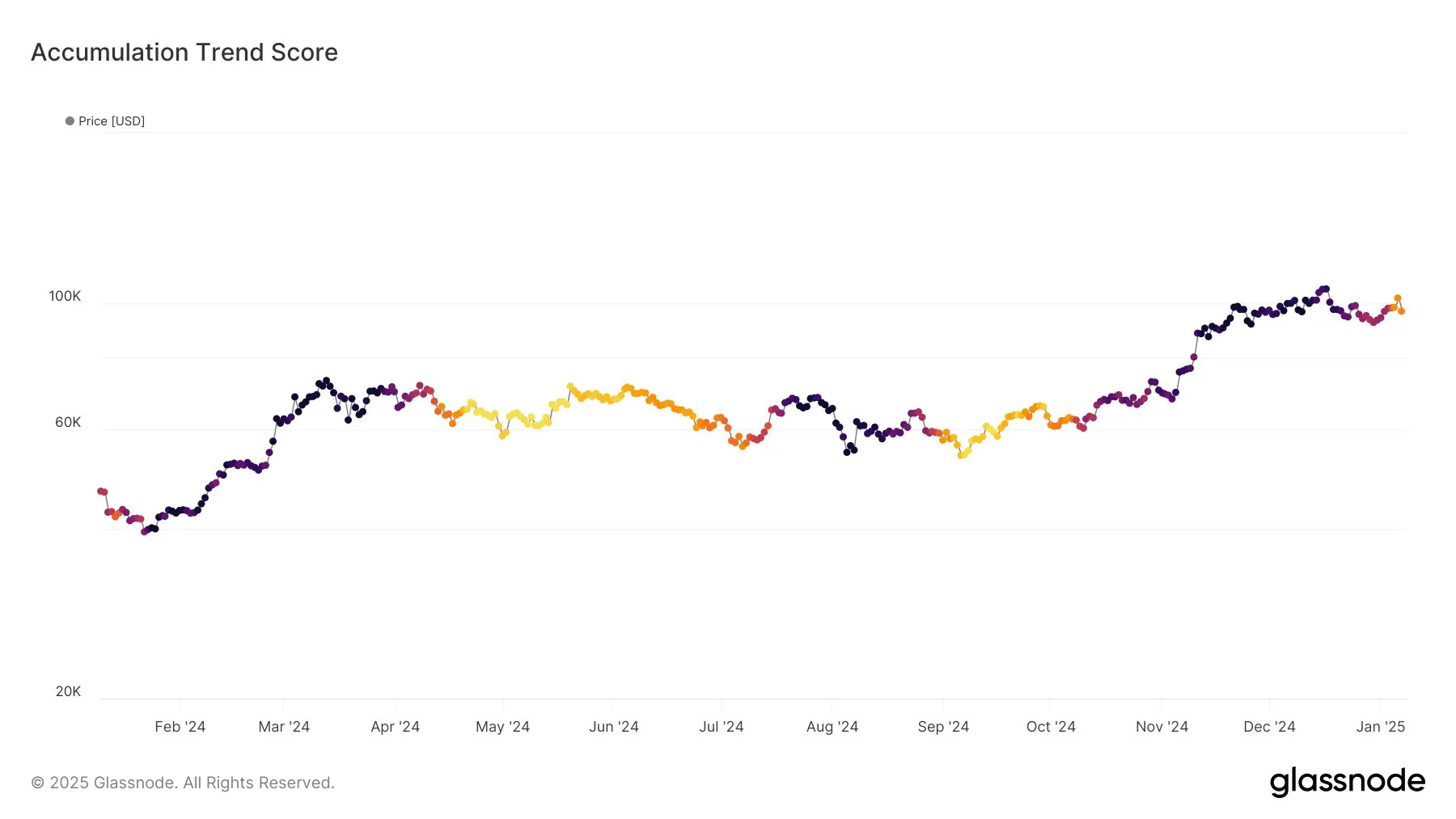

Bitcoin (BTC) price dropped 5.04% to $96,713, falling below the $100,000 psychological support level. The 24-hour trading volume rose 13% to $55.12 billion, indicating increased activity as traders reacted to the downturn. Its market capitalization declined to $1.91 trillion, reflecting the broader BTC bearish sentiment.

Meanwhile, Ethereum (ETH) was down by 8% to $3,394 after failing to hold the $3,600 level. Market capitalization of the company fell to $412.29 billion, while trading volume rose by 21% to $28.23 billion. Rising volatility indicated that the investors are more uncertain as compared to the previous periods in this environment.

Likewise, the value of XRP price declined by 5.66% to $2.29 as market capitalization fell by 6.03% to $131.29 billion. Nevertheless, the trading volume rose to $6.95 billion, which is 57.57% more, which shows increased activity.

The crypto market crash also affected top meme coins. Dogecoin (DOGE) recorded a 9.12% drop to $0.3546. Its market capitalization decreased to $52.3 billion, and trading volume soared 54% to $4.6 billion. The increase in trading activity reflected mixed reactions, ranging from profit-taking to panic-driven selling.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: