CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Raoul Pal, a former executive at Goldman Sachs, has pinpointed significant indicators suggesting a potential increase in Bitcoin‘s value. His analysis of global liquidity trends reveals that Bitcoin’s performance lags behind these cycles by approximately ten weeks, with a notable rise in the global M2 money supply projected to reach its lowest point by the end of 2024.

What Do Current Economic Trends Indicate?

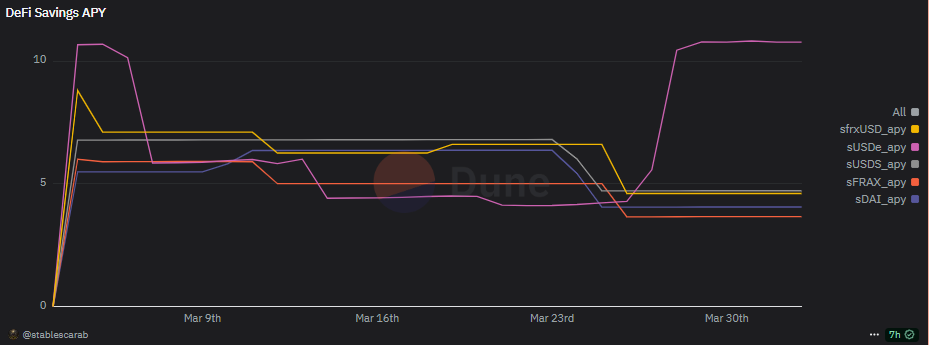

Pal’s published graph indicates that the increase in global M2 money supply may signal the conclusion of Bitcoin’s correction phase, initiating a period of upward movement. This surge in money supply could be a critical factor influencing the overall market dynamics.

Despite this optimism, there are concerns regarding potential liquidity pressure resulting from tariffs. Pal is likely to adjust his forecasts depending on the tariffs enforced by Trump in the coming week.

How High Could Bitcoin’s Price Rise?

Alongside Pal, Julien Bittel, who leads macro research at Global Macro Investor, shares similar sentiments, forecasting a local bottom for Bitcoin this week followed by a rebound.

Raoul Pal: “The wait is almost over; my preference is a ten-week advantage.”

Julien Bittel: “Bitcoin will see a local bottom this week and rise again.”

Experts anticipate Bitcoin’s price may regain momentum after its recent correction, with Pal estimating a peak this cycle of at least $210,000, and possibly soaring as high as $412,000, or even $805,000, based on long-term logarithmic regression trends.

Currently, Bitcoin is trading at $82,500, reflecting a decrease in its daily performance. Experts are keenly observing the impact of financial easing on the cryptocurrency market.

– Critical indicators suggest Bitcoin may rebound significantly.

– Global M2 money supply increases hint at the end of correction.

– Potential tariff impacts could influence future predictions.

With these insights, the technical analysis tools available can guide market participants in identifying long-term trends and potential reversal points. Monitoring the ongoing financial developments will be essential for those involved in the cryptocurrency space.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.