Stellar (XLM) price is up more than 6% in the last 24 hours as it works to reclaim an $11 billion market cap. Technical indicators like the DMI suggest an uptrend could be forming, with rising ADX and +DI dominance pointing to growing buying momentum.

Meanwhile, the Chaikin Money Flow (CMF) turning positive indicates improving capital inflows, signaling a potential shift in market sentiment. XLM is now trading between key levels, with the potential to rise toward $0.47 if bullish momentum builds or retest support at $0.31 if the uptrend fails to materialize.

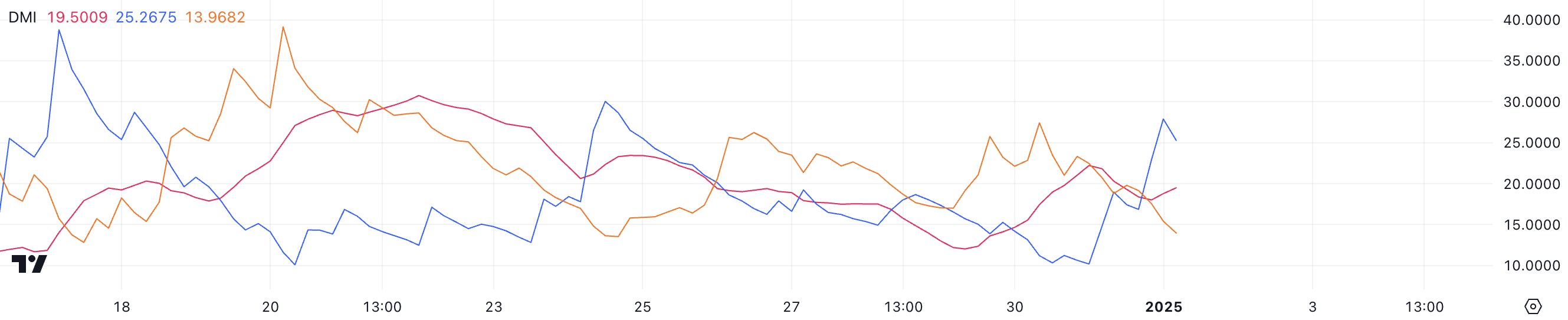

Stellar DMI Shows an Uptrend Could Appear Soon

XLM DMI chart shows its ADX currently at 19.5, rising from below 15 just three days ago, signaling an increase in trend strength. The +DI (Directional Indicator) has surged from 10 to 25.6 in just one day, while the -DI has dropped to 13.9, indicating a significant shift in momentum.

This crossover, with the +DI overtaking the -DI, suggests that buying pressure is now dominating selling pressure, hinting at the early stages of a potential uptrend.

The Average Directional Index (ADX) measures the strength of a trend on a scale of 0 to 100, with values above 25 indicating a strong trend and readings below 20 signaling weak or absent trend momentum. While Stellar ADX at 19.5 still reflects relatively weak trend strength, its upward trajectory suggests that the trend is gaining momentum.

Combined with the sharp rise in the +DI, this setup indicates that XLM price is making progress in reversing its recent downtrend. If the ADX continues to rise above 20 and the +DI maintains its dominance over the -DI, XLM could see further upward movement, signaling a potential shift into a sustained uptrend.

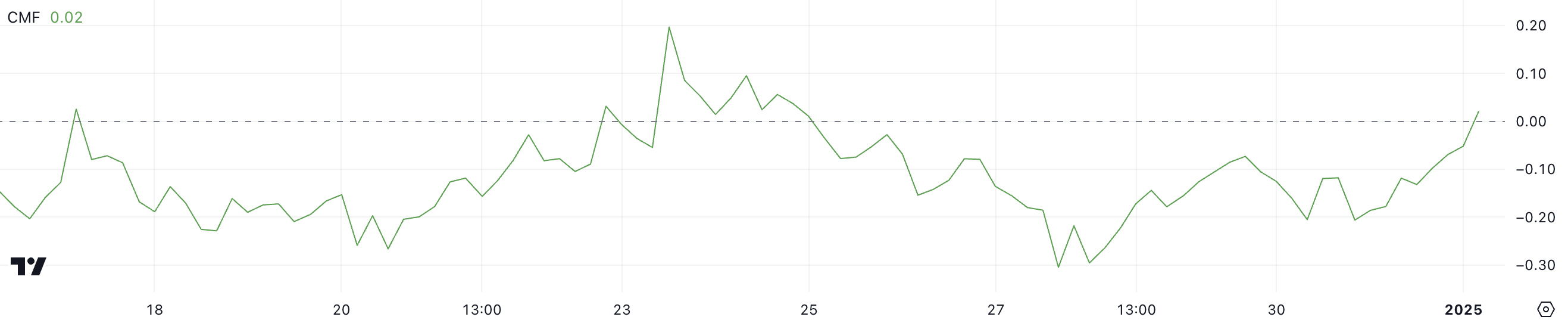

XLM CMF Is Now Positive

XLM’s Chaikin Money Flow (CMF) is currently at 0.02, recovering after remaining negative from December 25 to December 31. This shift into positive territory suggests that buying pressure is starting to outweigh selling pressure, albeit modestly.

The CMF’s recent rise reflects improving capital inflows into XLM, signaling a gradual return of investor confidence and a potential early indication of bullish momentum building in the market.

The CMF measures the flow of money into and out of an asset based on price and volume over a specific period. Values above 0 indicate net buying pressure, while values below 0 signify net selling pressure. Although Stellar CMF at 0.02 shows only a slight positive bias, it is a notable recovery from -0.20 just two days ago.

This sharp improvement suggests a significant shift in market sentiment, even if the momentum is still developing. If the CMF continues to rise, it could signal increasing accumulation and support for further price growth in the short term.

XLM Price Prediction: Will Stellar Rise 32% In the Next Few Days?

The EMA lines for XLM currently maintain a bearish setup, with short-term lines positioned below long-term ones, reflecting lingering downward momentum. However, the short-term EMAs are beginning to rise, and if they cross above the long-term EMAs, it will form a golden cross — a well-known bullish indicator that could signal a potential trend reversal.

If this upward momentum builds, Stellar price could test the resistance at $0.406, and breaking above this level could pave the way for a move toward the next resistance at $0.47.

On the downside, if the uptrend fails to materialize and the downtrend regains strength, XLM price could retest its closest support at $0.31. A failure to hold this level would open the door for further declines, with the next support at $0.25 potentially coming into play.

These critical support and resistance levels will likely define XLM’s short-term trajectory, with the EMA setup providing key insights into whether bullish momentum can fully take over or if bearish pressure will persist.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.