CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

- XRP ETF anticipated launch, SEC’s Ripple suit withdrawal, potential market impact.

- XRP ETF approval may occur in 2025, boosting market interest.

- The SEC lawsuit withdrawal is seen as a positive advancement.

Bloomberg analysts, led by James Seyffart, anticipate the potential launch of an XRP ETF in the next few months following the SEC’s decision to withdraw the Ripple lawsuit.

The move has increased the likelihood of XRP ETF approval by 2025, with 11 applications currently pending. This potential launch is seen as a pivotal moment for greater institutional interest in XRP.

XRP ETF Positioned for 2025 Approval Amid 11 Applications

Bloomberg analyst James Seyffart has highlighted the potential launch of an XRP exchange-traded fund (ETF) within months, predicting an XRP futures ETF might precede a spot ETF. This development follows the U.S. Securities and Exchange Commission (SEC)’s withdrawal of its lawsuit against Ripple.

Ripple CEO Brad Garlinghouse confirmed that there are currently 11 XRP ETF applications awaiting SEC review, targeting a launch by 2025. Experts believe that increased interest from different financial institutions could enhance XRP’s market liquidity and depth.

“With the SEC’s decision to withdraw the Ripple lawsuit, the probability of XRP ETF approval in 2025 has increased significantly. We might see an XRP futures ETF before a spot ETF.” — James Seyffart, ETF Analyst, Bloomberg

XRP Price and Institutional Interest Rise With Legal Clarity

Did you know? The approval of Bitcoin and Ethereum ETFs in 2024 led to a notable surge in institutional interest and liquidity, setting a precedent that may now benefit XRP’s prospects.

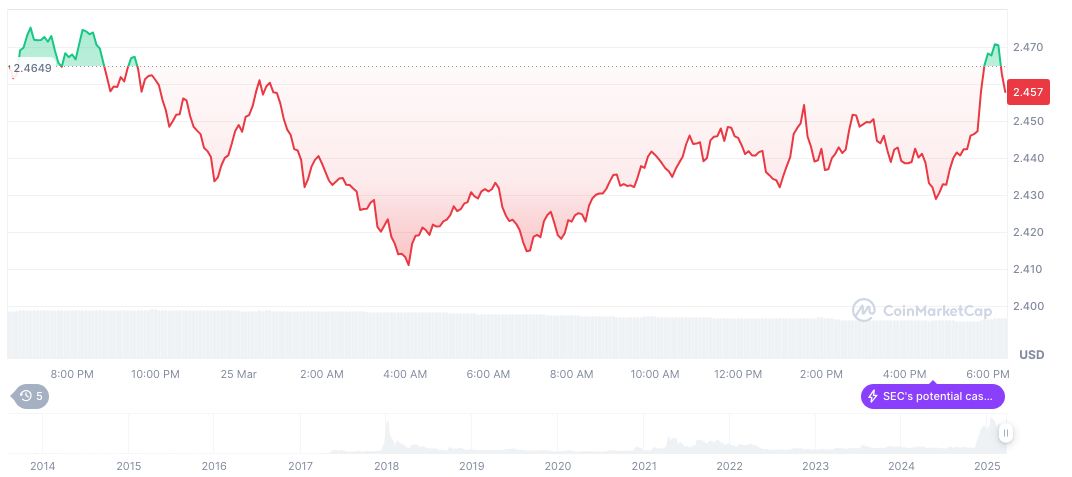

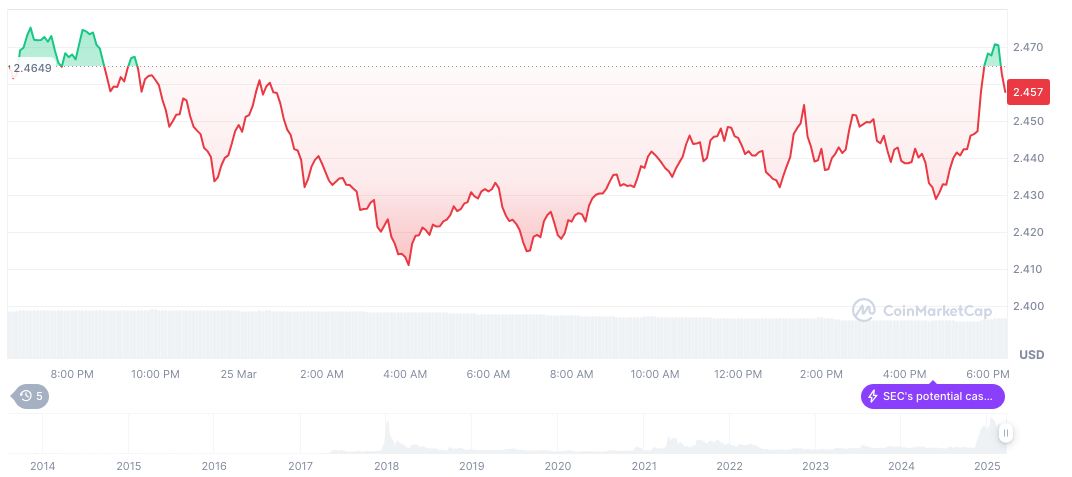

As reported by CoinMarketCap, XRP’s current price stands at $2.44, with a market capitalization of $141.86 billion and a 24-hour trading volume of $2.79 billion. XRP has experienced a 0.38% decrease in price over the past 24 hours, and a 21.93% decline over 60 days.

The Coincu research team expects the removal of regulatory hurdles to encourage more institutional investments, boosting XRP’s market position. Technological advancements and legal clarity might further XRP’s appeal among traders and investors, suggesting a promising path ahead.