CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

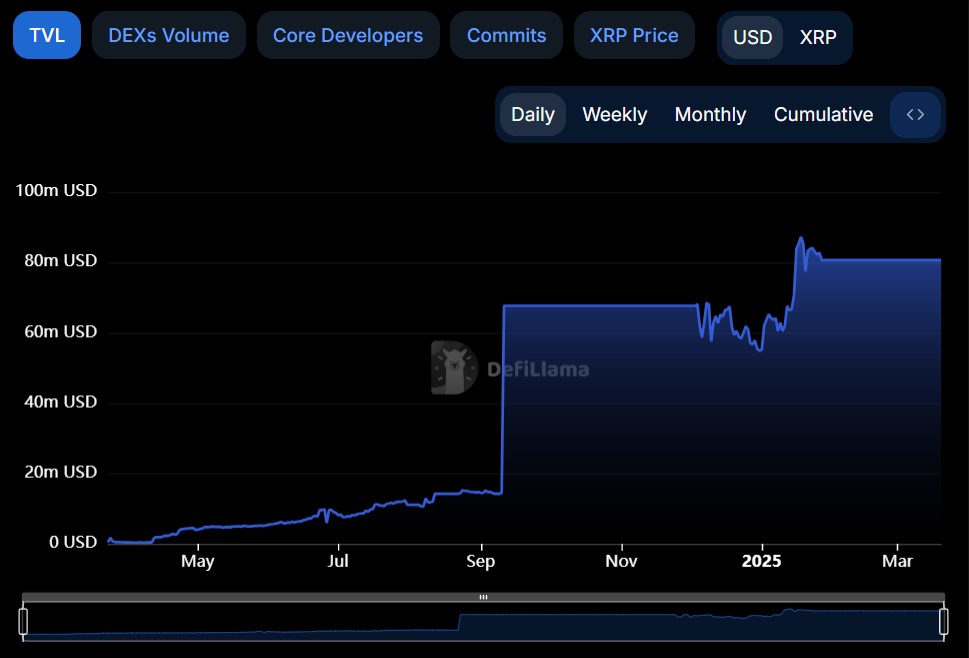

In a recent development, Ripple Labs Inc.-backed XRP Ledger (XRPL) has showcased a rare figure in its Total Value Locked (TVL).

Per data from DeFiLlama, XRPL now has 34.48 million XRP locked in its smart contracts.

This is equivalent to a TVL of $80.63 million. It shows a stagnant trend since at least January 30, 2025.

XRP Ledger TVL Growth and Market Trends

Notably, this outlook shows tempered user engagement with the XRPL decentralized finance (DeFi) ecosystem.

Similarly, as interest in decentralized finance continues to extend worldwide, XRPL’s expanding liquidity pools and decentralized applications (DApps) could potentially increase adoption and utility.

It is worth mentioning that the amount of XRP locked in XRPL DeFi protocols has progressed tremendously over the past years.

In January 2025, XRPL’s TVL stood at $65.52 million, showing an important 14% increase from the previous month.

By February, liquidity in Automated Market Maker (AMM) pools exceeded 13 million XRP.

Likewise, this persistent increase only means more investors and developers are exploring opportunities within the XRPL ecosystem.

This present trend with XRPL differs from the broader movement in the digital asset industry, where DeFi projects have consistently attracted more capital.

Onchain data show that blockchain networks, such as Ethereum and Binance Smart Chain, maintain higher TVLs when compared with XRPL.

However, XRPL’s baby steps show it is gradually becoming a stronger competitor in the DeFi space.

Many experts are now speculating whether XRPL can edge out the Ethereum network in the long term.

Furthermore, lower transaction fees and fast processing times make XRPL an appealing choice for DeFi users.

While XRPL’s current total value locked remains smaller than Ethereum or Solana’s, its increasing adoption shows positive signs for future development.

The consistent flow of liquidity and interest from institutional and retail investors supports XRPL’s potential expansion in the DeFi market.

XRPL’s Leading DApps and Their Impact

Several decentralized applications have contributed to the recent growth in XRPL’s TVL.

For instance, last month, market data revealed more than 18,000 active AMM pools on the XRP Ledger, supporting over 17,000 unique assets.

These pools allow users to provide liquidity and earn rewards while increasing the overall stability of the network.

AMMs, lending protocols, and yield farming platforms are important in XRPL’s expanding DeFi environment.

The ability to move assets efficiently across the network without high fees has attracted more users.

This has led to greater engagement with XRPL’s financial products, including decentralized exchanges and lending services.

Challenges and Future Innovations

Despite its growth, XRPL faces challenges competing with networks and more established DeFi ecosystems.

At the earliest stages, the lack of advanced native smart contract functionality has made it difficult for some developers to build on XRPL compared to Ethereum and Solana.

However, upgrades, such as introducing Hooks and sidechains, aim to improve XRPL’s capabilities.

These developments will allow for more complex financial applications, making XRPL a more appealing and suitable platform for DeFi projects.

If adoption continues at its current pace, XRPL could become a formidable player in the decentralized finance Industry.

In related news, Ripple Labs CEO Brad Garlinghouse revealed in an X post that the US security agency has finally dismissed its class actions against Ripple after five years.

This update has liberated XRP, whom the regulator noted earlier is an unregistered security. With this shift, developers and investors may explore the XRP Ledger freely.