CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

XRP price is up 14% in the last seven days but has entered a consolidation phase, consistently trading between $2.34 and $2.46 for the past six days. This period of range-bound movement reflects balanced market sentiment, with neither bulls nor bears taking control.

The number of XRP whales holding between 10 million and 100 million coins has also remained stable since late December, further supporting the neutral market conditions. However, if bullish momentum strengthens, XRP could break out and target significant upside levels, with $2.72 and $2.9 as potential next steps.

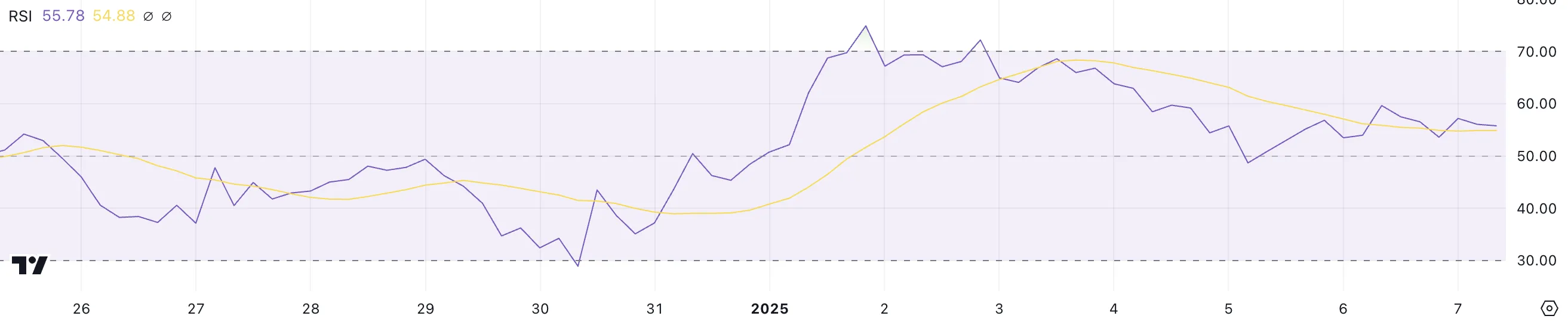

XRP RSI Is Currently Neutral

XRP Relative Strength Index (RSI) currently stands at 55.7, reflecting a period of moderate market momentum. RSI is a technical indicator that measures the speed and magnitude of price changes on a scale from 0 to 100, helping traders identify whether an asset is overbought or oversold.

Values above 70 typically indicate overbought conditions and potential for a pullback, while values below 30 suggest oversold conditions and potential for a price rebound. XRP’s RSI, being in the neutral zone since January 3, indicates balanced buying and selling pressures.

At its current level, XRP RSI suggests consolidation, with neither bulls nor bears dominating the market.

For upward momentum to resume, the RSI would need to climb closer to the overbought zone, reflecting stronger buying activity. Conversely, if the RSI begins to dip, it could signal weakening sentiment and the potential for a slight pullback.

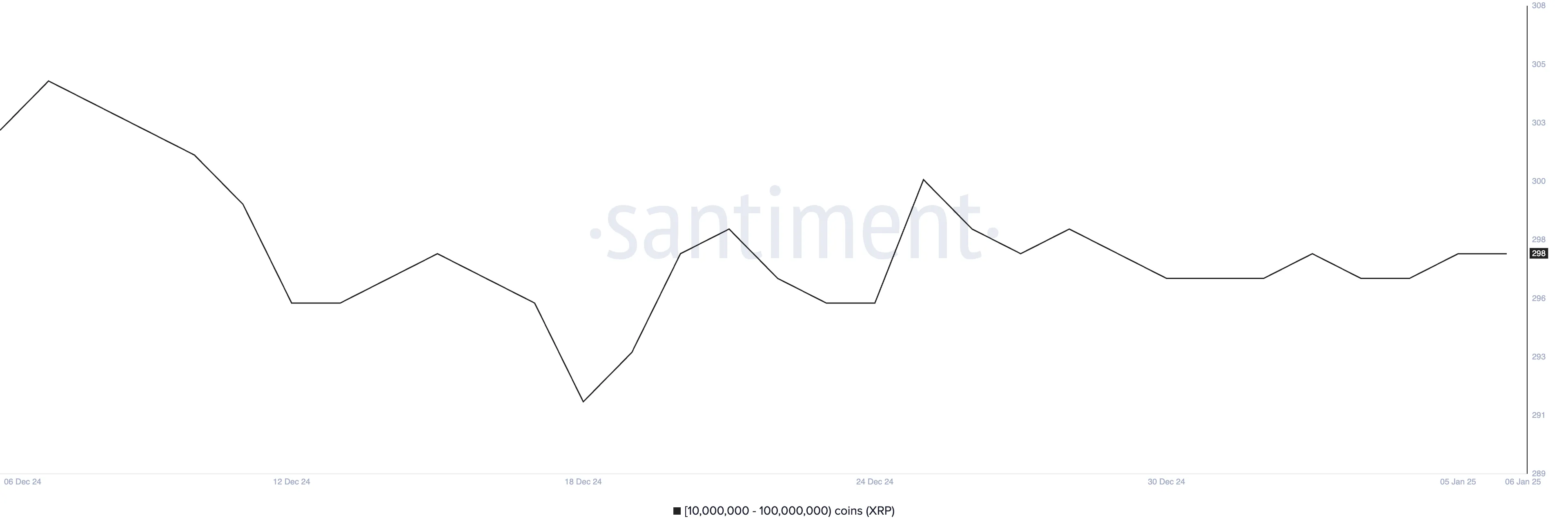

XRP Whales Has Been Stable Since the End of December 2024

The number of XRP whales holding between 10 million and 100 million coins has shown significant fluctuations recently. After reaching a month-high of 305 on December 7, the count declined sharply to a month-low of 292 on December 18.

Since then, it has recovered slightly and stabilized around 298, maintaining this level since December 27. Tracking whale activity is crucial because these large holders can significantly influence market trends through their buying or selling decisions.

The stabilization in whale numbers over the past two weeks suggests a period of market consolidation. This could indicate that major investors are neither aggressively accumulating nor offloading their holdings, reflecting a neutral sentiment.

For XRP price, this steadiness might mean limited volatility in the short term, as the absence of large-scale movements by whales helps maintain price stability. However, a renewed increase or decrease in whale activity could signal the start of a new trend.

XRP Price Prediction: Can It Rise 20%?

XRP price has been consolidating for the past six days, trading within a narrow range between a resistance at $2.53 and a support at $2.33. This price behavior reflects a lack of clear momentum, with the market awaiting a decisive move.

If the support at $2.33 is tested and fails to hold, XRP could face further downside, potentially dropping to $2.13 and $1.96 as the next key levels.

The EMA lines for XRP indicate uncertainty, with no clear directional signal at present. However, if bullish momentum returns, XRP price could test the resistance at $2.53.

A successful breakout above this level could spark further gains, targeting $2.72 and possibly $2.90, representing a potential 20.3% upside. The outcome will depend on whether buyers or sellers gain control in the coming days.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.