CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

- Egrag Crypto shares an XRP chart, signaling potential future price movement.

- XRP is trading at $2.23, down 5.8% in 24 hours and 7.3% over the past month.

- The $2 point is a key support level, while $3.00 remains a resistance zone.

Ripple’s XRP has drawn renewed community interest recently, even as its price faces downward pressure. Despite a major regulatory win with the SEC lawsuit dismissal, XRP hasn’t seen the sharp price surge many anticipated, currently trading around $2.23 after a ~5.8% daily decline.

This price action tests critical support levels, prompting analysts to weigh near-term risks against longer-term bullish projections, some targeting as high as $15.

XRP Tests Critical $2.22 Support: What Egrag’s Chart Shows

Analyst “Egrag” highlighted the importance of the $2.22 level for XRP. His chart analysis identifies this price point as crucial immediate support, an area tested multiple times previously.

According to Egrag, if buyers successfully defend this level, a bounce back towards the major resistance area around $3 could be likely. However, a sustained break below $2.22 could increase short-term bearish pressure, potentially leading XRP to retest lower support zones.

Long-Term View: Analyst Reiterates $15 Target After 600% Gain

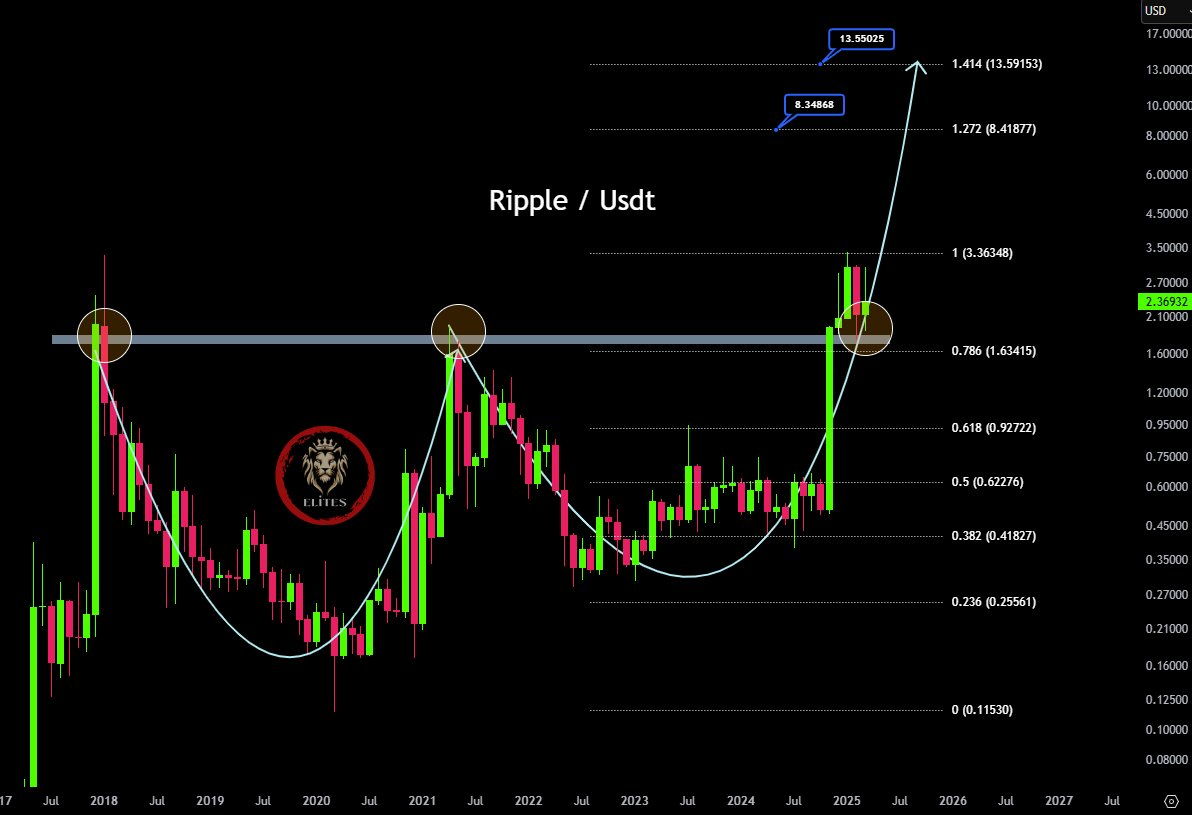

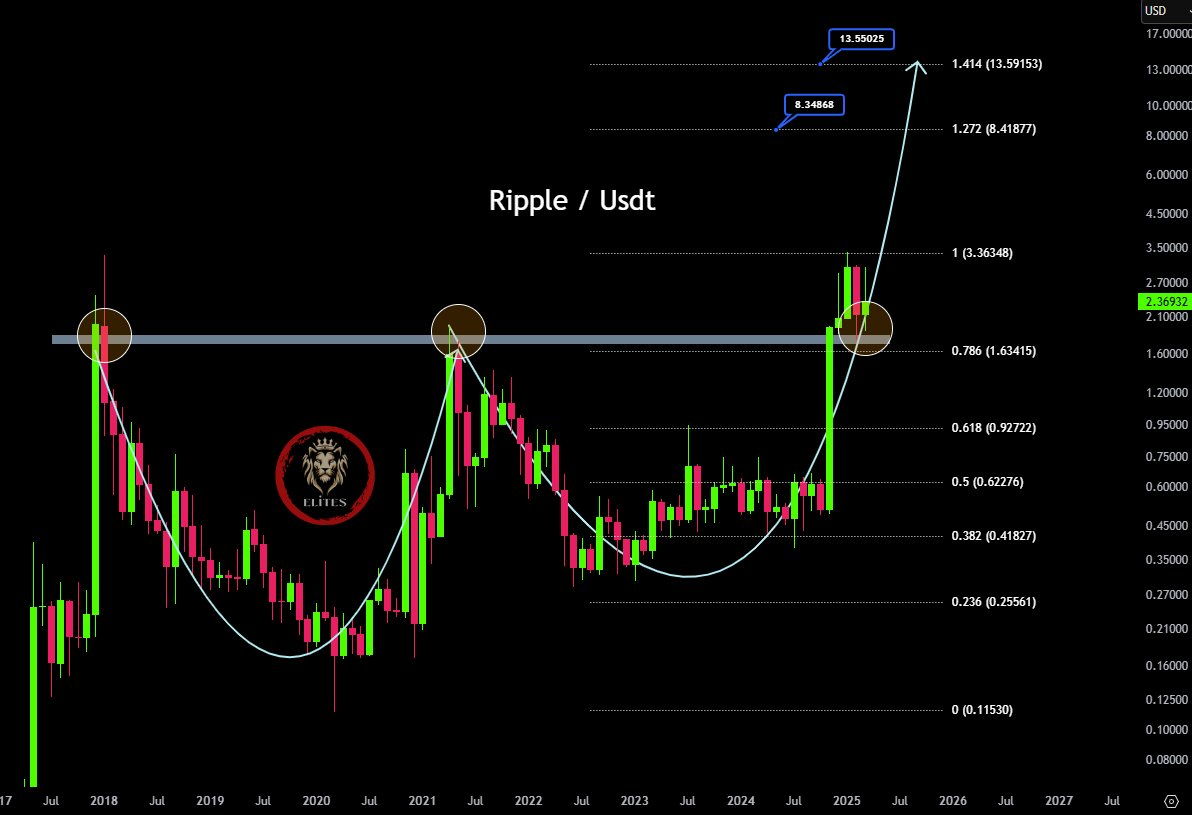

Offering a significantly more bullish long-term perspective, analyst “CryptoElite” recently reaffirmed a bold $15 price target for XRP. Notably, this analyst reportedly first shared this outlook when XRP traded near $0.50.

They cite XRP’s decisive break above multi-year resistance (formerly $1.95-$2.10) and the potential formation of a large cup and handle pattern as key technical confirmations.

CryptoElite’s analysis, based on Fibonacci extensions, points to potential targets near $8.34 and eventually $13.55–$15 if strong bullish momentum continues, drawing parallels to previous market cycles.

Related: Anatomy of a 600% Call: Analyst Explains Why XRP’s $15 Target Stands

Regulatory Clarity & ETF Hopes Remain Key Catalysts

Underpinning these bullish technical outlooks are significant positive shifts in the US regulatory landscape for XRP. Researcher “Anders,” among others, points to the SEC case dismissal as removing major legal uncertainty for Ripple. He also notes the repeal of the SEC’s Staff Accounting Bulletin 122 (SAB 122), which now allows regulated US banks to offer crypto custody services – a development that could benefit Ripple’s secure custody offerings and foster institutional adoption.

Related: “You Have No Idea”: Analyst’s XRP Chart Hints at a Truly Massive Price Surge

Also, speculation surrounding a potential US spot XRP ETF continues to grow. Nate Geraci, a noted ETF expert, has called such an ETF “inevitable.” Prediction market data also reflects high community expectations, recently showing an 82% perceived probability of approval possibly occurring this year. An ETF approval is widely seen as a potential game-changer capable of attracting significant institutional capital into XRP.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.