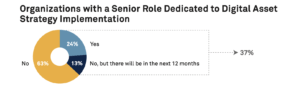

A recent report reveals that 25% of asset managers and hedge funds in the United States and Europe have hired experienced leaders to manage their plans involving digital assets.

According to a recent report by Amberdata, which studies financial markets, more investment companies in the United States, the United Kingdom, and Europe are putting senior executives in charge of their plans for investing in digital assets like cryptocurrencies.

The report, titled “Digital Assets: Managers’ Data Infrastructure Fuel,” found that 24% of asset management firms have already started using digital assets in their strategies. Additionally, 13% of these firms are planning to do the same in the next two years.

This shows that these companies are taking digital asset investments seriously and are getting senior leaders involved in making these important decisions.

Organizations with a senior role dedicated to dedicated asset strategy implementation. Source: Amberdata

Survey of Investment Professionals

A report surveyed 60 investment experts in the United States, United Kingdom, and Europe. These experts came from various areas, including asset management and hedge funds.

About 48% of those surveyed said they already include digital assets in their company’s investments. The report predicts that more asset managers will focus on digital asset trading and investment in the next two years.

Despite regulatory challenges in the U.S. crypto industry from the SEC and CFTC, the report suggests a more positive future. It expects that these agencies will offer better opportunities for investors in the next five years.

The report also mentions that Ripple’s recent legal success against the SEC might encourage more asset management firms to consider digital asset strategies.

Strong Performance by CoinShares

In other news, European digital asset manager CoinShares reported impressive earnings of £20.3 million ($25.9 million) in the second quarter of 2023. This marks a 33% increase compared to the same period the previous year.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News