Key Points

- $1.97 billion Bitcoin options and $350 million Ethereum options expired today.

- BTC is trading above $69,000 and ETH is priced at $2,500.

November 1st options data is delivered, showing that almost $2 billion in Bitcoin and Ethereum options expired today.

According to Greeks.live data, 28,000 BTC options expired with a Put Call Ratio of 0.92, a Maxpain point of $69,000, and a notional value of $1.97 billion.

Also, 137,000 ETH options with a Put Call Ratio of 0.69, a Maxpain point of $2,550, and a notional value of $350 million expired.

The options expiry data came following an exciting week for Bitcoin which topped $73,500 on October 29, fueled by multiple factors.

BTC Price Trades Above $69,000

At the moment of writing this article, BTC is trading above $69,000, down by over 4% in the past 24 hours.

This week was marked by a significant price rally for BTC which debuted on October 28 from price levels of $67,000, reaching its maximum price since March above $73,500.

The coin’s price rally was fueled by multiple factors including whale accumulation, the upcoming US elections next week, and significant inflows in BTC ETFs in the US.

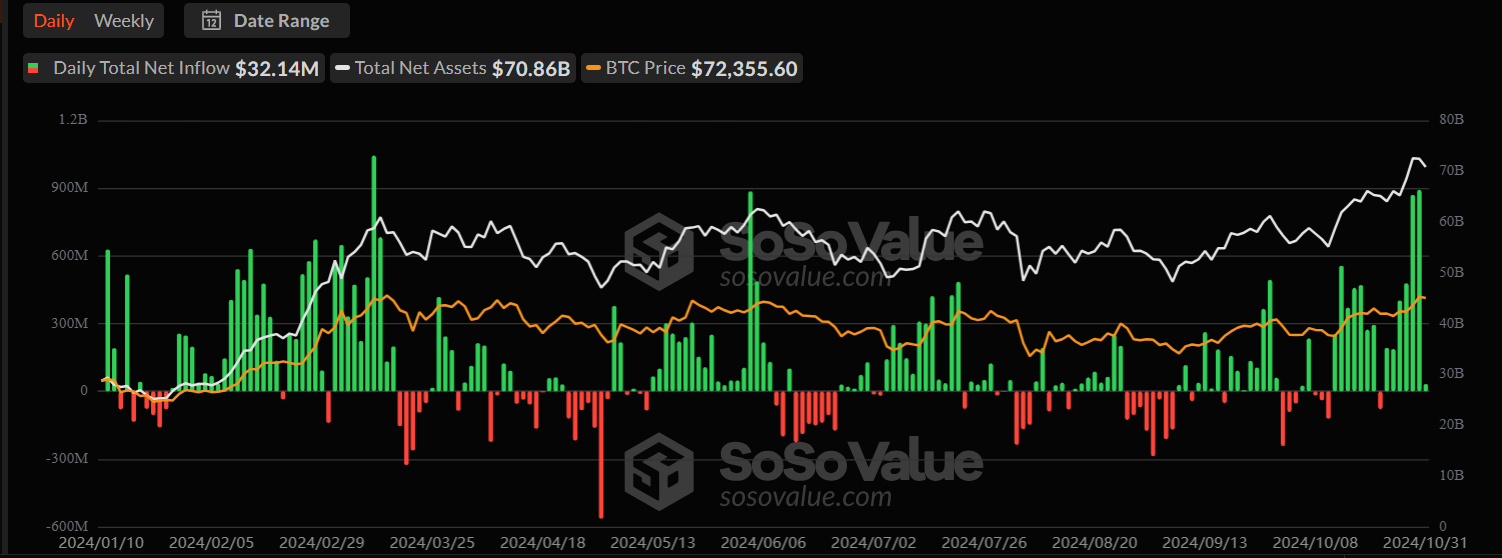

On October 31, the crypto products recorded over $32 million in inflows, and on October 30, they saw over $893 million in inflows, the biggest day since June.

BTC ETFs saw a significant streak of inflows which debuted on October 11, at over $253 million, and continued until yesterday. During this period, the only outflow day was October 14, when the crypto products saw outflows of $79 million.

The total net assets locked in the US BTC ETFs as of October 31 were over $70 billion and the total cumulative flows in the crypto products since their January debut was over $24.2 billion, according to SoSoValue data.

Following this week’s rally, BTC recorded a price drop that debuted yesterday and reached a dip today around $68,900 ahead of a quick rebound above $69,000.

Data from CoinGlass shows that BTC liquidations in the past 24 hours were almost $90 million, $80 million in long positions, and over $9 million in short positions.

Greeks.live shared a post via X earlier today, highlighting their previous prediction of a significant whale dump.

They also noted that the BTC ATM IV predicted for November 8 is close to 70%.

ETH Price Trades at $2,500

Regarding Ethereum’s price today, at the moment of writing this article, the coin is trading at $2,500, down by more than 5% in the past 24 hours.

Unlike BTC, ETH performed poorly throughout the entire year, despite the launch of ETH ETFs in the US. The crypto products didn’t see the success of BTC ETFs.

In the past 24 hours, ETH saw liquidations of over $45 million, $41 million in long positions, and $4.3 million in shorts.

The crypto market is expected to see increased volatility as the US Elections are approaching.