Key Points

- Bitcoin and Ethereum options worth over $4.5 billion expired today.

- BTC is trading above $75,000 and ETH’s price is over $2,900.

Today, Bitcoin and Ethereum options data is released amidst a bullish market triggered by the US election results and fueled even more by the latest Fed decision to cut interest rates by 25 bps.

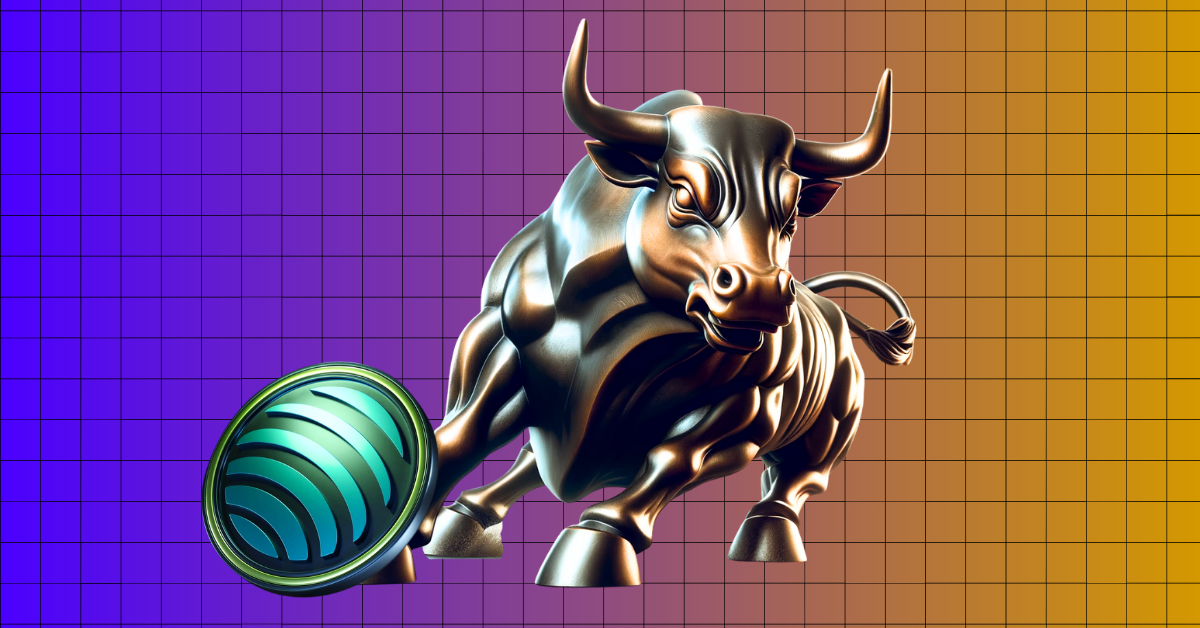

49,000 Bitcoin options expired today, with a Put Call Ratio of 0.72, a Maxpain point of $69,000, and a notional value of $3.7 billion.

Also, 295,000 Ethereum options expired today with a Put Call Ratio of 0.65, a Maxpain point of $2,500, and a national value of $860 million, according to data from Greeks.live revealed via their X account.

Greeks.live also noted that the end of the US election triggered a significant decline in short-term options IV, and mainstream term options parity IV also declined to varying degrees.

This was a bullish week for the entire crypto market that propelled Bitcoin to a new ATH close to $77,000 and fueled a notable price increase for Ethereum.

Bitcoin is Trading Above $75,000

At the moment of writing this article, BTC is trading above $75,800, up by 1% in the past 24 hours.

On November 7, BTC hit a new ATH above $76,800, fueled by the US election results that revealed Donald Trump as the new US President, and other factors including, the latest Fed decision to cut interest rates by 25 bps, and a considerable amount of inflows in US BTC ETFs.

Yesterday marked the biggest inflow day since the crypto products’ launch at $1.38 billion, according to data from SoSoValue.

Ethereum also had a bullish week, recording a price surge of around 15% in the past 7 days.

ETH Is Trading Above $2,900

At the moment of writing this article, ETH is priced above $2,900, up by 3% in the past 24 hours.

Earlier, the coin reached a peak at $2,945, following a notable rally during the past week that kicked off on November 6 from price levels of $2,400.

The overall sentiment in the crypto market is very optimistic and more bullish price moves are expected.