- Apart from the spot BTC ETF market, markets such as spot Ether ETFs have also witnessed significant growth by marking $515 million in inflows.

- The net inflows in the Bitcoin ETF market are also a result of the significant surge of Bitcoin which has so far crossed the $90,000 mark.

- SoSoValue further reports that the six consecutive weeks of inflows recorded by spot Bitcoin ETFs started on October 11 and the amount is estimated to be $8.95 billion.

Spot Bitcoin exchange-traded funds (ETF) are showing an outstanding performance as they have continued their upward momentum and have marked one more week of success following the overall market surge.

SoSoValue, a crypto data provider reports that In the last week, Spot Bitcoin ETFs have marked an outstanding inflow of about $1.67 billion. After this record, it has marked six continuous weeks having positive inflows.

Talking about outflows, $20.3 billion in outflow has been recorded by the Grayscale Bitcoin Trust ETF since spot BTC ETFs started trading in the first month of this year. At the same time, iShares Bitcoin Trust of BlackRock (IBIT) has recorded an inflow of $29.3 billion and is currently in the leading position.

Other markets witnessing the surge

Apart from the spot BTC ETF market, markets such as spot Ether ETFs have also witnessed significant growth by marking $515 million in inflows recorded weekly and a consecutive three weeks of positive flows. Overall, around $682 million of net inflows have been recorded in these consecutive weeks.

SoSoValue further reports that the six consecutive weeks of inflows recorded by spot Bitcoin ETFs started on October 11 and the amount is estimated to be $8.95 billion. Now, the total assets under management for the same stand at $95.4 billion, as a result of these inflows.

The Bitcoin’s effect

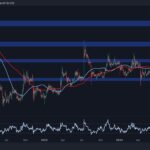

The net inflows in the Bitcoin ETF market are also a result of the significant surge of Bitcoin which has so far crossed the $90,000 mark. Now, the market analyst speculates that it will continue to surge and will hit $100,000 before the new year. At the time of writing, Bitcoin is currently trading at $90,716.

Paul Tudor Jones, an American Billionaire investor has joined the race of those who are expanding their exposure to Bitcoin ETFs. The investor has significantly added $130 million worth of IBIT shares.

Jones is currently the ninth-largest holder of IBIT shares. Other data highlights that the inflows over the globe to crypto exchange-traded products are estimated at about $2.2 billion as recorded in the last week.