- Over 92% of Bitcoin investors were in profit as it crossed $66k on the charts

- A sustained rally could push BTC to an ATH

Bitcoin [BTC] has been comfortably moving north lately, with the cryptocurrency managing to climb above $66k again. Now, while this pointed to an optimistic turn for the king coin, the market might soon take a U turn in the coming days.

This could be the case, especially as a multi-year bearish pattern appeared on BTC’s chart.

Bitcoin sees danger ahead

AMBCrypto reported previously that the cryptocurrency had crossed its long-term moving average, breaking key resistance levels. Thanks to that, BTC’s price rallied above $66k on the charts.

After it crossed $66k, more than 49 million BTC addresses were in profit, which accounted for over 92% of the total number of BTC addresses.

However, the bull rally might end soon. Ash Crypto, a popular crypto analyst, recently shared a tweet highlighting a multi-year bearish head and shoulder pattern on BTC’s chart.

The pattern emerged in 2021, and at press time, the coin’s price was approaching the neckline support of the same pattern. As per the tweet, a failed test of the support could result in a massive crash.

Is BTC awaiting a correction?

Since there is some probability of a crash, AMBCrypto checked BTC’s metrics to find the odds of BTC dropping to its neckline support level.

As per our analysis of CryptoQuant’s data, BTC’s net deposit on exchanges was high, compared to the last seven days’ average. This underlined a hike in selling pressure. Whenever selling pressure rises, it often results in price corrections.

The coin’s aSORP turned red, suggesting that more investors have been selling at a profit. In the middle of a bull market, it can indicate a market top. Its NULP also looked bearish. All of these metrics clearly indicated that the chances of BTC price correction were high.

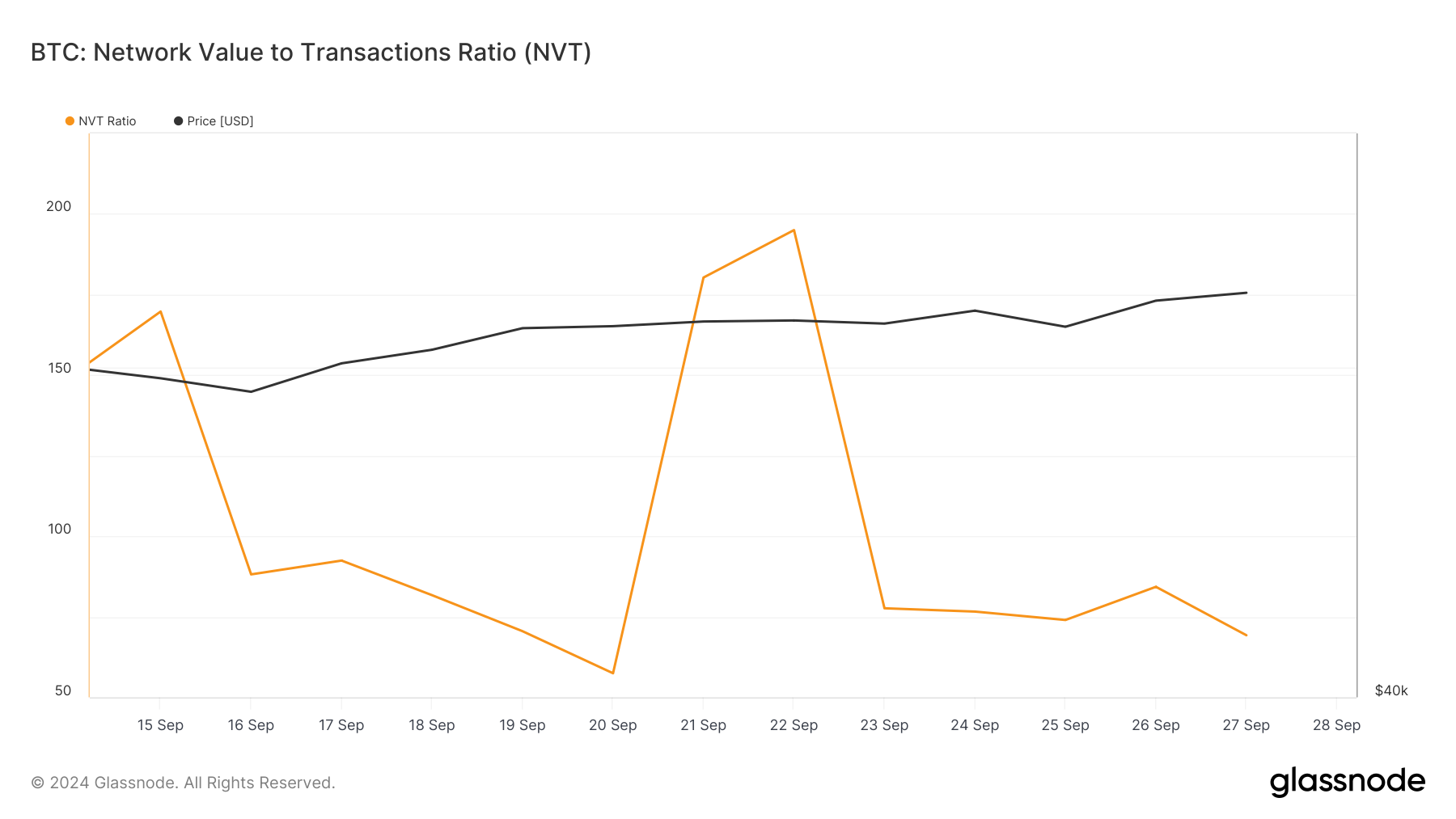

However, not everything turned against BTC. AMBCrypto’s look at Glassnode’s data revealed an optimistic metric.

We found that BTC’s NVT ratio was dropping. A decline in the metric means that an asset is undervalued, hinting at a price hike in the coming days.

We then checked Bitcoin’s weekly chart to find out where it might go if the uptrend continues, as suggested by the NVT ratio. As per our assessment, a sustained bull rally could push BTC towards its all-time high once again.

Is your portfolio green? Check out the BTC Profit Calculator

If things fall in place, then the coin might as well reach a new ATH. However, if a price correction happens, then BTC might again fall to $54k in the coming weeks.