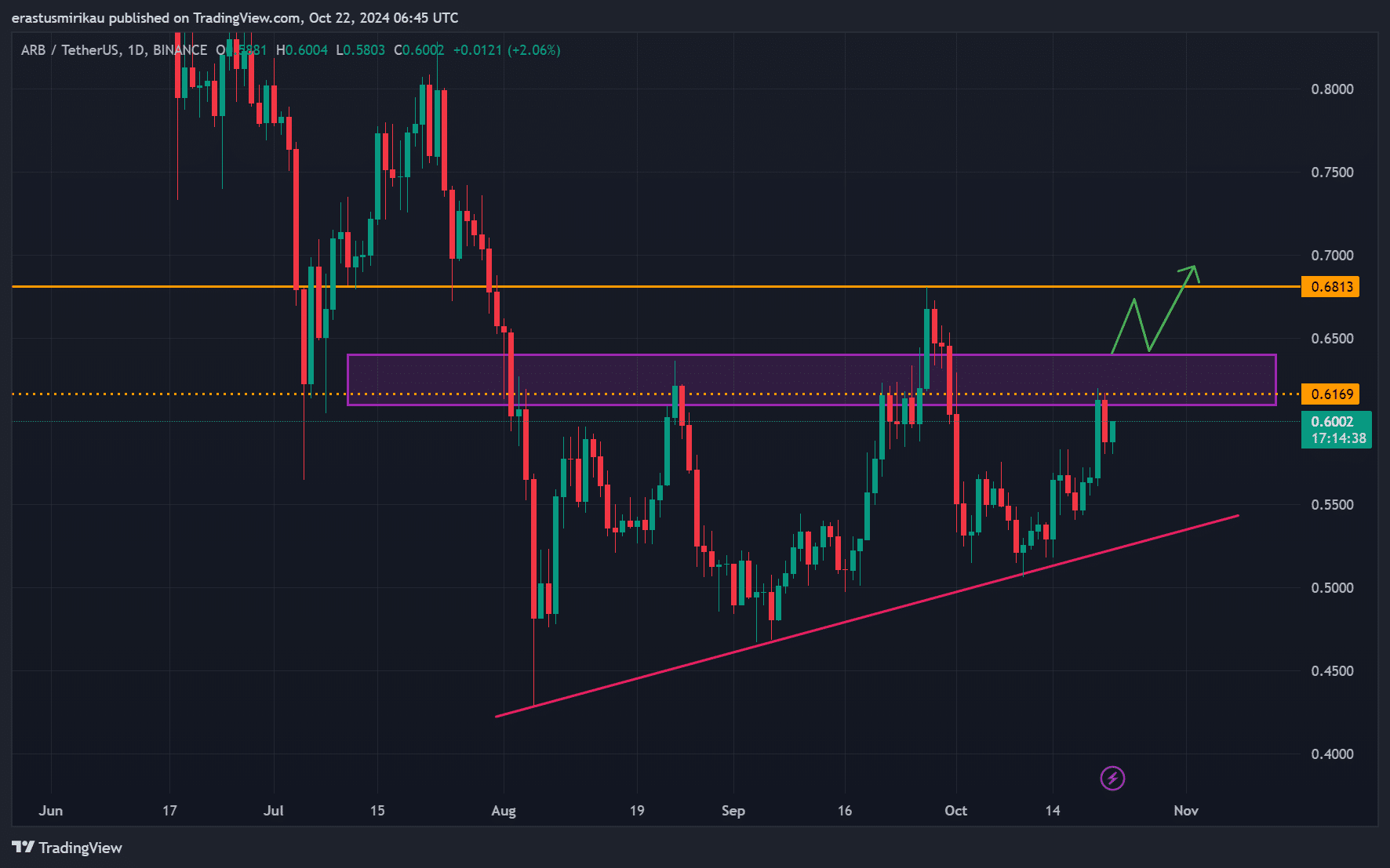

- ARB is testing key resistance at $0.61, with bullish momentum pushing prices higher.

- Technical indicators favor a breakout, but on-chain data signals caution despite positive funding rates.

Arbitrum [ARB] shows signs of a potential breakout, currently trading near the $0.60 mark, supported by growing bullish momentum. At press time, ARB trades at $0.5995, reflecting a slight 1.76% decline in the past 24 hours.

ARB’s price chart indicates the token is testing a key resistance zone near $0.61. This horizontal resistance has proven difficult to breach, but if ARB manages to close above it, the path toward $0.68 becomes much clearer. The $0.55 support level remains crucial in this potential breakout.

Additionally, the rising trendline suggests continued bullish pressure, increasing the likelihood of further upward momentum. However, failure to break past $0.61 could result in a temporary pullback, potentially towards $0.55.

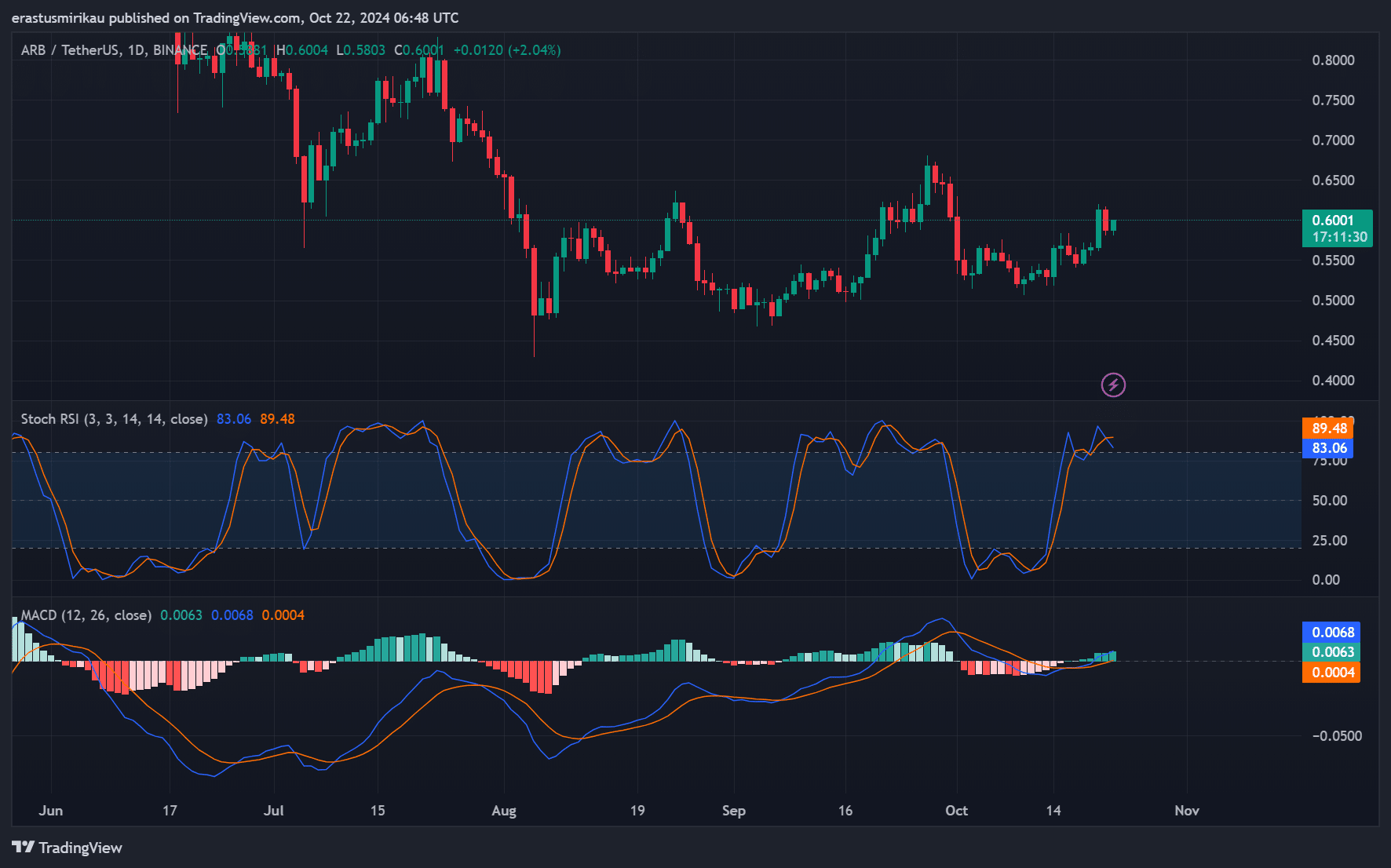

Analyzing technical indicators: Are bulls still in control?

Technical indicators reveal a mostly bullish outlook for Arbitrum. The Stochastic RSI currently sits at 89.48, indicating overbought conditions. Therefore, while upward momentum remains strong, the token might experience a slight pullback before making another push.

Additionally, the MACD shows a positive crossover, reinforcing the possibility of continued price increases. Consequently, these indicators suggest that while short-term corrections may occur, the overall trend leans bullish for ARB.

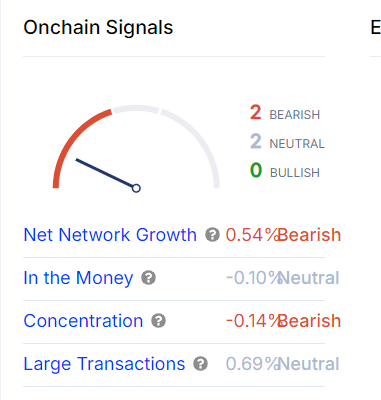

Evaluating on-chain data: Mixed signals for ARB

On-chain signals present a mixed view of Arbitrum’s potential. Net network growth registers at 0.54%, signaling slight bearish sentiment. Additionally, the concentration of large holders also leans bearish at -0.14%, indicating that whales may not be accumulating.

However, the “in the money” and large transactions metrics remain neutral, suggesting that there is still room for market recovery despite short-term uncertainties.

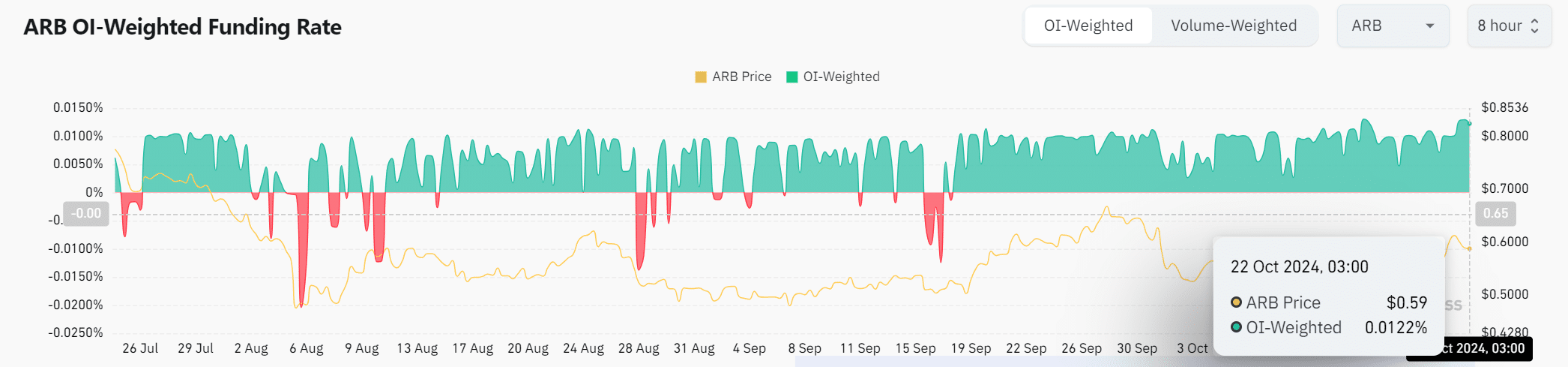

Is the OI-weighted funding rate supporting ARB’s bullish case?

The OI-weighted funding rate remains positive at 0.0122%, signaling optimism in the futures market. This bullish sentiment in the derivatives market could support ARB’s price breakout if it can surpass its current resistance.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

Can ARB break out?

Arbitrum appears poised for a potential breakout if it can clear the critical $0.61 resistance. The technical and market indicators mostly favor a bullish scenario. However, traders should remain cautious of short-term corrections due to overbought signals.

If Arbitrum can hold current support levels, the likelihood of testing $0.68 becomes increasingly probable.