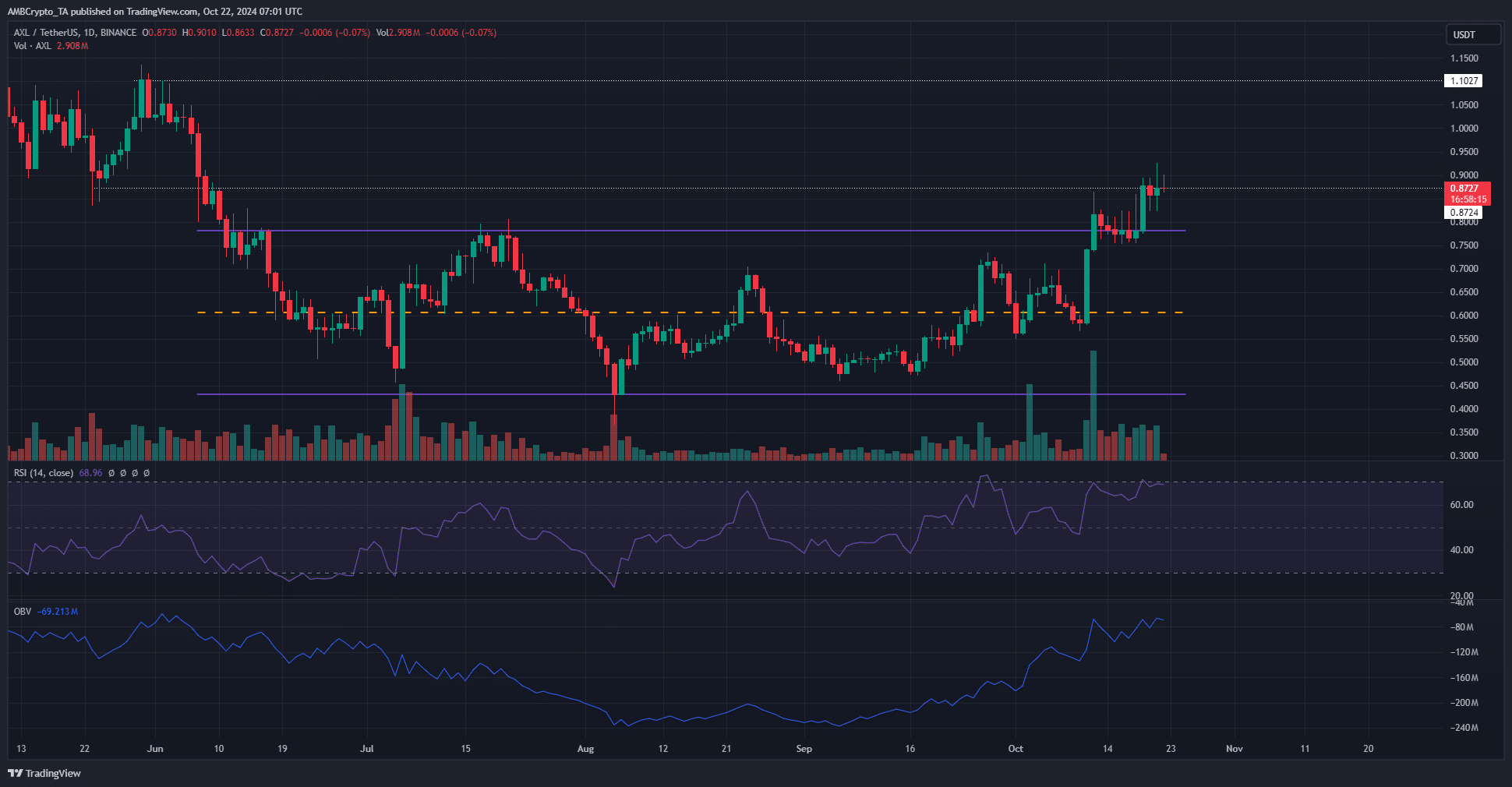

- AXL coin was making steady progress after breaching the 4-month range’s highs.

- The next targets are the psychological $1 level and beyond.

Axelar [AXL] was up by 52.8% within two weeks. It rose by 12.35% in the past 24 hours but saw a sizeable dip recently, making its 1-day gains worth just over 5%.

The trading volume of the $700 million market cap token was up 78% in the past 24 hours. This influx of activity is due to bullish expectations. A retest of the $0.872 level as support could be an ideal buying opportunity.

Range breakout going strong for AXL coin

Axelar broke out of a range formation that has been in play since mid-June. The 4-month range reached from $0.434 to $0.738. The trading of the past two weeks saw AXL break out past the highs and retest them as support.

The OBV was rising to show increased buying pressure. The indicator has been trending upward for a month now, and because of this, the chances of a sustained move higher are better.

The daily RSI did not show a divergence yet but was close to the overbought zone. Traders can keep an eye on the momentum indicator for early signs of a price pullback.

The $0.872 and $1.1 are the next resistance levels that could stall the bulls. Based on the strength of the buyers during and after the breakout, it is likely that AXL coin prices would grow beyond $1.1.

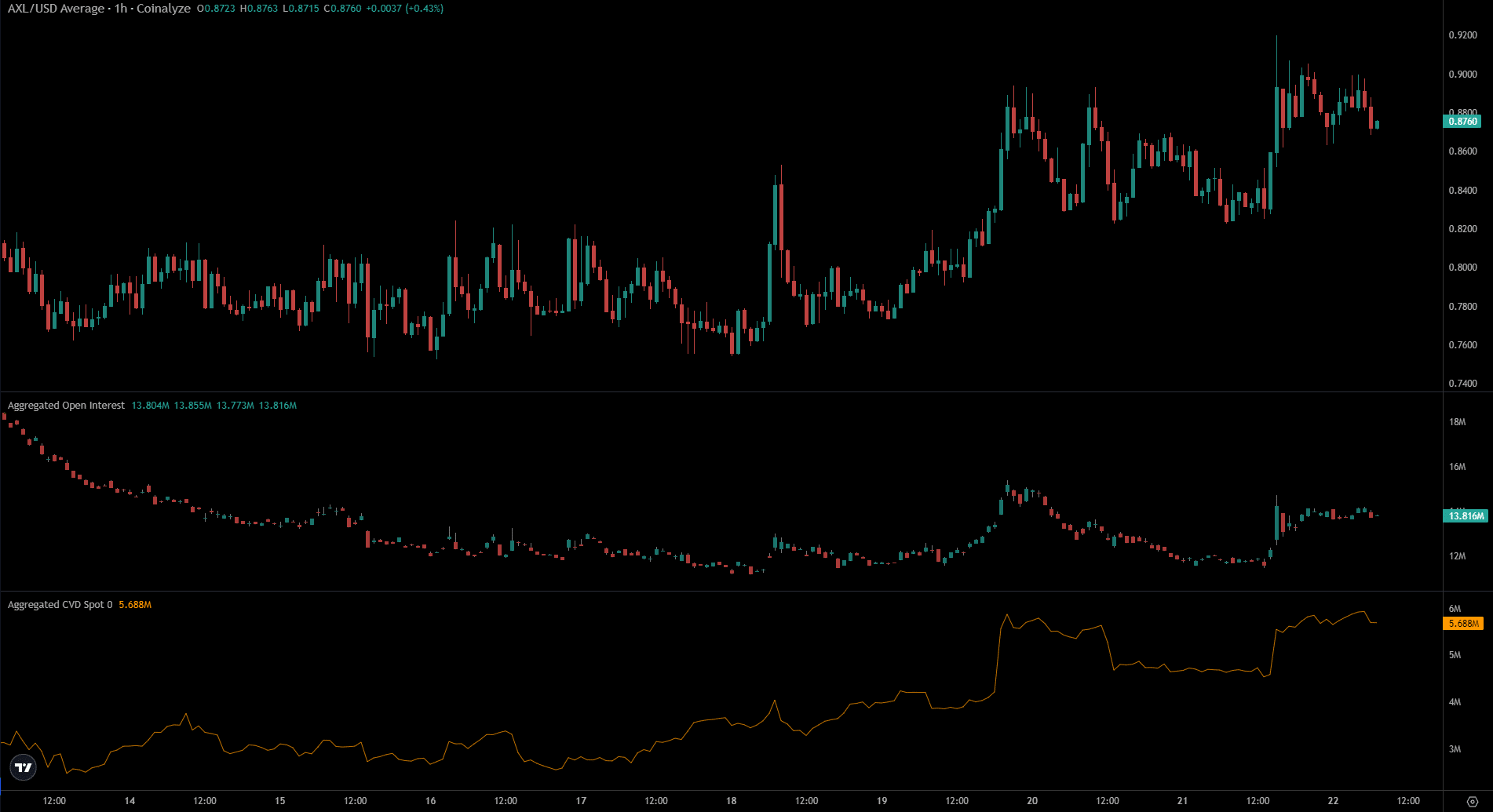

Open Interest could fade soon?

Source: Coinalyze

On the 11th and 12th of October, when AXL surged toward $0.8, the Open Interest rose from $7.44 million to $21.6 million. After AXL coin broke out past the highs and consolidated near the $0.77 level, OI fell dramatically to reach $12.8 million.

Read Axelar’s [AXL] Price Prediction 2024-25

A similar scenario could occur in the coming days once the $0.872 level is breached and flipped. Therefore, traders should not give in to FOMO and can wait for a buying opportunity.

Meanwhile, the spot CVD’s uptrend indicated sustained demand for Axelar.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion