Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

MicroStrategy’s aggressive Bitcoin acquisition strategy has contributed significantly to the company’s stock price reaching an all-time high. The rise in Bitcoin’s value has directly benefited the company’s stockholders because it has continuously purchased substantial quantities of the cryptocurrency.

The market is becoming more confident in MicroStrategy’s plan to incorporate Bitcoin into its balance sheet, as evidenced by the company’s remarkable stock chart rally, especially in the last 12 months. Notably, after the company decided to buy Bitcoin, MicroStrategy’s stock began to rise sharply after trading flatly for years.

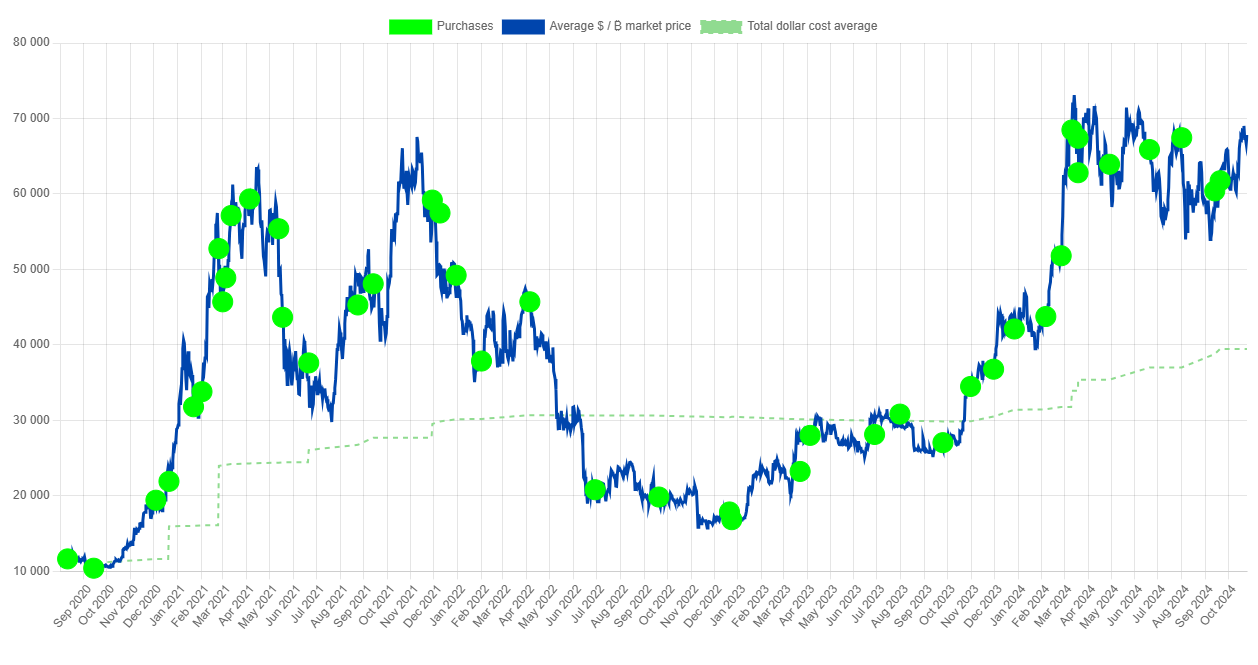

As Bitcoin’s value rises and MicroStrategy’s holdings gain value, this rise is being observed once more. MicroStrategy CEO Michael Saylor has made frequent purchases of Bitcoin and has repeatedly reaffirmed the company’s commitment to it. Based on the company’s portfolio tracker, MicroStrategy has purchased over $17 billion worth of Bitcoin at an average purchase price of about $39,000 per coin.

With Bitcoin’s current price at over $67,000, this strategy has demonstrated a significant return on investment, with a portfolio increase of over 72% for this strategy. Recent purchases by MicroStrategy which included the purchase of over 74,000 Bitcoin on Sept. 20, 2024, at an average price of $61,750 per Bitcoin, demonstrate the company’s buying spree. The recent spike in the stock was a result of this calculated move.

The portfolio tracker and on-chain data both demonstrate a consistent rise in MicroStrategy’s Bitcoin holdings over the past few months, confirming Saylor’s long-held conviction that the cryptocurrency is a store of value and an inflation hedge.

To sum up, MicroStrategy’s Bitcoin buying spree is directly responsible for the company’s stock hitting its all-time high. The company’s stock will probably keep rising as long as Bitcoin maintains or rises in value, confirming MicroStrategy’s position as a leader in corporate Bitcoin adoption.