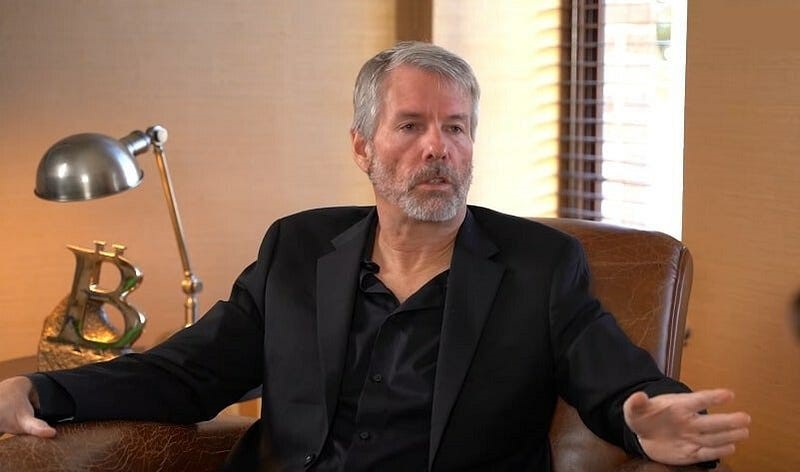

Michael Saylor, the CEO of MicroStrategy, recently stirred up controversy in the Bitcoin community with his remarks on Bitcoin custody and regulation.

In an interview, he expressed concerns about the risks associated with self-custody, where individuals manage their own Bitcoin, suggesting that it could lead to potential seizure or confiscation. Instead, he advocated for Bitcoin to be held by regulated institutions like BlackRock and JPMorgan Chase, arguing that this approach could enhance security.

Saylor’s comments were met with significant backlash from notable figures in the crypto space, who view self-custody as a fundamental principle of Bitcoin’s decentralized nature.

Ethereum co-founder Vitalik Buterin was particularly vocal, labeling Saylor’s views as “batshit insane.” This criticism highlights a broader sentiment among many in the cryptocurrency community who believe that self-custody is essential for maintaining Bitcoin’s independence from centralized control.

In response to the backlash, Saylor took to social media to clarify his position, acknowledging the right to self-custody while also emphasizing the importance of institutional investment in Bitcoin.

He stated that he supports self-custody for those who are capable and willing, while also recognizing that different investors have varying needs. Some, like Gabor Gurbacs from Tether, found Saylor‘s refined stance to be reasonable, while others, including long-time Bitcoin advocate Max Keiser, argued that relying on institutions undermines Bitcoin’s core values.

The debate has also led to speculation about MicroStrategy’s future role in the Bitcoin ecosystem, with some analysts suggesting that the company might be positioning itself as a Bitcoin bank.

This aligns with early predictions about the emergence of Bitcoin banks to manage cryptocurrency for larger institutions. While some see institutional involvement as a way to legitimize and expand Bitcoin’s adoption, others remain wary of the risks associated with relinquishing control to third parties.

As the discussion around Bitcoin custody continues, it reflects a deeper philosophical divide within the community. On one side are those who champion individual sovereignty and self-custody, while on the other are advocates for institutional participation that could drive broader acceptance and security.

The ongoing debate will likely evolve alongside regulatory developments, shaping the future of Bitcoin custody and its role in the financial landscape.