- Popcat has surged by 41.8% in 30 days.

- The memecoin seemed to be losing momentum, with bears attempting to gain control.

Over the past month, memecoins have made significant gains. As such, Popcat [POPCAT] has remained a top gainer over the past 30 days.

In fact, at the time of writing, Popcat was trading at $1.47. This marked a 10.60% increase over the past week, with the memecoin gaining by 41.80% on monthly charts.

However, the past 48 hours have seen a strong downside, with the memecoin dropping from $1.68 to $1.47. This was a 12.5% decline in the past 2 days.

This strong downside suggests a potential shift in market sentiment. Thus, the question is now rises –

Is Popcat losing upward momentum?

According to AMBCrypto’s analysis, Popcat seemed to be losing its current momentum.

Notably, the memecoin’s Directional Movement Index (DMI), the downtrend trend was gaining strength.

In fact, the negative index -DI at 35.4 sat above +DI at 23, showing that sellers were starting to dominate, causing prices to either drop or stagnate.

When the DMI is set like this, it signals that the market is either in a downtrend or entering one.

Additionally, Popcat’s Relative Strength Index has declined from 65 to 57. In the meantime, its MA — at 59 — rose. Thus, the current momentum appeared to be weakening, and a reversal might be looming.

Another market indicator to consider is the Advance decline Ratio (ADR). This metric has remained below 1 for the past two days to settle at 0.71.

When ADR falls below 1, it indicates that there are more losses than recent gains. This is usually a sign of bearish sentiment, indicating bears are starting to dominate.

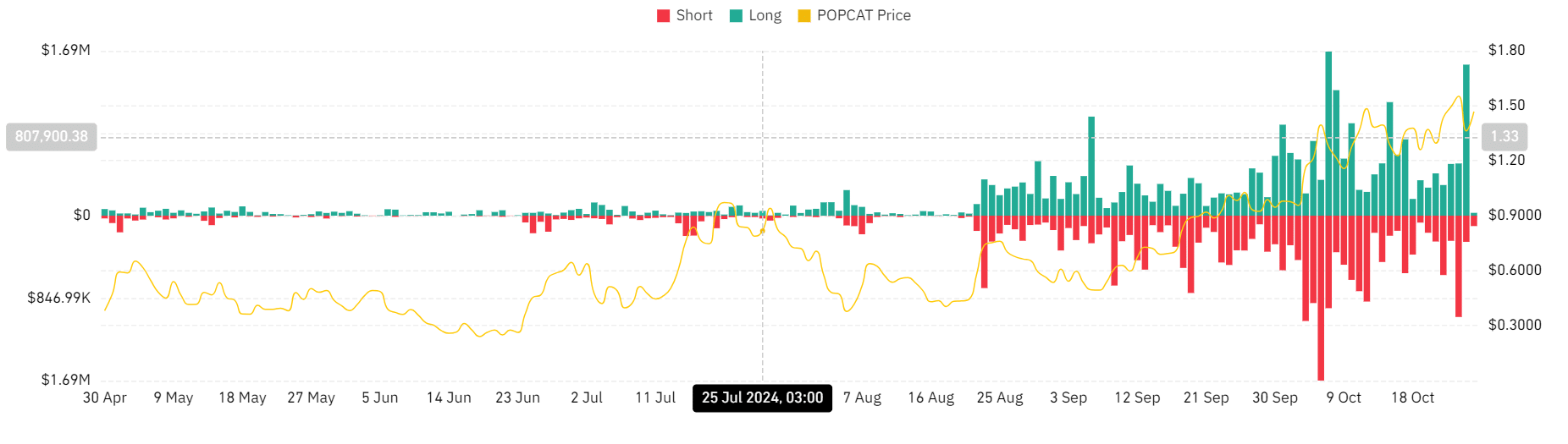

This shift in market sentiment is further evidenced by high levels of total liquidations. Over the past week, liquidations for long positions have surged, hitting a high of $1.55 million in the last 24 hours.

The rise in liquidations both for shorts and longs don’t only indicate volatility but also a lack of market confidence.

Read Popcat’s [POPCAT] Price Prediction 2024–2025

The fact that investors are unwilling to pay premium fees to hold their position suggests their lack of conviction.

If the bears gain control of the market, Popcat will decline to $1.2. However, if the bulls regain their dominance, the memecoin will break out of $1.5 resistance towards a new ATH.