- Whale addresses which hold between 10k and 100k LINK are reported to have added 11 million more tokens as they anticipate a bullish run from the current level.

- Research discloses that there have been a significant amount of LINK moved from exchanges in the past 30 days with 667,290 LINK withdrawn on Thursday alone.

Chainlink (LINK) has “shed off” 4.4% of its accumulated value in the last 24 hours to decline from its daily high of $11.98 to $11.27. Meanwhile, its trading volume is 73% high as $414 million changes hands at press time. Against the backdrop of this unexpected correction, whales have massively entered the market and aggressively acquired the dip.

Chainlink’s (LINK) Whale Activities

Subjecting the supply distribution of LINK to critical analysis, CNF observed that Whale addresses holding between 10,000 and 1,000,000 LINK have increased their assets by 11 million more tokens ($130 million) in the last 30 days. According to data, this batch of investors now holds a record amount of 221 million LINK. Interestingly, this is the highest amount ever recorded since December 2017.

The pace of Whale accumulation has also been consistent for the past few months. On October 8, the number of whales increased to 502 from 489 on October 1. Prior to that, we disclosed on September 27 that a whale had accumulated 8.5 million LINK tokens valued at $108.8 million at that time. Between mid-August and late September, wallets holding $100,000 and $1 million worth of LINK increased their position from 685.5 million LINK to 694 million. In the technical sense, these activities reduce circulating supply, signal confidence, and encourage retailers to buy.

Exchange Netflow of the Asset

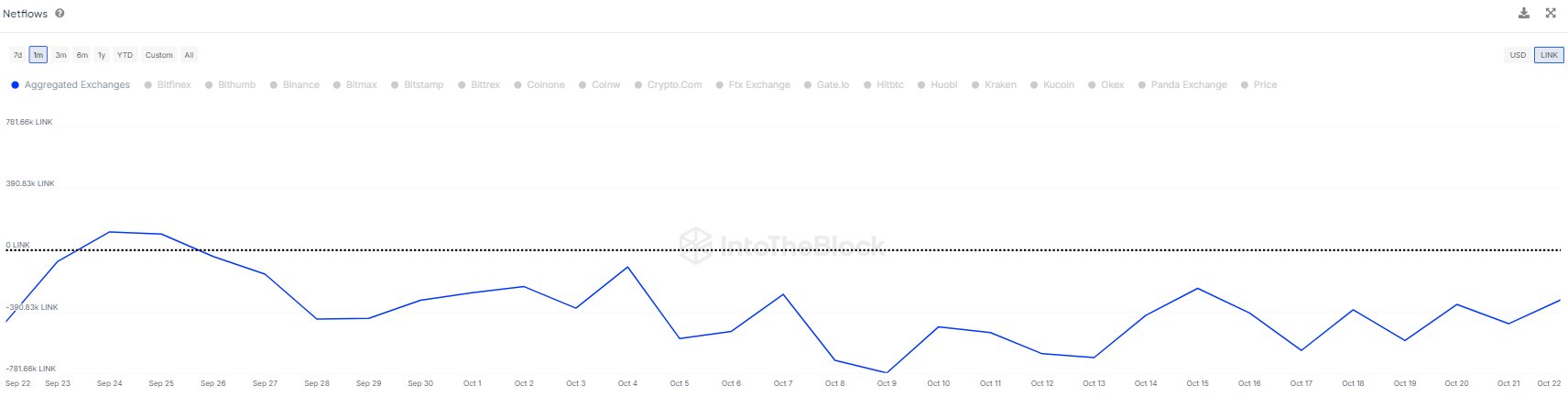

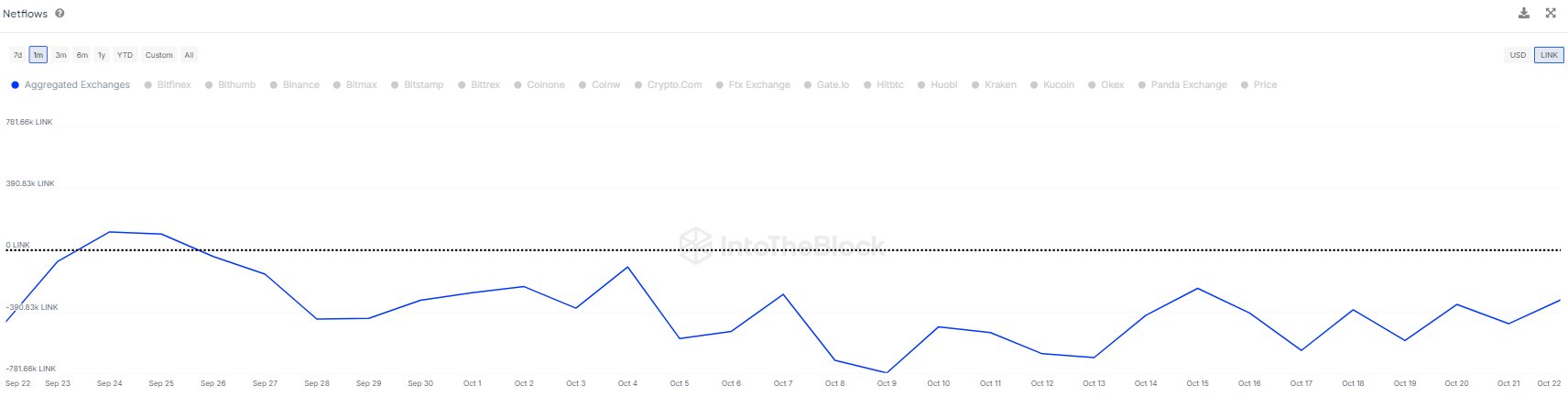

Investigating investors’ behavior, we took a look at the LINK’s Exchange Netflow and discovered that it is negative. According to analysts, this indicates that more assets are leaving the exchanges than entering them. On Thursday (October 24), for instance, about 667,290 LINK were moved out of the various crypto exchanges. As seen in the chart below, the Chainlink exchange netflow has been negative for the past 30 days.

This signals accumulation and a bullish outlook, according to IntoTheBlock’s interpretation.

This trend often signals accumulation, as holders move assets to cold storage or private wallets, reducing immediate sell pressure.

Looking at the Weighted Sentiment metric on Santiment, we also observed that there has been a sharp turnaround of -372%, implying that investors are currently feeling Fear, Uncertainty, and Doubt (FUD).

For crypto analyst Michaël van de Poppe, Chainlink is an opportunity of a lifetime. As we reported, this analyst finds the price range of $9-11 as the perfect entry point. From this level, he believes that LINK could surge to $35 and proceed to breach the three-year resistance level of $52.88.

Chainlink is still consolidating above the crucial resistance and flipping that for support. I think anything between $9-11 is an interesting one to buy into. I mentioned it a few times, but it remains to be an opportunity of a lifetime.

Similar to this, another analyst identified as ZAYK Charts has predicted that LINK could surge by 229% to hit $40 in this cycle.