Matthew Sigel, Head of Digital Asset Research at VanEck, has made a bold prediction about Bitcoin’s future price amid the upcoming election cycle.

Sigel disclosed that VanEck uses its own proprietary prediction model, estimating Bitcoin could reach $3 million under this framework.

Why VanEck Believes Bitcoin’s Price Could Soar Soon?

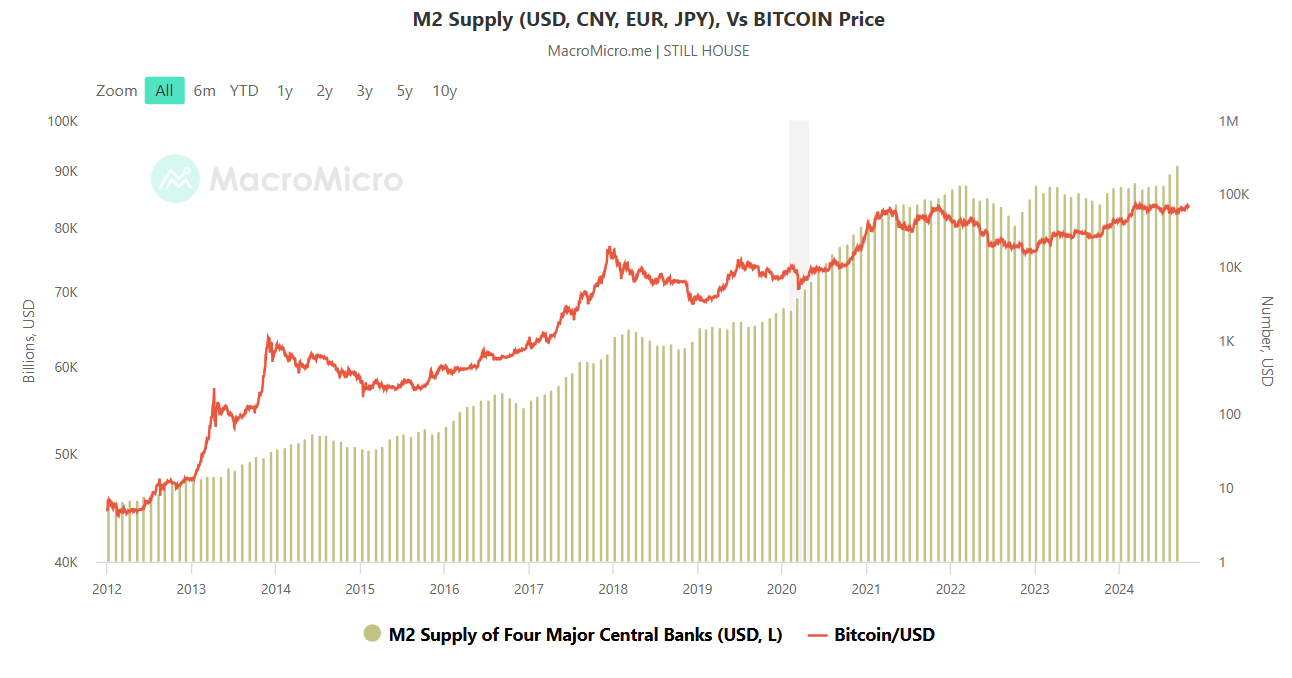

In a recent CNBC interview, Sigel outlined factors that could support a potential surge in Bitcoin’s price. He emphasized Bitcoin’s negative correlation with the US dollar and its positive correlation with money supply growth (M2). Sigel also suggested that election results might impact Bitcoin’s price, similar to the pattern observed in 2020 when Bitcoin surged following the announcement of election outcomes.

Additionally, Sigel mentioned recent large Bitcoin sales by governments, including those of Germany and the United States, which have helped ease selling pressure on the market. Moreover, BRICS nations, including Russia, are rolling out Bitcoin-related initiatives that could further fuel Bitcoin’s development.

“In fact, Russia announced an initiative. Their sovereign wealth fund is going to invest in regional initiatives to build Bitcoin mining and AI infrastructure throughout BRICS with the idea of settling global trade in Bitcoin,” Sigel said.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Sigel noted that VanEck’s model predicts Bitcoin could hit $3 million by 2050 if it becomes a global reserve asset, based on a 2% allocation in global reserves and an annual growth rate of around 16%.

“We have a model that assumes that by 2050, this is very long term that Bitcoin becomes a reserve asset that’s used in global trade and held by global central banks at a very modest 2% weight. And in that model we arrive at a $3 million price target for Bitcoin. Now that sounds you know extreme but that’s a 16% compound annual growth rate for a couple decades,” Sigel explained.

Currently, Bitcoin exhibits a high correlation with risk assets like NASDAQ, which may still deter some investors. However, Sigel believes this trend could shift as Bitcoin evolves into a more independent asset.

At the time of writing, with less than a week to go until the US election, the price of Bitcoin has surpassed $71,000 and is only 4% away from setting a new all-time high (ATH).

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

VanEck, a US-based asset management firm with over $107 billion in AUM, including $1.8 billion in digital assets, had previously made an even bolder projection three months ago, forecasting Bitcoin could soar to $52.38 million by 2050 in a bullish market scenario.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.