Crypto lender Nexo has rebranded itself as a “digital assets wealth platform” as it attempts to pivot from headwinds faced in prior years, aiming to boost its clientele amid heightened investor interest in the industry.

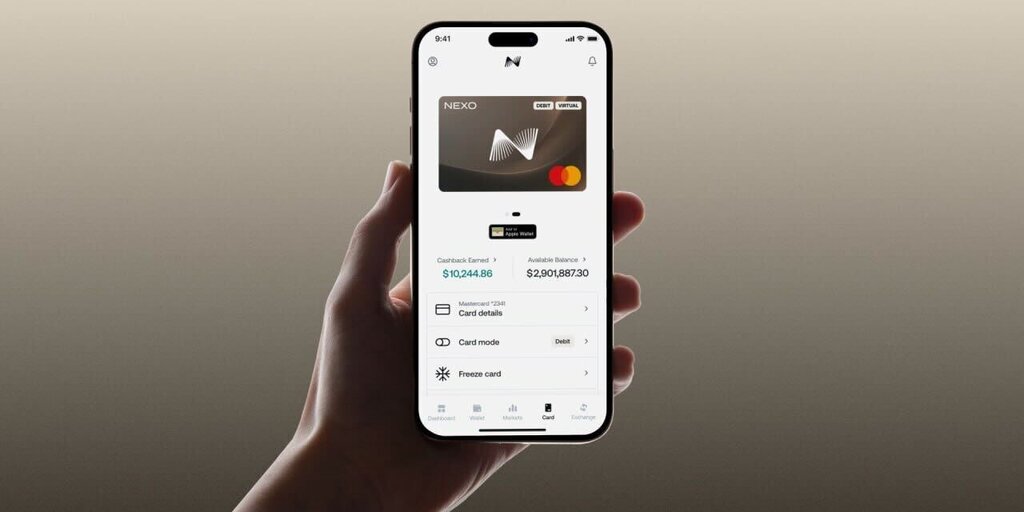

Nexo told Decrypt it has refreshed its website and logo and has updated its user interface with an emphasis on flexibility and compliance (disclaimer: Nexo is one of 22 investors in an editorially independent Decrypt).

The company says it has served more than 7 million users worldwide who’ve used Nexo’s products to buy and exchange digital assets. The company also offers an Earn Product, enabling users to earn up to 16% yield on stablecoins lent to the platform in certain regions.

Imbuing Nexo’s look with gray and beige tones alongside a dash of green, the company is hoping its new look will resonate with a high-end crowd. Alongside the rebrand, the company said it’s trying to strike a refined tone while catering to retail and institutional investors.

“Our new visual identity mirrors Nexo’s evolution into a sophisticated digital assets wealth platform,” Elitsa Taskova, Nexo’s chief product officer, said in a statement. “Going forward, we are focusing on hyper-personalized, white-glove service.”

The company claims to have issued $8 billion in credit on crypto loans through Nexo’s platform, which is available in 23 countries. Nexo said it has paid out $945 million in interest to users who ultimately inspired Nexo’s visual overhaul through 20 months of research.

Nexo is positioning itself as a one-stop shop for “independent, savvy investors” looking for “more flexible ways to grow and access their wealth,” co-founder and Executive Chairman Kosta Kanchev said in a statement.

In the U.S., wealth management platforms are commonly used by advisors who manage assets on behalf of clients. They are primarily regulated by the Financial Industry Regulatory Authority and Securities and Exchange Commission (SEC)—but Nexo no longer operates in the U.S., nor does it claim to be a wealth management platform.

Launched in 2018, the London-based firm encountered headwinds in the U.S. After several state securities regulators hit Nexo’s parent company with an enforcement action in 2022—describing Nexo’s Earn Interest product as an unregistered security—the firm gradually began phasing out its products and services in the U.S., hitting a “dead end” with regulators.

Following the collapse of several crypto lenders in 2022, including Celsius and BlockFi, government agencies stepped up their scrutiny of firms lending customers’ crypto. This year, the SEC reached settlements with crypto lenders Abra and TradeStation over their products.

Last year, Nexo reached a settlement with state regulators, the Securities and Exchange Commission (SEC), agreeing to pay $45 million in total penalties. Nexo was charged with offering its lending product to the public without first registering it with the SEC, leading the company to focus on developing an international presence.

“We are content with this unified resolution,” Nexo co-founder Antoni Trenchev said in a press release at the time. “We can now focus on what we do best—build seamless financial solutions for our worldwide audience.”

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.