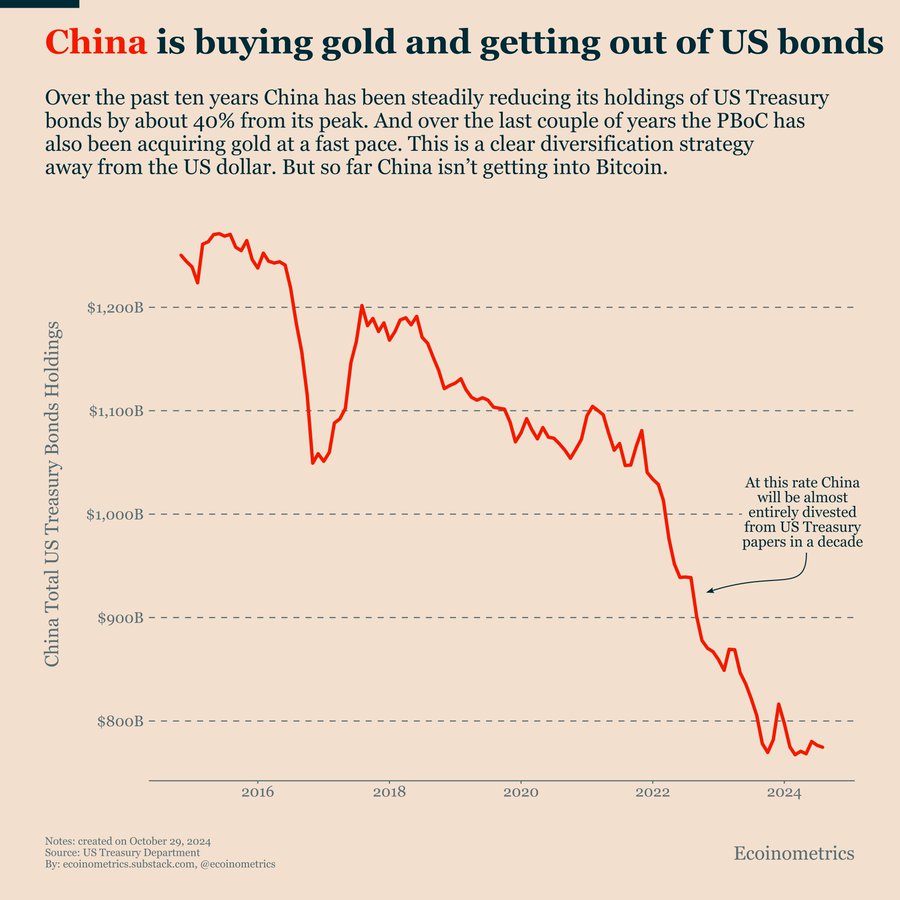

In recent years, China has consistently reduced its exposure to US Treasury bonds but has turned to gold rather than other alternative assets like Bitcoin.

Per data from the US Treasury, China’s holdings of US Treasury bonds have declined from a peak of around $1.2 trillion in 2017 to under $800 billion this month.

This decline indicates a change in China’s strategy, a move away from the US dollar and towards other assets that hold less dependency on the American economy.

However, despite this diversification, China has steered clear of Bitcoin as a potential addition to its reserves. Instead, over the past decade, the People’s Bank of China (PBoC) has been gradually accumulating gold reserves.

China Avoids Bitcoin While Acquiring Gold

The acquisition of gold acts as a hedge against inflation and a more stable asset to balance its portfolio. China aims to shield itself from risks tied to the dollar’s value and political uncertainties surrounding US fiscal policies.

Ecoinometrics, an economic analysis firm, recently noted that this shift shows China’s plan to lessen its reliance on the US dollar as a reserve currency.

While China’s strategy has seen it acquire gold, Bitcoin remains absent from the country’s portfolio. This is no surprise, given that China has imposed strict regulations on crypto. As a result, the nation has shown no intention of adopting Bitcoin as part of its financial strategy.

Despite the rise of cryptocurrency adoption worldwide, the Chinese government maintains that the risks and potential for financial instability associated with Bitcoin outweigh any advantages it might offer. In this context, gold presents a far more traditional and stable alternative.

While China is pulling back from US bonds, other regions, particularly in Europe, are stepping in to fill the gap. According to Ecoinometrics, Europe has shown increased interest in purchasing US Treasury bonds, with European investments reportedly offsetting the reduction in China’s holdings.

Countries and Companies Turn to Bitcoin

Meanwhile, as China steps away from both US bonds and Bitcoin, other countries and corporations are embracing the cryptocurrency. El Salvador made headlines in 2021 as the first country to adopt Bitcoin as legal tender.

The South American nation has since continued to acquire BTC, now holding 5,918 BTC worth over $427 million. Recall that El Salvador committed to buying 1 BTC a day in November 2022 during the bear market.

Further, the small country of Bhutan is also expanding its Bitcoin stash, with its holdings recently reaching 13,036 BTC, now worth $925 million. In addition, GOP candidate Donald Trump has hinted at retaining the BTC holdings of the U.S. government if he becomes president.

Major corporations, too, have added Bitcoin to their balance sheets as a hedge against inflation, with MicroStrategy leading the charge.

However, while Bitcoin’s popularity continues to grow, China’s strict regulatory approach leaves little room for speculation on whether the country might reverse its stance. Despite this, the Chinese government holds 194K BTC, which it acquired from confiscations.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.