A popular crypto analyst discussed the case for one of the most bullish price predictions for Ripple.

In an X post, Armando Pantoja, an analyst with nearly 20,000 followers, predicted that Ripple (XRP) could reach between $25 and $100 in 2025.

XRP was trading at $0.52 on Oct. 31, meaning his forecast suggests a potential rally of 4,700% from current levels. The upper end of his prediction implies a 19,130% increase.

Such gains are possible in the crypto industry. Notably, Popcat (POPCAT) has surged over 17,600% from its lowest level this year.

Pantoja cited four main reasons he believes the coin could stage a strong comeback in the coming year.

He expects Donald Trump to win the upcoming U.S. presidential election, as predicted by many in the prediction market. Should Trump win, Pantoja anticipates that he will replace Gary Gensler with a more crypto-friendly regulator.

Trump has also pledged to pardon Ross Ulbricht, the founder of Silk Road, a move that Pantoja suggests would promote innovation in the crypto sector. He further anticipates that a Trump-led administration would end the practice of regulation by enforcement.

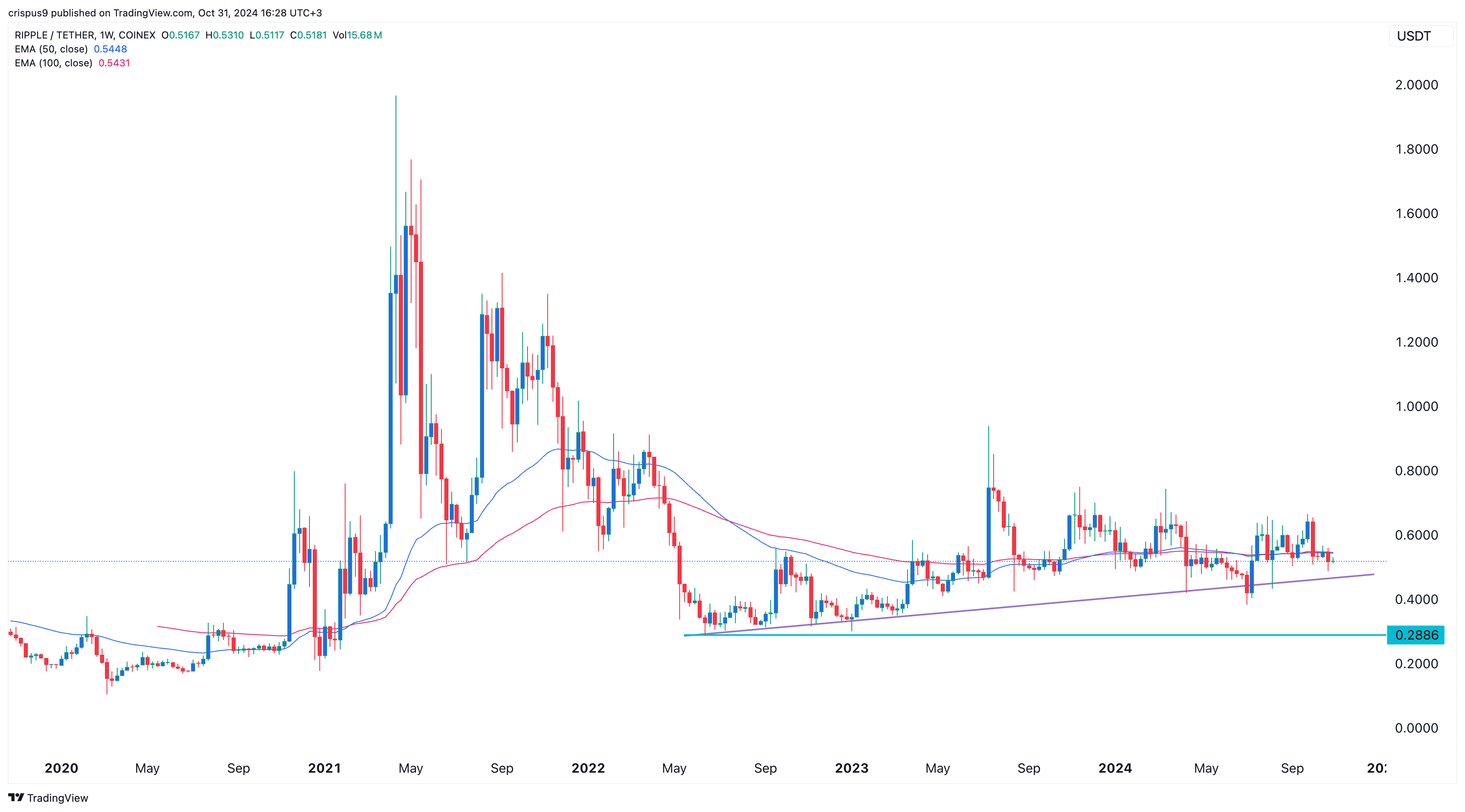

Additionally, he views Ripple’s seven-year pennant pattern as poised for a breakout in 2025.

Still, Pantoja’s forecast has a crucial risk: Trump may not win the election. Analysts cautionan that Polymraket may not be the most reliable predictor, as its users tend to lean conservative.

Moreover, most polls indicate a close race in key swing states. For instance, the New York Times reports a tie between the candidates in Nevada, Wisconsin, North Carolina, and Michigan. Polling accuracy remains uncertain.

Ripple also faces other fundamental risks, including the potential underperformance of its upcoming stablecoin. Data shows that many newly launched stablecoins, like PayPal’s, have not achieved significant success.

XRP has formed a H&S pattern

Another risk is that XRP has formed a head and shoulders pattern on the weekly chart, a formation generally considered bearish.

XRP has also dropped slightly below the 100-week and 50-week Exponential Moving Averages. A break below the ascending trendline connecting the lowest swings since June 2022 could signal further downside, with the next level to watch at $0.2886, its lowest point in June 2022.