Grayscale begins its 240-day review process for its Digital Large Cap Fund (GDLC) with the U.S. Securities and Exchange Commission (SEC). Grayscale wants to turn its existing GDLC fund, which provides diversified exposure to multiple cryptocurrencies, into an exchange-traded fund (ETF).

The review started after NYSE Arca filed a rule change to enable its national securities exchange to list and trade multi-crypto asset ETPs for the first time.

If approved, this would allow U.S. investors access to crypto assets beyond Bitcoin and Ether. However, the fund will undergo the SEC’s review to pass a multi-crypto product in the public markets that needs to meet regulatory standards. This proposal could increase regulatory clarity of diversification crypto investments and increase adoption.

– Advertisement –

Grayscale’s Multi-Crypto ETF Proposal Eyes Regulatory Approval

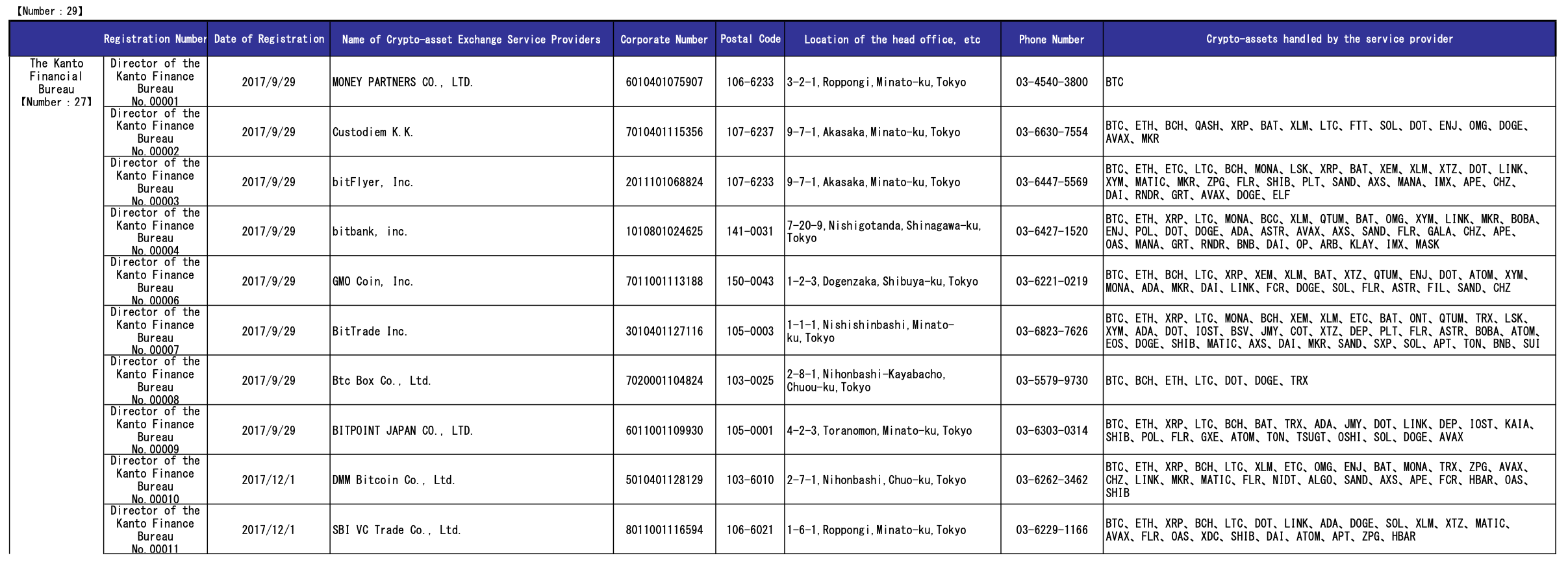

According to the proposed NYSE Arca Rule 8.800E, the fund would allocate at least 90% of the holdings to established cryptocurrencies.

These assets, such as Bitcoin and Ether, have stable, mature markets; we can keep up to 10 % of them as newer digital assets. GDLC’s structure aims to strike this balance of stability and exposure to new cryptocurrencies, making it unique relative to single-asset funds focusing on Bitcoin or Ether.

The GDLC recently reported a $530 million portfolio for the CoinDesk Large Cap Select Index (DLCS), weighted in Bitcoin and Ether.

Grayscale’s proposal is consistent with the growing investor demand for diversified exposure in a regulatory environment. By integrating the most established and emerging assets, the rule change could significantly impact future U.S. crypto-based ETFs.

Hashdex is one of many firms exploring new crypto product filings, and other firms such as Franklin Templeton and Hashdex released applications that initially only deal with BTC and Ether.

However, Grayscale’s blanket asset approach makes it the frontrunner in multi-crypto ETP development. However, industry analysts predict that this rule change could spark follow-on filings that increase investment options for institutional and retail investors.

U.S. Election May Shape ETF Future

Inspired by initial trading on Grayscale’s private placement in 2018, GDLC became publicly traded in 2019 and became an SEC reporting entity in 2022.

At present, GDLC trades over the counter under the ticker symbol GDLC and invests in various cryptocurrencies for accredited investors. An ETF of the fund would improve access to retail investors, increasing liquidity and regulatory oversight in the process.

Like GDLC, Grayscale has thematic and single-asset funds, like the Grayscale Decentralized AI Fund, focused on rapidly developing parts of the digital asset market. Unlike many investors, Grayscale’s diversified approach sets it apart from competitors and situates it as a proven leader in crypto-based funds.

Unlike competing products, which offer two products focused exclusively on Bitcoin or Ether, GDLC tracks five assets, Bitcoin, Ether, Solana, XRP, and Avalanche, through the DLCS index.

Bloomberg ETF analyst Eric Balchunas said the U.S. regulatory stance on crypto ETFs could change based on the outcome of the 2024 presidential election.

That can mean a more crypto-friendly SEC and quicker moves on ETF approvals under Trump or a more conservative approach under Harris. Potential regulatory shifts, however, remain the focus of industry experts who are monitoring the changes and could impact Grayscale’s proposal and other similar filings.

Diverse Crypto ETFs Likely to Attract Institutions

That interest is being fueled by a wave of ETF proposals from several firms as the crypto investment vehicle space has grown.

Turning to Bitwise and Canary Capital, for example, the firm filed for an XRP-specific ETF as well as a Litecoin ETF. They exemplify larger market interest in enabling investors access to digital assets through multiple regulated products.

Grayscale’s proposal for its multi-crypto ETF could clear the way for the diversification of crypto ETFs in the same way that there is diversification of stock indices, like the S&P 500.

Multi-asset ETFs could become more popular as analysts say they could provide diversified exposure to one overall product. It could be a move to attract more institutional interest that improves market liquidity and extends the reach for the retail investor.