Key Points

- Ethereum’s price action mirrors Solana’s early 2023 pattern, indicating a potential major bullish breakout.

- Liquidity grabs on Ethereum could trigger a significant rally, similar to Solana’s 222% rise.

Similarities Between Ethereum and Solana’s Price Actions

Ethereum’s recent price action mirrors Solana’s early 2023 pattern.

In early 2023, Solana’s price formed an ascending triangle under resistance, leading to a significant 222% rally after a breakout.

Ethereum is currently exhibiting a similar pattern, forming an ascending triangle below its resistance level.

This pattern alignment may suggest that Ethereum is on the verge of a major bullish breakout, similar to Solana’s trajectory.

The ascending triangle, often viewed as a bullish continuation pattern, indicates a potential breakout that could significantly propel Ethereum higher.

Momentum indicators and trader activity would have to align for Ethereum to achieve similar gains.

If Ethereum breaks above the current resistance zone, it could spark a strong rally, positioning Ethereum for another significant uptrend.

Indicators Suggest Potential Market Strength

The relative strength index and moving average convergence divergence indicators for Ethereum suggest potential market strength.

The relative strength index is in neutral to slightly bullish territory, indicating potential upward momentum.

The histogram for the moving average convergence divergence indicator shows diminishing red bars, suggesting that bearish pressure may be easing.

Additionally, the moving average convergence divergence line appears to be nearing a crossover above the signal line, a common bullish signal.

These indicators imply that Ethereum may experience buying momentum if fundamentals like liquidity grabs and on-chain activities align with price patterns.

The Impact of Liquidity Grabs on Ethereum

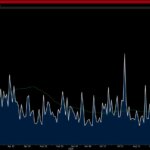

An analysis of Ethereum’s liquidity heatmap reveals a recurring pattern: a strategic liquidity grab.

Price action consistently dips to absorb liquidity, suggesting that market makers and larger players are shaking out weaker hands.

This scenario seems to set Ethereum up for a rebound following the liquidity grab, especially as there is a significant cluster of liquidity near the current price.

These higher liquidity levels could act as magnets, making it likely that Ethereum will aim to move upward next, targeting those areas.

This could potentially lead Ethereum to achieve similar 222% gains as Solana.

Traders can anticipate that Ethereum, following this liquidity sweep, might leverage the regained momentum to rise and capture the nearby liquidity pools, leading to potentially bullish short-term movement.