Bitcoin marks a new ATH above $76,000, the most expected event after Donald Trump’s win in the U.S. presidential elections. Meanwhile, the Ethereum price, which usually follows the top crypto, ascended with less volatility. However, the bulls seem to have shifted their focus back to Ethereum as the price has broken out of the bearish range. As a result, the price is expected to trigger a monstrous rally shortly.

The Ethereum price was stuck within a range-bound after experiencing a major drop from the yearly high of close to $4000. As the bullish wave circulated with the space, the ETH price broke above the parallel channel after a 3-month long consolidation. With this, the price is ready for another bullish action and a rise in buying pressure may trigger a fine bull run towards a new ATH.

The weekly chart of the ETH price is extremely bullish, as the token appears to be ready to set up the ‘D’ wave after completing the ‘A-B-C’ wave. The weekly MACD is about to undergo a bullish crossover as the selling pressure has remained low since September. On the other hand, the price is trading between the 50-day & 200-day weekly MAs, which are acting as strong resistance and support levels. A close observation suggests the token has not experienced a weekly death cross in the near past, indicating a strong hold of bulls even in times of a bear market.

What’s Next for ETH Price Rally-Will it Reach $4000 in 2024?

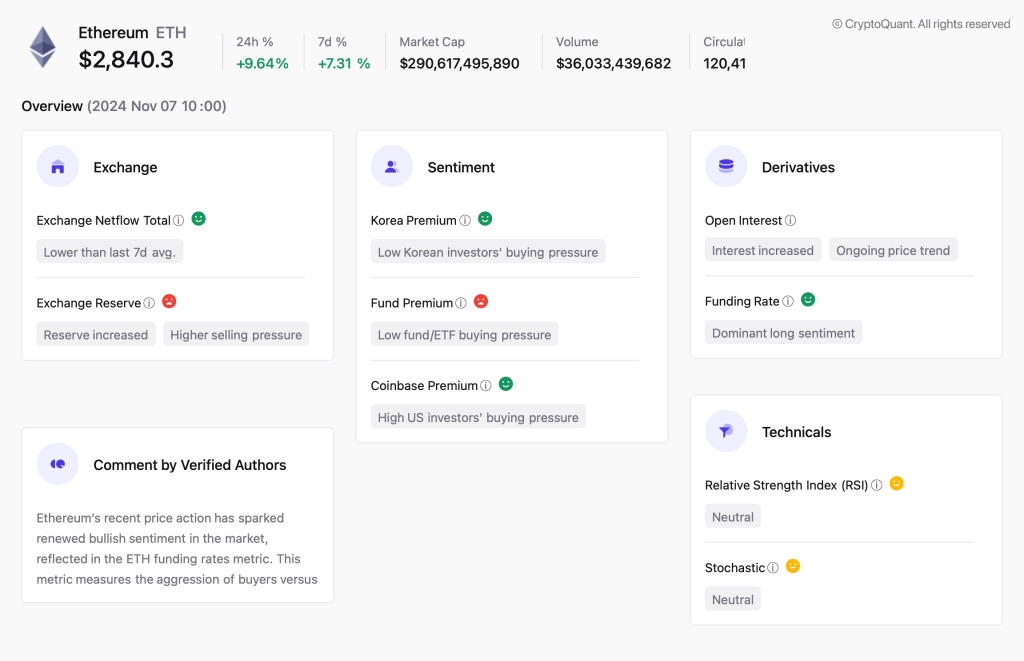

Regardless of this, here are a few indicators that do not support the bullish narrative and hence more vigilance is required for each move of the ETH price henceforth. The exchange reserve has continued to rise in the past couple of days, now reaching levels above 19.2 million. This suggests bearish sentiments among the market participants, resulting in a higher selling pressure. Alongside, the transfer volume, active addresses, and the total number of transactions have taken a bow, adding to the bearish narrative.

Meanwhile, the net deposits on exchanges are low compared to the 7-day average, which is interpreted as a lower selling pressure. Secondly, the long positions remain dominant as the open interest continues to surge, indicating more liquidity, volatility, and attention entering the derivative market. Additionally, more than $46 million worth of short liquidations have been liquidated, setting up a strong bullish narrative.

Therefore, the data suggests the market participants are still a little unsure of the next price action. However, a rise above the yearly highs at $4000 or even a sustained rally above $3500 may bring back the Ethereum (ETH) price rally at the center stage.