Donald Trump’s recent win in the U.S. presidential elections has sparked optimism for both gold and Bitcoin (BTC), with forecasts from JPMorgan indicating a promising performance for these assets. This positive outlook is largely influenced by a strategy focused on investing in safe-haven assets to mitigate the impact of currency depreciation driven by inflation and expansive monetary policies.

Will Central Banks Favor Gold?

JPMorgan experts suggest that the trajectory of gold prices will be significantly influenced by how actively central banks acquire gold until 2025. The aftermath of the Ukraine crisis and subsequent sanctions against Russia in 2022 led to a surge in gold purchases. However, since last April, China’s central bank has halted its gold buying activities.

How Is Bitcoin’s Investment Demand Shifting?

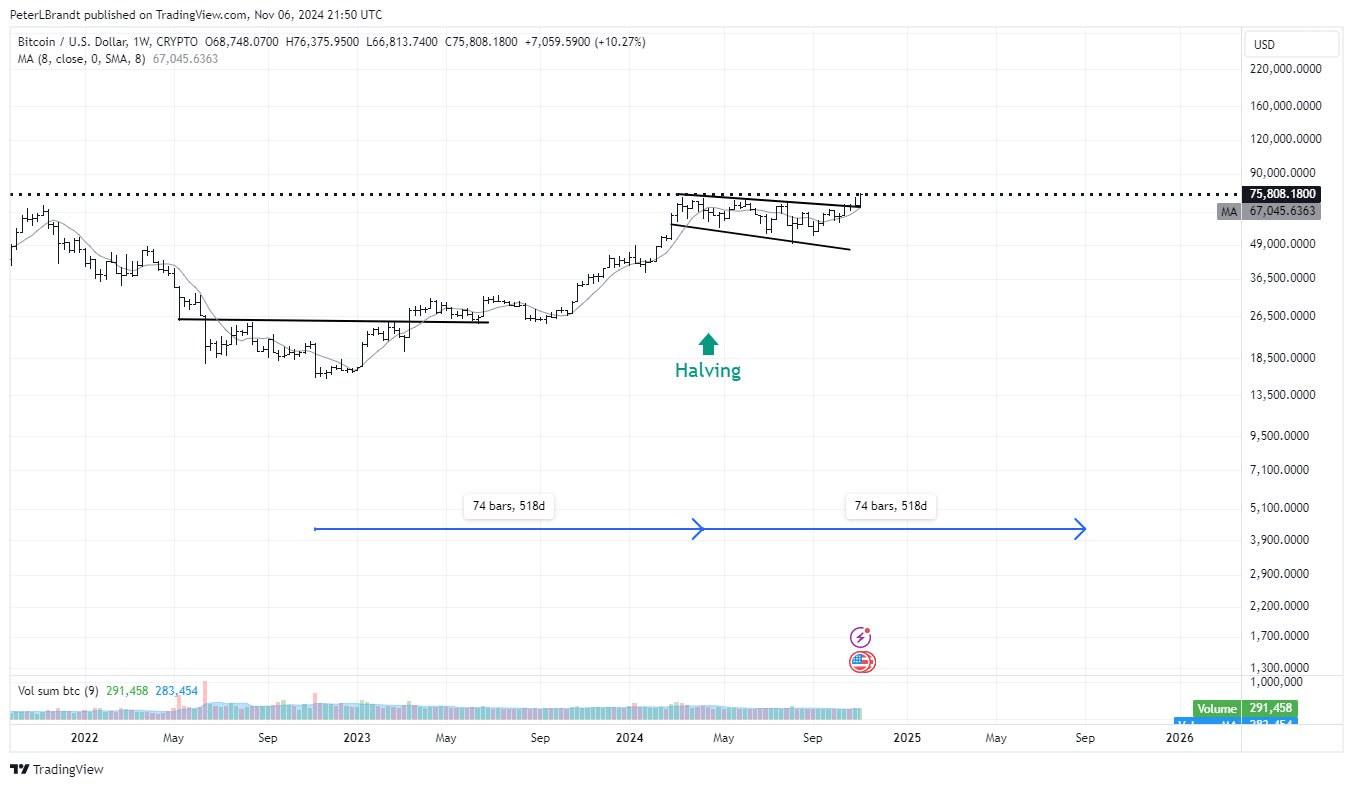

Bitcoin has experienced a remarkable rise, reaching a record price of $76,244 following the election results, and currently trades around $75,100. Analysts believe that the cryptocurrency will maintain an upward trend through 2025, driven by robust interest from institutional players like MicroStrategy, which plans to invest $42 billion in Bitcoin over the next three years.

- Trump’s election win correlates with increased interest in gold and Bitcoin.

- Central bank gold strategies may pivot due to geopolitical tensions.

- MicroStrategy’s $10 billion annual investment in Bitcoin is likely to support its price.

The interplay between political developments and financial markets underscores the significant role that leadership and geopolitical events play in shaping investor sentiment and asset performance. Investors are keenly monitoring these trends as they strategize for the upcoming years.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.