With the booming demand for artificial intelligence products, Amazon (AMZN) is poised to increase its efforts to challenge Nvidia’s (NVDA) AI dominance. Indeed, the e-commerce juggernaut has continued to embrace its development of generative AI chips to compete for market share.

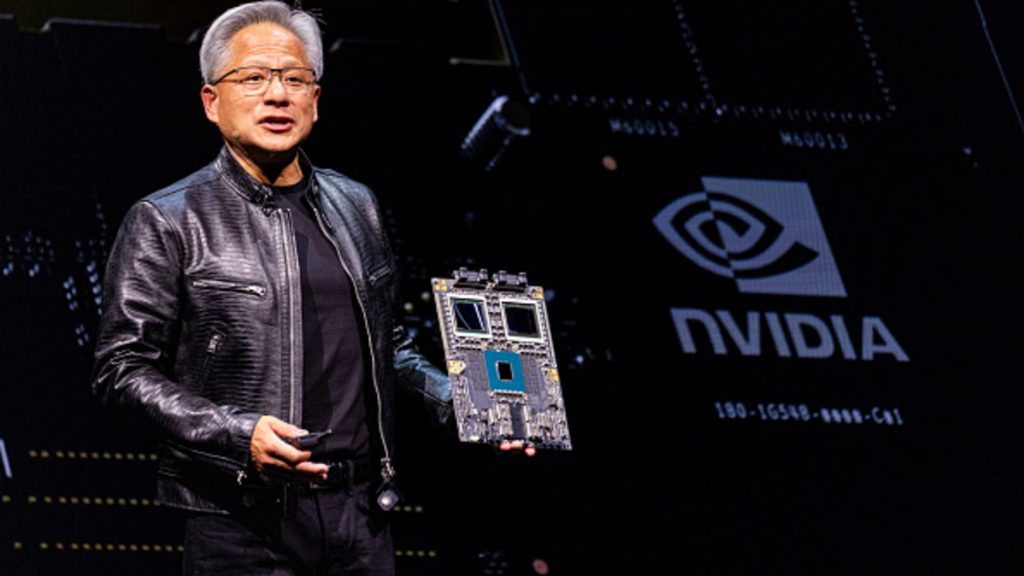

Currently, Nvidia is on track to be the first company to reach a $4 trillion market cap. Moreover, it has surged as much as 205% over the course of the year, as it leads the emerging technology sector. However, with competition booming, Amazon has not shied away from increasing investment to garner consumer interest.

Also Read: Amazon: AMZN Is The Magnificent 7 Stock With the Most Potential

Amazon Target’s Increased Chipmaking as it Eyes Nvidia Market Share

2024 has proven that the ongoing AI arms race on Wall Street is real. With the arrival of OpenAI’s ChatGPT, the demand from consumers for artificial intelligence integration has skyrocketed. That reality has pushed companies to increase spending to satiate that interest.

To this point, Nvidia has led the charge. The company recently booted Intel (INTC) from the Dow Jones Index after 25 years. Moreover, its role in the emerging sector has seen Wall Street firmly embrace its overwhelming potential. Yet that could be set to change this coming year.

Also Read: Nvidia (NVDA) and Amazon (AMZN) Hit ATHs, Pumping Nasdaq

One merging challenger is Amazon (AMZN), as the company has sought to increase its efforts to rival Nvidia’s undeniable dominance in the AI sector. Specifically, the company’s Annapurna Labs is spending big on AI chips, according to a report from The Financial Times.

The company was acquired by Amazon in 2015 for $350 million. Moreover, their latest Trainium 2 AI chip is looking to be the next evolution of language model training technology. Currency, the chip is being tested by Anthopic. Another Amazon acquisition, the OpenAI competitor, was bought for $4 billion.

If Amazon can increase its AI impact, that will only boost its overall value. The firm is already a leader in cloud computing with its Amazon Web Services (AWS) business. Its position within the other emerging technology could have it well established as a Wall Street favorite throughout 2025.